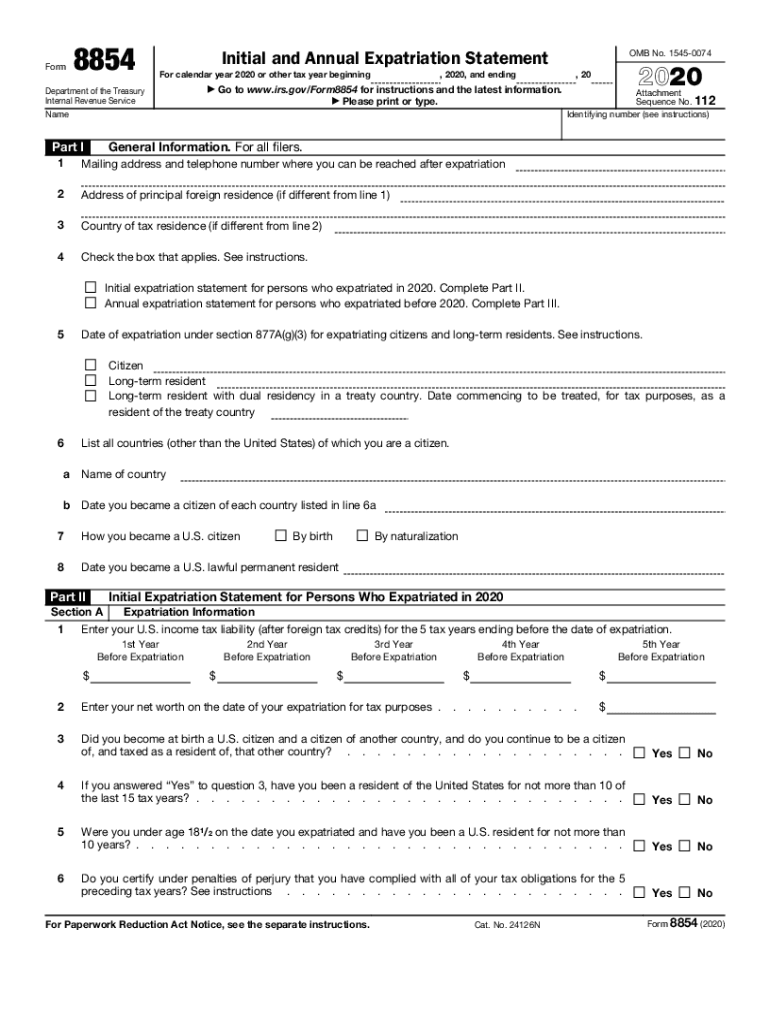

Form 8854 Initial and Annual Expatriation Statement 2020

What is the Form 8854 Initial And Annual Expatriation Statement

The Form 8854, known as the Initial and Annual Expatriation Statement, is a crucial document for individuals who are expatriating from the United States. This form must be filed with the Internal Revenue Service (IRS) to report the individual's expatriation status and to provide information about their tax obligations. It is particularly relevant for those classified as covered expatriates, which includes individuals who meet certain income or net worth thresholds. The form helps the IRS determine any potential exit tax liabilities that may arise from the expatriation process.

Steps to complete the Form 8854 Initial And Annual Expatriation Statement

Completing the Form 8854 requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary financial documentation, including information about your worldwide income and net worth.

- Determine your expatriate status and whether you qualify as a covered expatriate based on the IRS criteria.

- Fill out the form accurately, ensuring all required sections are completed, including personal information and tax-related details.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically or via mail, adhering to the IRS guidelines for submission methods.

Legal use of the Form 8854 Initial And Annual Expatriation Statement

The legal use of Form 8854 is essential for ensuring compliance with U.S. tax laws during the expatriation process. Filing this form is a legal requirement for individuals who meet the criteria for expatriation. It serves as a formal declaration of an individual's intent to relinquish their U.S. citizenship or long-term resident status. Proper completion and submission of the form help prevent potential legal issues, including penalties for non-compliance. The form must be filed alongside other relevant tax returns to maintain good standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 8854 are critical to avoid penalties. The form must be submitted on or before the due date of your tax return for the year of expatriation. This typically means that if you expatriate during the calendar year, you should file Form 8854 along with your annual tax return by April 15 of the following year. If you are granted an extension for your tax return, this extension does not apply to Form 8854, so it is important to plan accordingly to meet the filing requirements.

Required Documents

When completing Form 8854, certain documents are necessary to provide accurate information. These may include:

- Financial statements that detail your worldwide income and net worth.

- Tax returns for the previous five years to demonstrate compliance with U.S. tax obligations.

- Documentation proving your expatriation status, such as a certificate of loss of nationality.

Having these documents ready will facilitate a smoother filing process and help ensure that all required information is accurately reported.

Penalties for Non-Compliance

Failure to file Form 8854 or inaccuracies in the form can lead to significant penalties. Individuals who do not comply with the filing requirements may face a penalty of $10,000. Additionally, if the IRS determines that you are a covered expatriate but you did not file the form, you may be subject to an exit tax on your unrealized gains. It is essential to understand these potential consequences and ensure that the form is filed correctly and on time to avoid unnecessary financial burdens.

Quick guide on how to complete 2020 form 8854 initial and annual expatriation statement

Prepare Form 8854 Initial And Annual Expatriation Statement seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, as you can locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to craft, modify, and eSign your documents swiftly without any hindrances. Handle Form 8854 Initial And Annual Expatriation Statement on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related activity today.

How to modify and eSign Form 8854 Initial And Annual Expatriation Statement effortlessly

- Locate Form 8854 Initial And Annual Expatriation Statement and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow parts of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, burdensome form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Alter and eSign Form 8854 Initial And Annual Expatriation Statement and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8854 initial and annual expatriation statement

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8854 initial and annual expatriation statement

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 8854?

airSlate SignNow is a powerful e-signature solution that enables businesses to send, sign, and manage documents efficiently. The reference to 8854 in our context highlights regulatory compliance features that help businesses meet their obligations more effectively, ensuring that all signatures are legally binding.

-

How much does airSlate SignNow cost for users interested in 8854 compliance?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those focused on 8854 compliance. Plans start at an affordable rate, and we encourage users to explore our pricing page for details on options that suit their budget while ensuring compliance.

-

What features of airSlate SignNow enhance the experience for those using 8854?

Key features of airSlate SignNow that enhance the user experience related to 8854 include customizable templates, automated workflows, and detailed audit trails. These features streamline document processes and ensure all compliant signatures and records are tracked accurately.

-

How does airSlate SignNow support document security for 8854 related transactions?

Document security is a top priority at airSlate SignNow, especially for transactions related to 8854. We implement advanced encryption methods and secure access controls to ensure that sensitive documents are protected throughout the signing process, giving businesses peace of mind.

-

Can I integrate airSlate SignNow with other tools for my 8854 processes?

Yes, airSlate SignNow easily integrates with a variety of popular business applications to streamline your 8854 processes. Whether you’re using CRM software or document management systems, our integration capabilities ensure smooth workflows and enhanced efficiency.

-

What benefits does airSlate SignNow offer for businesses dealing with 8854 documentation?

Businesses working with 8854 documentation can benefit from airSlate SignNow's efficiency and cost-effectiveness. The platform simplifies the signing process, reduces paperwork, and minimizes delays, all while ensuring that documents meet necessary compliance standards.

-

Is there a free trial available for airSlate SignNow to test its 8854 features?

Absolutely! airSlate SignNow offers a free trial that allows users to explore its features, including those relevant to 8854 compliance. This trial provides an opportunity to evaluate how our solution can meet your document signing and management needs without any financial commitment.

Get more for Form 8854 Initial And Annual Expatriation Statement

- Owners or sellers affidavit of no liens washington form

- Washington affidavit form 497429907

- Complex will with credit shelter marital trust for large estates washington form

- Washington jury form

- Washington firearm form

- Petition discharge form

- Cr 080650 certificate and order of discharge washington form

- Obtaining certificate discharge form

Find out other Form 8854 Initial And Annual Expatriation Statement

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms