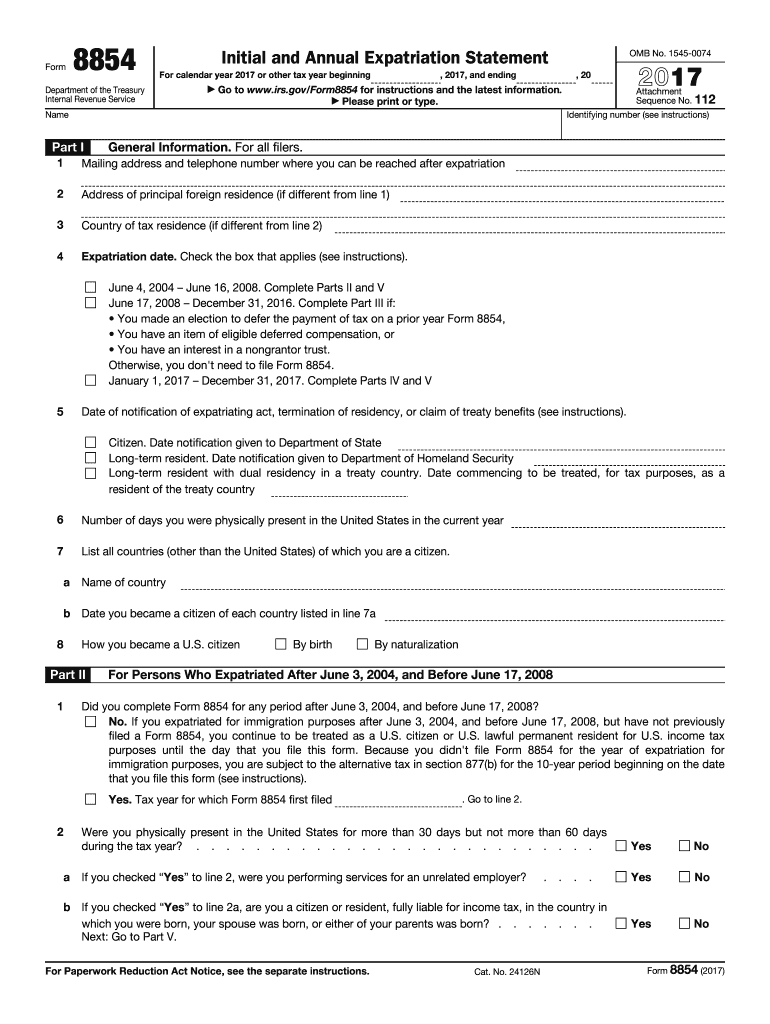

Irs Form 8854 2017

What is the IRS Form 8854

The IRS Form 8854, also known as the Initial and Annual Expatriation Statement, is a tax form used by individuals who have expatriated from the United States. This form is essential for reporting information about the expatriate's tax obligations and ensuring compliance with U.S. tax laws. It is required for those who meet specific criteria, including individuals who have renounced their U.S. citizenship or terminated their long-term resident status. The form helps the IRS determine if the individual meets the criteria for being classified as a covered expatriate, which can have significant tax implications.

How to use the IRS Form 8854

Using the IRS Form 8854 involves several steps to ensure accurate reporting of your expatriate status and tax obligations. First, gather necessary documentation, including details of your citizenship, residency, and tax filings for the previous five years. Next, fill out the form by providing personal information and answering questions regarding your expatriation. It is crucial to review the form thoroughly to ensure all information is correct before submission. Finally, submit the completed form to the IRS by the specified deadline to avoid penalties.

Steps to complete the IRS Form 8854

Completing the IRS Form 8854 requires careful attention to detail. Follow these steps:

- Step 1: Gather your personal information, including your Social Security number and details about your expatriation.

- Step 2: Review the IRS guidelines to understand the requirements for expatriates.

- Step 3: Fill out the form, ensuring you answer all questions accurately.

- Step 4: Attach any required documentation, such as tax returns for the past five years.

- Step 5: Review the completed form for accuracy and completeness.

- Step 6: Submit the form to the IRS by the deadline.

Legal use of the IRS Form 8854

The legal use of the IRS Form 8854 is crucial for individuals who have expatriated from the U.S. Properly completing and submitting this form ensures compliance with U.S. tax laws and helps avoid potential penalties. The form serves as a declaration of your expatriate status and outlines your tax obligations as a former U.S. citizen or long-term resident. Failure to file this form can result in significant tax consequences, including being classified as a covered expatriate, which may lead to an exit tax on certain assets.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8854 are critical to avoid penalties. Generally, the form must be submitted by the due date of your tax return for the year in which you expatriated. If you expatriated during the year, you must file the form along with your tax return for that year. It is advisable to check the IRS website for any updates on deadlines, as they may vary based on specific circumstances or changes in tax law.

Penalties for Non-Compliance

Non-compliance with the IRS Form 8854 requirements can result in severe penalties. Individuals who fail to file the form may be subject to an exit tax and could be classified as covered expatriates, leading to additional tax liabilities. The IRS may impose fines for late filing, and the penalties can accumulate over time. It is essential to understand these consequences to ensure timely and accurate submission of the form.

Quick guide on how to complete irs form 8854 2017

Effortlessly prepare Irs Form 8854 on any device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your files swiftly without unnecessary delays. Handle Irs Form 8854 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Irs Form 8854 with ease

- Find Irs Form 8854 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Underline pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 8854 and maintain exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8854 2017

Create this form in 5 minutes!

How to create an eSignature for the irs form 8854 2017

How to generate an electronic signature for the Irs Form 8854 2017 online

How to generate an eSignature for your Irs Form 8854 2017 in Google Chrome

How to create an eSignature for signing the Irs Form 8854 2017 in Gmail

How to make an eSignature for the Irs Form 8854 2017 right from your smart phone

How to make an eSignature for the Irs Form 8854 2017 on iOS

How to make an electronic signature for the Irs Form 8854 2017 on Android devices

People also ask

-

What is IRS Form 8854 and why is it important?

IRS Form 8854 is used by expatriates to report their expatriation and comply with U.S. tax laws. It is crucial for individuals who have relinquished their U.S. citizenship or terminated their long-term resident status, as it helps determine tax obligations and potential penalties.

-

How can airSlate SignNow assist with IRS Form 8854?

AirSlate SignNow provides a seamless platform for electronically signing and sending IRS Form 8854 and other important documents. With its user-friendly interface, you can easily manage your expatriation paperwork, ensuring timely submissions and compliance.

-

What features does airSlate SignNow offer for managing IRS Form 8854?

AirSlate SignNow offers features such as customizable templates, secure document storage, and advanced eSignature capabilities that make managing IRS Form 8854 efficient. You can quickly create, send, and track your forms, all while maintaining compliance with IRS regulations.

-

Is airSlate SignNow a cost-effective solution for handling IRS Form 8854?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and individuals needing to handle IRS Form 8854. With flexible pricing plans, you can choose the option that best fits your needs while benefiting from a comprehensive eSigning solution.

-

Can I integrate airSlate SignNow with other applications for IRS Form 8854?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow for IRS Form 8854. This means you can connect it with your CRM, document management systems, and more, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form 8854 submissions?

Using airSlate SignNow for IRS Form 8854 submissions simplifies the eSigning process, enhances security, and ensures compliance with IRS standards. Additionally, it provides real-time tracking and notifications, so you always know the status of your important documents.

-

Is airSlate SignNow secure for handling sensitive documents like IRS Form 8854?

Yes, airSlate SignNow prioritizes security and uses advanced encryption methods to protect sensitive documents, such as IRS Form 8854. With robust security measures in place, you can trust that your data is safe and secure throughout the signing process.

Get more for Irs Form 8854

Find out other Irs Form 8854

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney