Prior Year Products IRS Gov 2013

What is the Prior Year Products IRS gov

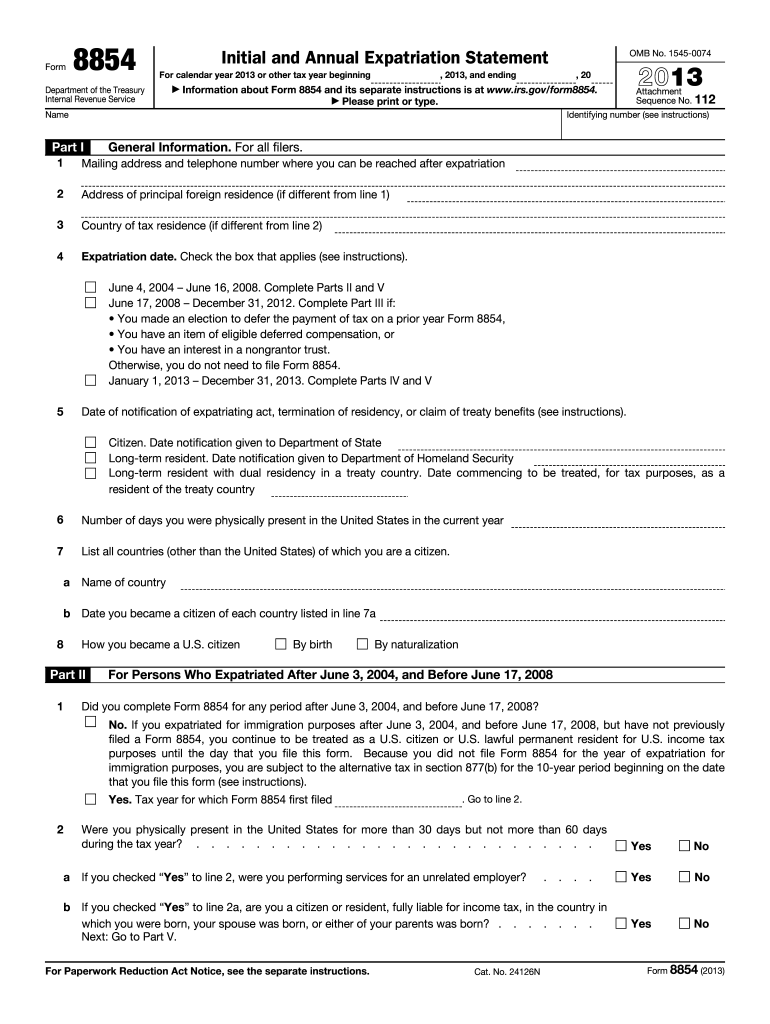

The Prior Year Products IRS gov refers to specific forms and documents that the Internal Revenue Service provides to assist taxpayers in accessing and filing their previous year's tax information. These products are essential for individuals and businesses who need to reference their past tax returns for various reasons, including audits, amendments, or applying for loans. Understanding these products can help ensure compliance with tax regulations and facilitate accurate financial reporting.

How to use the Prior Year Products IRS gov

Using the Prior Year Products IRS gov involves several steps. First, taxpayers should identify which specific forms they need, such as the previous year's tax return or supporting documents. Next, they can access these forms on the IRS website or through authorized providers. Once obtained, users can fill out the forms digitally or print them for manual completion. It is crucial to ensure that all information is accurate and up-to-date to avoid potential issues with the IRS.

Steps to complete the Prior Year Products IRS gov

Completing the Prior Year Products IRS gov requires careful attention to detail. The following steps can guide users through the process:

- Gather necessary information, including Social Security numbers, income details, and prior year tax documents.

- Access the required forms from the IRS website or authorized sources.

- Fill out the forms accurately, ensuring all fields are completed as required.

- Review the completed forms for errors or omissions.

- Submit the forms electronically or by mail, following the IRS guidelines for submission.

Legal use of the Prior Year Products IRS gov

The legal use of the Prior Year Products IRS gov is critical for maintaining compliance with federal tax laws. These forms must be completed accurately and submitted within the designated timeframes to avoid penalties. Moreover, electronic submissions are legally recognized, provided they meet the requirements set forth by the IRS, including proper eSignature protocols. Utilizing a secure platform for electronic submissions can enhance the legal validity of these documents.

Filing Deadlines / Important Dates

Filing deadlines for the Prior Year Products IRS gov are essential for taxpayers to observe. Generally, the deadline for filing individual tax returns is April fifteenth of the following year. However, specific dates may vary depending on circumstances such as extensions or special provisions for certain taxpayer categories. It is advisable to check the IRS website for the most current deadlines and any changes that may affect filing requirements.

Required Documents

To effectively complete the Prior Year Products IRS gov, certain documents are typically required. These may include:

- Previous year's tax return (Form 1040 or equivalent).

- W-2 forms from employers.

- 1099 forms for other income sources.

- Any supporting documentation for deductions or credits claimed.

Having these documents readily available can streamline the process and ensure that all necessary information is included in the forms.

Quick guide on how to complete prior year products irsgov

Prepare Prior Year Products IRS gov effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents promptly without delays. Handle Prior Year Products IRS gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Prior Year Products IRS gov seamlessly

- Locate Prior Year Products IRS gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Prior Year Products IRS gov while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct prior year products irsgov

Create this form in 5 minutes!

How to create an eSignature for the prior year products irsgov

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What are Prior Year Products from IRS gov?

Prior Year Products from IRS gov refer to tax forms and associated materials that are necessary for filing past tax returns. These resources ensure that taxpayers have accurate information available for their specific tax situations. Accessing these forms on IRS gov can streamline the tax filing process for those who need to amend or file prior years.

-

How can airSlate SignNow help with Prior Year Products from IRS gov?

airSlate SignNow provides an efficient way to eSign and manage documents related to Prior Year Products from IRS gov. Users can easily upload tax documents, get them signed digitally, and track the process seamlessly. This enhances organization and simplifies compliance when addressing any historical tax matters.

-

Are there any costs associated with utilizing Prior Year Products from IRS gov?

Accessing Prior Year Products from IRS gov is typically free since the IRS provides these tax forms and publications at no cost. However, businesses may incur expenses for software solutions like airSlate SignNow, which enhances the process of signing and managing these documents. It's advisable to weigh the benefits of improved efficiency against potential costs.

-

What features does airSlate SignNow offer for managing Prior Year Products?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are perfect for managing Prior Year Products from IRS gov. These tools help streamline workflow, maintain compliance, and ensure that users can easily access their documents. Additionally, the platform provides intuitive functionality tailored to businesses’ needs.

-

Can I integrate airSlate SignNow with accounting software that deals with Prior Year Products?

Yes, airSlate SignNow integrates smoothly with various accounting software, making it easy to manage documents related to Prior Year Products from IRS gov. This integration allows you to simplify your workflow by combining document management and accounting processes in one place. It ultimately saves time and enhances productivity for users.

-

What are the benefits of using airSlate SignNow for Prior Year Products?

Using airSlate SignNow for managing Prior Year Products from IRS gov offers benefits like improved efficiency, reduced paper usage, and enhanced document security. The tool allows users to complete and sign tax-related documents quickly and securely. Additionally, this digital approach minimizes errors and ensures compliance with tax regulations.

-

Is airSlate SignNow compliant with IRS regulations when dealing with Prior Year Products?

Yes, airSlate SignNow adheres to compliance standards required by the IRS for handling tax documents, including Prior Year Products from IRS gov. The platform ensures that all electronic signatures and document management processes meet legal requirements, providing peace of mind to users. You can trust that your sensitive tax information is handled securely.

Get more for Prior Year Products IRS gov

Find out other Prior Year Products IRS gov

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple