IRS Form 8854 Beginner's Guide to the Tax Expatriation 2024-2026

Understanding IRS Form 8854

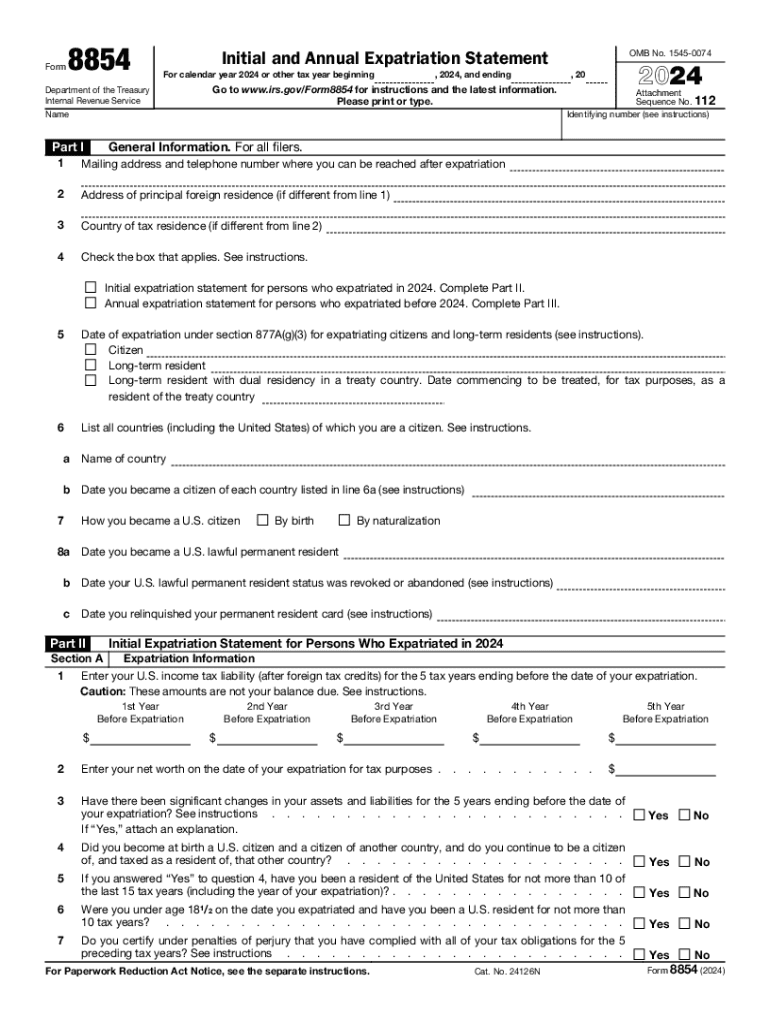

IRS Form 8854 is a critical document for individuals who are expatriating from the United States. This form is used to report information about your expatriation and to determine if you are classified as a covered expatriate. A covered expatriate may be subject to the U.S. exit tax, which can have significant financial implications. Understanding the purpose and requirements of Form 8854 is essential for anyone considering expatriation.

Steps to Complete IRS Form 8854

Completing IRS Form 8854 involves several key steps. First, gather all necessary financial information, including your income, assets, and liabilities. Next, fill out the form accurately, ensuring that all sections are completed according to the instructions provided by the IRS. Pay particular attention to the asset thresholds, as these determine your status as a covered expatriate. After completing the form, review it for accuracy before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with IRS Form 8854. Generally, the form must be submitted by the due date of your tax return for the year of expatriation. This is typically April 15, but may vary based on individual circumstances. Missing the deadline can lead to penalties, so it is advisable to plan ahead and ensure timely submission.

Required Documents for IRS Form 8854

When completing IRS Form 8854, certain documents are required to support your claims and provide necessary information. These may include financial statements, tax returns from the previous five years, and any documentation related to your assets and liabilities. Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Penalties for Non-Compliance

Failing to file IRS Form 8854 or submitting it inaccurately can result in significant penalties. If you are classified as a covered expatriate and do not file the form, you may be subject to the exit tax on your worldwide assets. Additionally, the IRS may impose a penalty for failing to report your expatriation, which can be substantial. Understanding these consequences is crucial for anyone considering expatriation.

Eligibility Criteria for IRS Form 8854

To be eligible to file IRS Form 8854, you must meet specific criteria related to your expatriation status. Generally, this includes individuals who have relinquished their U.S. citizenship or long-term residents who have terminated their residency. It is important to assess your eligibility carefully, as this will determine your obligations under U.S. tax law and the necessity of filing the form.

Examples of Using IRS Form 8854

Real-world scenarios can illustrate the importance of IRS Form 8854. For instance, an individual who has lived in the U.S. for many years and decides to move abroad may need to file this form to report their expatriation. Another example includes a long-term resident who has held a green card and chooses to relinquish it. In both cases, understanding the implications of Form 8854 is vital for compliance and financial planning.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8854 beginners guide to the tax expatriation

Create this form in 5 minutes!

How to create an eSignature for the irs form 8854 beginners guide to the tax expatriation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8854 and why is it important?

Form 8854 is a crucial document for expatriates who are relinquishing their U.S. citizenship or long-term residency. It serves to report your compliance with U.S. tax obligations and helps determine your status as a covered expatriate. Understanding Form 8854 is essential to avoid potential tax penalties.

-

How can airSlate SignNow help with Form 8854?

airSlate SignNow provides a streamlined platform for completing and eSigning Form 8854. With our easy-to-use interface, you can fill out the form digitally, ensuring accuracy and compliance. This simplifies the process, allowing you to focus on your expatriation without the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8854?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those who need to complete Form 8854. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 8854?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for Form 8854. These tools enhance your workflow, making it easier to manage your expatriation documents efficiently. Additionally, our platform ensures that your data is secure and compliant with regulations.

-

Can I integrate airSlate SignNow with other applications for Form 8854?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling Form 8854. Whether you use CRM systems or cloud storage solutions, our platform can connect seamlessly to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for Form 8854?

Using airSlate SignNow for Form 8854 provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform simplifies the eSigning process, ensuring that you can complete your forms quickly and without errors. Additionally, your documents are stored securely, giving you peace of mind.

-

Is airSlate SignNow user-friendly for completing Form 8854?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete Form 8854. Our intuitive interface guides you through the process, ensuring that you can fill out and eSign your documents without any technical difficulties. You don’t need to be tech-savvy to use our platform effectively.

Get more for IRS Form 8854 Beginner's Guide To The Tax Expatriation

- California apartment association lease agreement form

- Tc0131 printable form

- Et 4310 form

- Idaho political party affiliation declaration form

- Location scouting template form

- Texas medicaid gas reimbursement form

- Online par q form 448983563

- Oklahoma govodotsize and weightoklahoma size and weight permits oklahoma department of form

Find out other IRS Form 8854 Beginner's Guide To The Tax Expatriation

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form