8854 Form 2011

What is the 8854 Form

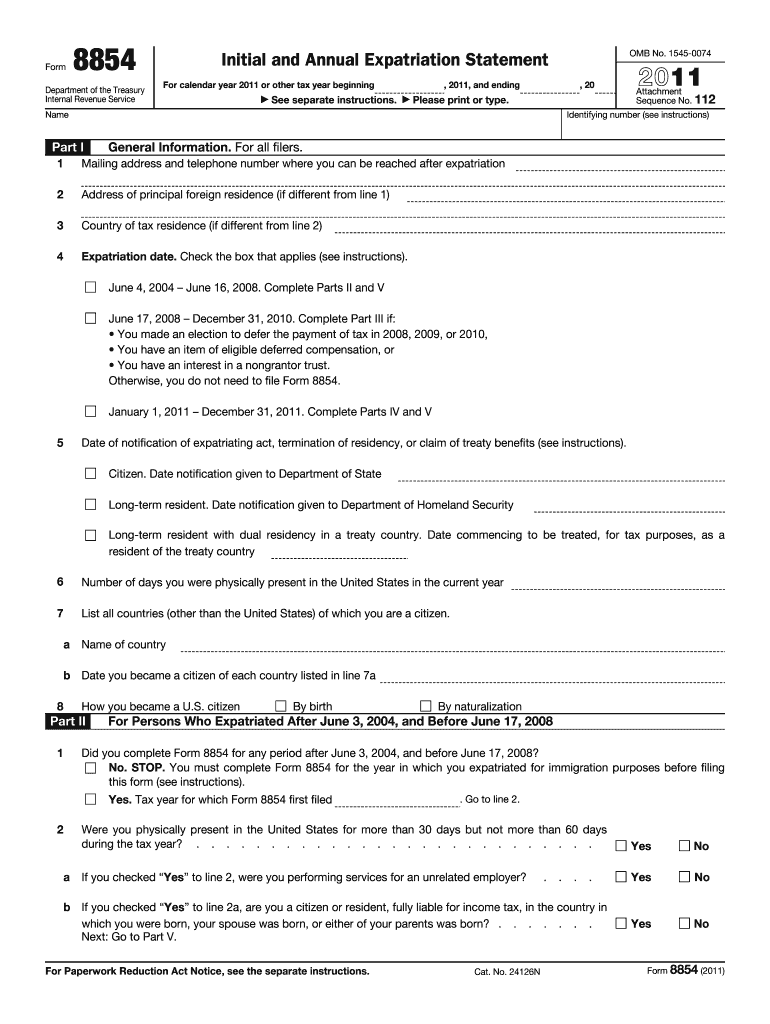

The 8854 Form, officially known as the Initial and Annual Expatriation Statement, is a tax form required by the Internal Revenue Service (IRS) for individuals who are expatriating from the United States. This form is essential for reporting the individual's expatriation and ensuring compliance with U.S. tax laws. It is particularly relevant for those who have renounced their U.S. citizenship or terminated their long-term residency status. The form helps the IRS determine if the individual meets the criteria for being classified as a "covered expatriate," which can have significant tax implications.

How to use the 8854 Form

Using the 8854 Form involves several steps to ensure accurate completion and submission. First, individuals must gather necessary information regarding their income, assets, and tax liabilities. The form requires details such as the date of expatriation, net worth, and tax compliance history. After filling out the form, it must be submitted along with the individual's final tax return for the year of expatriation. This ensures that the IRS has a complete record of the individual's tax obligations up to the date of expatriation.

Steps to complete the 8854 Form

Completing the 8854 Form requires careful attention to detail. Here are the steps to follow:

- Gather documentation: Collect financial statements, tax returns, and any other relevant documents.

- Fill out personal information: Provide your name, address, and expatriation date.

- Report assets: List all assets and their fair market values as of the expatriation date.

- Complete tax compliance section: Indicate whether you have met your tax obligations for the five years preceding expatriation.

- Review and sign: Ensure all information is accurate before signing the form.

Legal use of the 8854 Form

The legal use of the 8854 Form is critical for individuals expatriating from the U.S. It serves to inform the IRS of an individual's status change and ensures compliance with tax laws. Proper completion of this form can help avoid penalties associated with failure to report expatriation. Additionally, the form must be submitted in accordance with IRS guidelines to be considered valid. Understanding the legal implications of the information provided is essential for maintaining compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 8854 Form are crucial for compliance. The form must be submitted with your final tax return for the year of expatriation. Generally, the deadline for filing individual tax returns is April fifteenth of the following year. If you are living abroad, you may qualify for an automatic extension, but it is important to ensure that the 8854 Form is submitted timely to avoid penalties.

Penalties for Non-Compliance

Failure to file the 8854 Form or inaccuracies in the information provided can lead to significant penalties. Individuals classified as covered expatriates may face an exit tax on their net worth at the time of expatriation. Additionally, non-compliance can result in a 10,000-dollar penalty for failing to file the form. Understanding these penalties highlights the importance of accurate and timely submission of the 8854 Form.

Quick guide on how to complete 8854 2011 form

Easily Prepare 8854 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage 8854 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Method to Edit and E-Sign 8854 Form Without Stress

- Obtain 8854 Form and click on Get Form to begin.

- Make use of the tools we provide to submit your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your amendments.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign 8854 Form to ensure excellent communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8854 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 8854 2011 form

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the 8854 Form and why do I need it?

The 8854 Form, also known as the Initial and Annual Expatriation Statement, is a required document for individuals who have expatriated from the U.S. It serves to report your expatriation status and any tax obligations. By completing the 8854 Form accurately, you can ensure compliance with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help me with the 8854 Form?

airSlate SignNow provides a seamless platform for eSigning the 8854 Form, ensuring that you can complete and send it securely and efficiently. With features like templates and automated workflows, you can streamline the process of preparing your 8854 Form while maintaining compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for the 8854 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing you to choose the best option for managing your documents, including the 8854 Form. Our cost-effective solution ensures that you get the best value for your eSigning and document management needs.

-

What features does airSlate SignNow offer for managing the 8854 Form?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure eSigning which are particularly beneficial when handling the 8854 Form. These tools help simplify the process, ensuring that you can manage your expatriation paperwork efficiently while keeping all data secure.

-

Can I integrate airSlate SignNow with other tools to manage the 8854 Form?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and CRM systems, which can be particularly useful when managing the 8854 Form. This allows for a smooth workflow, enabling you to access and send your documents seamlessly across platforms.

-

How secure is my information when using airSlate SignNow for the 8854 Form?

Security is our top priority at airSlate SignNow. When you use our platform to complete the 8854 Form, your information is protected with bank-level encryption and secure access controls. This ensures that your sensitive data is safe throughout the signing and submission process.

-

What are the benefits of using airSlate SignNow for the 8854 Form as an expatriate?

Using airSlate SignNow for the 8854 Form offers numerous benefits, including time-saving efficiencies, enhanced compliance with IRS regulations, and a user-friendly interface. These advantages make it easier for expatriates to manage their documentation needs without the hassle of traditional paper methods.

Get more for 8854 Form

- Vet payment plan applicationpdf form

- Pdf imm 0008e schedule 2 refugees outside canada canadaca form

- Dd form 2752 nsep service agreement for scholarship and fellowship awards 20140310 draft

- Imm 5562 form

- Imm 0008 472880276 form

- Immigration formpdf save reset form print form

- Revalidation form amvets

- Application for group enrolment medical services form

Find out other 8854 Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy