Form 8854 2010

What is the Form 8854

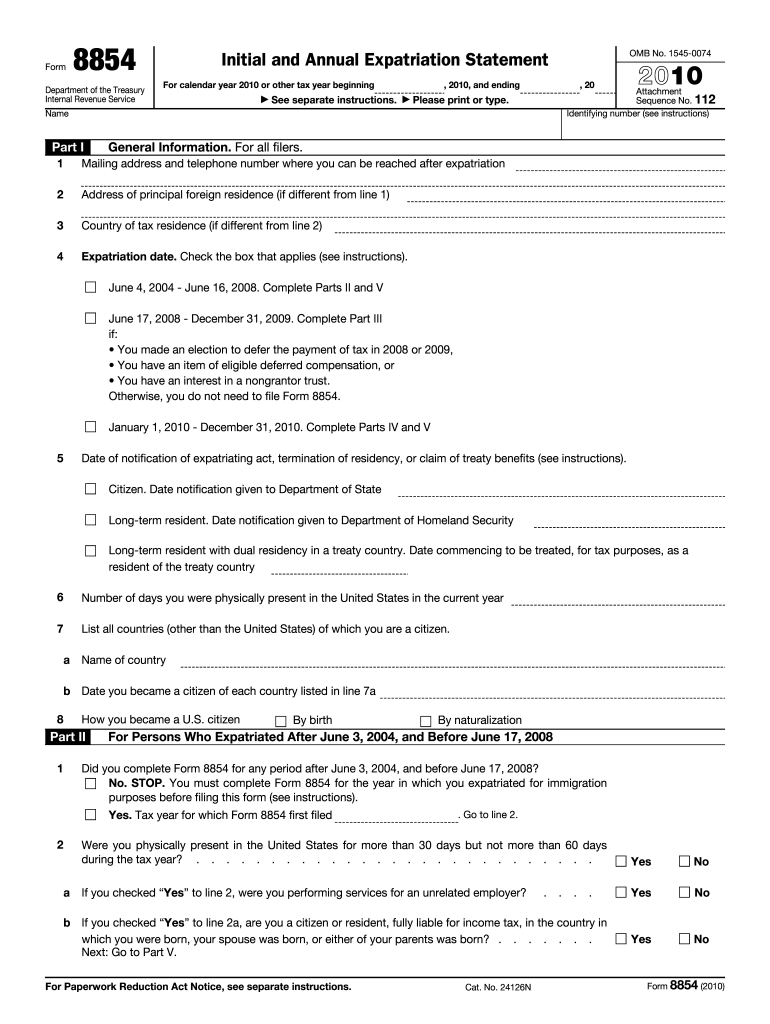

The Form 8854, also known as the Initial and Annual Expatriation Statement, is a tax form used by individuals who are expatriating from the United States. This form is essential for reporting information related to the relinquishment of U.S. citizenship or the termination of long-term resident status. It is required for individuals who meet specific criteria set by the IRS, ensuring compliance with tax obligations upon expatriation. The form includes details about the individual's assets, liabilities, and tax compliance status, which are crucial for determining any potential tax implications stemming from expatriation.

How to use the Form 8854

Using Form 8854 involves accurately completing the document to reflect your expatriation status. Start by gathering all necessary information, including details about your income, assets, and liabilities. It is important to clearly indicate your expatriation date and provide a comprehensive account of your financial situation. After filling out the form, review it carefully to ensure accuracy. Once completed, the form must be submitted to the IRS as part of your tax return for the year of expatriation. This ensures that you fulfill your reporting obligations and avoid potential penalties.

Steps to complete the Form 8854

Completing Form 8854 requires a systematic approach to ensure all required information is accurately reported. Follow these steps:

- Gather documentation: Collect financial statements, tax returns, and any other relevant documents that outline your financial status.

- Fill in personal information: Provide your name, address, and expatriation date at the top of the form.

- Report your assets: List your worldwide assets, including bank accounts, real estate, and investments, along with their fair market values.

- Detail your liabilities: Include any debts or obligations you have, which will help in calculating your net worth.

- Sign and date the form: Ensure you sign the form to validate the information provided.

Legal use of the Form 8854

The legal use of Form 8854 is paramount for individuals undergoing expatriation. This form must be filed in accordance with IRS regulations to avoid penalties. Failure to submit the form or providing inaccurate information can lead to significant tax consequences, including the potential for being treated as a covered expatriate. This designation may result in an exit tax on unrealized gains and other tax implications. Therefore, it is crucial to adhere to the legal requirements outlined by the IRS when using this form.

Filing Deadlines / Important Dates

Filing deadlines for Form 8854 are critical for compliance. Generally, the form must be submitted by the tax return due date for the year of expatriation, which is typically April 15 for most taxpayers. If you are living abroad, the deadline may be extended to June 15. However, to avoid penalties, ensure that Form 8854 is filed timely, as late submissions can lead to complications with the IRS. Keeping track of these important dates is essential for maintaining compliance and avoiding unnecessary penalties.

Required Documents

When preparing to file Form 8854, certain documents are necessary to support your claims and provide a complete picture of your financial status. Required documents may include:

- Recent tax returns for the past five years.

- Statements of all foreign and domestic bank accounts.

- Documentation of real estate holdings and other assets.

- Records of any outstanding debts or liabilities.

Having these documents ready will facilitate a smoother completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete form 8854 2010

Complete Form 8854 with ease on any device

Digital document management has become favored by companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without holdups. Manage Form 8854 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form 8854 effortlessly

- Locate Form 8854 and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8854 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8854 2010

Create this form in 5 minutes!

How to create an eSignature for the form 8854 2010

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is Form 8854 and why is it important?

Form 8854 is a tax form required by expatriates to report their status and compliance with U.S. tax obligations. It is essential for those who have given up their U.S. citizenship or long-term residency, as it indicates their tax liabilities and ensures proper reporting to the IRS.

-

How can airSlate SignNow help with Form 8854 filing?

airSlate SignNow provides a streamlined platform for sending and eSigning Form 8854 and other related documents. With easy templates and a user-friendly interface, businesses can efficiently manage their expatriation paperwork while ensuring that all signatures are collected securely and accurately.

-

What are the pricing options for using airSlate SignNow for Form 8854?

airSlate SignNow offers flexible pricing plans depending on your needs, with options suitable for individuals and businesses. Each plan includes essential features to ensure effortless handling of Form 8854 and other documents without breaking the bank.

-

Does airSlate SignNow have any integrations for Form 8854 processing?

Yes, airSlate SignNow integrates seamlessly with various third-party applications that can assist in processing Form 8854. These integrations can enhance your document management workflow, allowing you to sync data across platforms for optimized usability.

-

What features does airSlate SignNow offer for managing Form 8854?

airSlate SignNow provides advanced features such as customizable templates, audit trails, and secure cloud storage to enhance the management of Form 8854. Additionally, its mobile access makes it easy to send and eSign documents anytime, anywhere.

-

Is airSlate SignNow secure for filing Form 8854?

Absolutely! airSlate SignNow employs industry-leading security measures including encryption and secure servers to protect your data while filing Form 8854. You can trust that sensitive information will be guarded against unauthorized access.

-

Can I access Form 8854 from multiple devices with airSlate SignNow?

Yes, airSlate SignNow is designed for accessibility across devices, allowing you to access Form 8854 from desktops, tablets, and smartphones. This flexibility ensures that you can complete your documents on the go without any hassle.

Get more for Form 8854

- Self employment short 2020 if youre self employed have relatively simple tax affairs and your annual business turnover was form

- Form ftc1 application for permission to appeal and govuk

- Appointments and hours of operation for mildred nelson fort form

- Bi100pd notes industrial injuries disablement benefit form

- Crops fresh produce and beef amp lamb farm record book form

- Support your child or partners student finance application if form

- Hs302 duel residents 2020 claim form claim as a non resident for relief from uk tax under the terms of a double taxation

- Motorcycle trainer standards check form the form used to record motorcycle trainer standards check results

Find out other Form 8854

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF