Cocodoc Comus Federal Tax Forms Irsindividual4 8854 Form to Edit, Download & PrintCocoDoc 2022

Understanding Form 8854

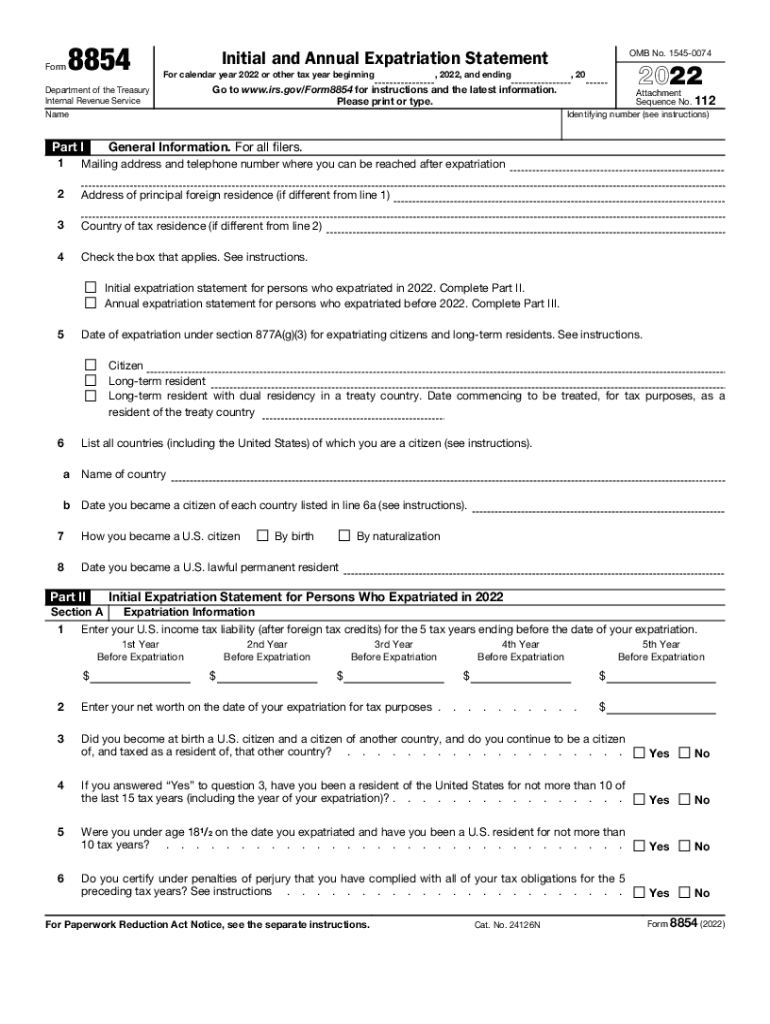

Form 8854, also known as the Initial and Annual Expatriation Statement, is a crucial document for individuals who are expatriating from the United States. This form is required by the IRS to determine whether a person is classified as a covered expatriate and to assess any potential tax liabilities associated with expatriation. Understanding the implications of this form is vital for anyone considering renouncing their U.S. citizenship or terminating long-term residency.

Key Elements of Form 8854

The form includes several key components that must be completed accurately. These elements typically cover:

- Personal Information: This section requires your name, address, and taxpayer identification number.

- Expatriation Date: You must specify the date you expatriated, which is critical for determining tax obligations.

- Asset Valuation: You will need to provide details about your worldwide assets, including their fair market value.

- Tax Compliance: A declaration of your compliance with U.S. tax obligations for the five years preceding your expatriation.

Steps to Complete Form 8854

Filling out Form 8854 requires careful attention to detail. Here are the steps to ensure proper completion:

- Gather all necessary documentation, including tax returns and financial statements.

- Complete the personal information section accurately.

- Determine your expatriation date and ensure it aligns with your records.

- Evaluate your assets and report their values as required.

- Review your tax compliance history for the past five years.

- Sign and date the form before submission.

Filing Deadlines for Form 8854

It is essential to adhere to the filing deadlines for Form 8854 to avoid penalties. Generally, the form must be filed with your tax return for the year of expatriation. If you are not required to file a tax return, Form 8854 should still be submitted by the due date of your tax return for that year.

Penalties for Non-Compliance

Failure to file Form 8854 or inaccuracies in the form can lead to significant penalties. If classified as a covered expatriate, you may be subject to an exit tax on your worldwide assets. Additionally, not filing the form can result in penalties that accumulate over time, making it crucial to ensure compliance.

Digital vs. Paper Version of Form 8854

Form 8854 can be submitted in both digital and paper formats. Using a digital platform to complete and eSign the form can enhance accuracy and efficiency. Digital submissions often allow for easier tracking and compliance with IRS requirements, making them a preferred choice for many expatriates.

Quick guide on how to complete cocodoccomus federal tax forms irsindividual4 8854 form free to edit download ampamp printcocodoc

Effortlessly finalize Cocodoc comus federal tax forms irsindividual4 8854 Form To Edit, Download & PrintCocoDoc on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, enabling you to find the required form and securely store it in the cloud. airSlate SignNow offers all the essentials you need to create, edit, and eSign your documents swiftly without delays. Handle Cocodoc comus federal tax forms irsindividual4 8854 Form To Edit, Download & PrintCocoDoc on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to modify and eSign Cocodoc comus federal tax forms irsindividual4 8854 Form To Edit, Download & PrintCocoDoc with ease

- Find Cocodoc comus federal tax forms irsindividual4 8854 Form To Edit, Download & PrintCocoDoc and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Alter and eSign Cocodoc comus federal tax forms irsindividual4 8854 Form To Edit, Download & PrintCocoDoc and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cocodoccomus federal tax forms irsindividual4 8854 form free to edit download ampamp printcocodoc

Create this form in 5 minutes!

People also ask

-

What is Form 8854 and who needs to file it?

Form 8854 is a tax form used by expatriates to report their status to the IRS when they give up their U.S. citizenship or long-term resident status. Individuals who are considered covered expatriates must file this form as part of their tax obligations after expatriation.

-

How can airSlate SignNow help me complete Form 8854?

airSlate SignNow offers an intuitive platform that simplifies the process of completing Form 8854 by allowing users to fill out and eSign the document securely. With our easy-to-use interface, you can ensure that your form is completed accurately and efficiently, making your compliance process smoother.

-

Is there a cost associated with using airSlate SignNow for Form 8854?

Yes, airSlate SignNow offers various pricing plans to suit your needs, ensuring that you have access to the tools necessary for filing Form 8854. Our plans are competitive and designed for businesses of all sizes, providing great value for document management and e-signature capabilities.

-

What features does airSlate SignNow offer for handling Form 8854?

airSlate SignNow includes features like customizable templates, secure storage, and bulk sending, which streamline the process of managing Form 8854. Additionally, users can track the status of their documents and gain insights into completions, ensuring compliance and accuracy.

-

Can I integrate airSlate SignNow with other tools for managing Form 8854?

Absolutely! airSlate SignNow supports integrations with various cloud storage and business applications, making it easier to manage Form 8854 alongside other critical documents. This seamless integration ensures that all your workflows remain efficient and organized.

-

What are the benefits of using airSlate SignNow for e-signing Form 8854?

Using airSlate SignNow for e-signing Form 8854 enhances convenience and security, allowing users to sign documents from anywhere, at any time. This not only speeds up the process of compliance but also provides a secure audit trail that can be invaluable for tax records.

-

How secure is my data when using airSlate SignNow for Form 8854?

airSlate SignNow employs industry-standard security measures, including encryption and secure data storage, to protect your information while handling Form 8854. You can trust that your sensitive information remains confidential and secure throughout the e-signing process.

Get more for Cocodoc comus federal tax forms irsindividual4 8854 Form To Edit, Download & PrintCocoDoc

- Warranty deed for parents to child with reservation of life estate nevada form

- Warranty deed to convert community property to joint tenancy nevada form

- Warranty deed for separate or joint property to joint tenancy nevada form

- Warranty deed to separate property of one spouse to both spouses as joint tenants nevada form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries nevada form

- Nv fiduciary deed form

- Warranty deed from limited partnership or llc is the grantor or grantee nevada form

- Quitclaim deed for three individuals to one individual nevada form

Find out other Cocodoc comus federal tax forms irsindividual4 8854 Form To Edit, Download & PrintCocoDoc

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF