Form 8854 2015

What is the Form 8854

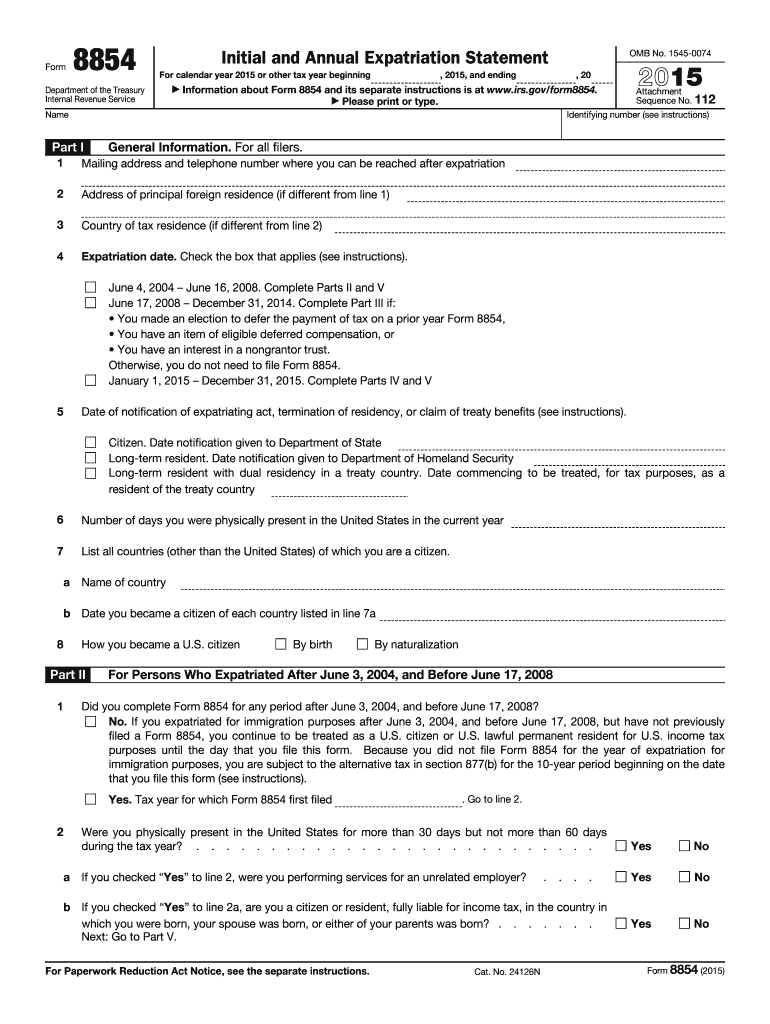

The Form 8854, also known as the Initial and Annual Expatriation Statement, is a tax form required by the Internal Revenue Service (IRS) for U.S. citizens and long-term residents who are expatriating or terminating their U.S. residency. This form is crucial for reporting the individual's tax obligations and ensuring compliance with U.S. tax laws upon leaving the country. It helps the IRS assess any potential exit tax liabilities that may arise from the expatriation process.

How to use the Form 8854

Using Form 8854 involves accurately completing the form to disclose your expatriation status and any associated tax liabilities. The form requires detailed information about your income, assets, and tax history. It is essential to follow the instructions provided by the IRS carefully to avoid any penalties. Once completed, the form must be submitted along with your final tax return for the year of expatriation. This ensures that all necessary information is reported to the IRS in a timely manner.

Steps to complete the Form 8854

Completing Form 8854 requires several steps to ensure accuracy and compliance:

- Gather all necessary documentation, including financial statements and tax returns from previous years.

- Complete Part I, which includes personal information and the date of expatriation.

- Fill out Part II, detailing your income, assets, and liabilities.

- Review the form for completeness and accuracy, ensuring all required fields are filled out.

- Submit the completed form along with your final tax return to the IRS.

Legal use of the Form 8854

The legal use of Form 8854 is governed by U.S. tax laws that require individuals who expatriate to report their financial status. The form must be filed to comply with the IRS regulations, and failure to do so may result in penalties. The information provided on the form is used to determine any exit tax obligations, which can apply to individuals with a net worth exceeding a certain threshold or those who have not complied with U.S. tax obligations for the five years preceding their expatriation.

Filing Deadlines / Important Dates

Filing deadlines for Form 8854 are critical to avoid penalties. Generally, the form must be submitted with your final tax return for the year of expatriation. The deadline for filing your tax return is typically April fifteenth of the following year. However, if you are living abroad, you may qualify for an automatic extension until June fifteenth, but it is essential to file Form 8854 by the original due date to avoid penalties.

Required Documents

To complete Form 8854, you will need several documents to support your claims and ensure accurate reporting. These may include:

- Previous years' tax returns.

- Financial statements detailing your assets and liabilities.

- Documentation proving your expatriation status.

- Any relevant correspondence with the IRS regarding your tax obligations.

Penalties for Non-Compliance

Non-compliance with the requirements of Form 8854 can lead to significant penalties. If you fail to file the form or provide inaccurate information, the IRS may impose a penalty of up to $10,000. Additionally, if you do not meet your tax obligations, you may face further financial repercussions, including the assessment of exit taxes. It is crucial to ensure that the form is completed accurately and submitted on time to avoid these penalties.

Quick guide on how to complete 2015 form 8854

Prepare Form 8854 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an excellent environmentally friendly option to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage Form 8854 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to edit and electronically sign Form 8854 with ease

- Locate Form 8854 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8854 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 8854

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 8854

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 8854 and why is it important?

Form 8854 is a key document for expatriates, used to report information regarding the expatriation process to the IRS. It is crucial for individuals who are planning to renounce their U.S. citizenship or terminate their long-term resident status. Filling out Form 8854 accurately helps ensure compliance with U.S. tax laws and avoids potential penalties.

-

How can airSlate SignNow assist with signing Form 8854?

airSlate SignNow provides an efficient platform to electronically sign Form 8854, making the process quick and secure. Our easy-to-use interface allows users to upload, edit, and eSign documents seamlessly. This ensures you can manage your expatriation documents without any hassle.

-

Is there a cost associated with using airSlate SignNow for Form 8854?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including individual users and businesses. Our pricing is competitive and designed to deliver a cost-effective solution for managing documents like Form 8854. You can choose a plan that fits your requirements and budget.

-

What features does airSlate SignNow offer for handling Form 8854?

airSlate SignNow includes features such as document templates, secure cloud storage, and real-time tracking of signed documents. These features enhance the user experience and streamline the process of preparing and submitting Form 8854. Additionally, you can easily share your completed forms with tax professionals.

-

Can I integrate airSlate SignNow with other applications for Form 8854 processing?

Absolutely! airSlate SignNow offers robust integration capabilities with popular applications like Google Drive, Dropbox, and more. This integration allows for easy access to your Form 8854 and other documents, ensuring a smooth workflow and efficient document management.

-

What are the benefits of using airSlate SignNow for Form 8854?

Using airSlate SignNow for Form 8854 provides several benefits, including enhanced security, time savings, and easy accessibility. Our platform ensures that your sensitive information is protected, while also allowing you to manage your forms anytime, anywhere. This convenience is particularly valuable during the expatriation process.

-

Is airSlate SignNow user-friendly for completing Form 8854?

Yes, airSlate SignNow is designed to be intuitive and user-friendly, making it simple for anyone to complete Form 8854. Our platform guides users through the signing process with clear instructions and helpful features, ensuring that you can handle your documents with confidence and ease.

Get more for Form 8854

Find out other Form 8854

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now