W3pr 2017

What is the W3pr

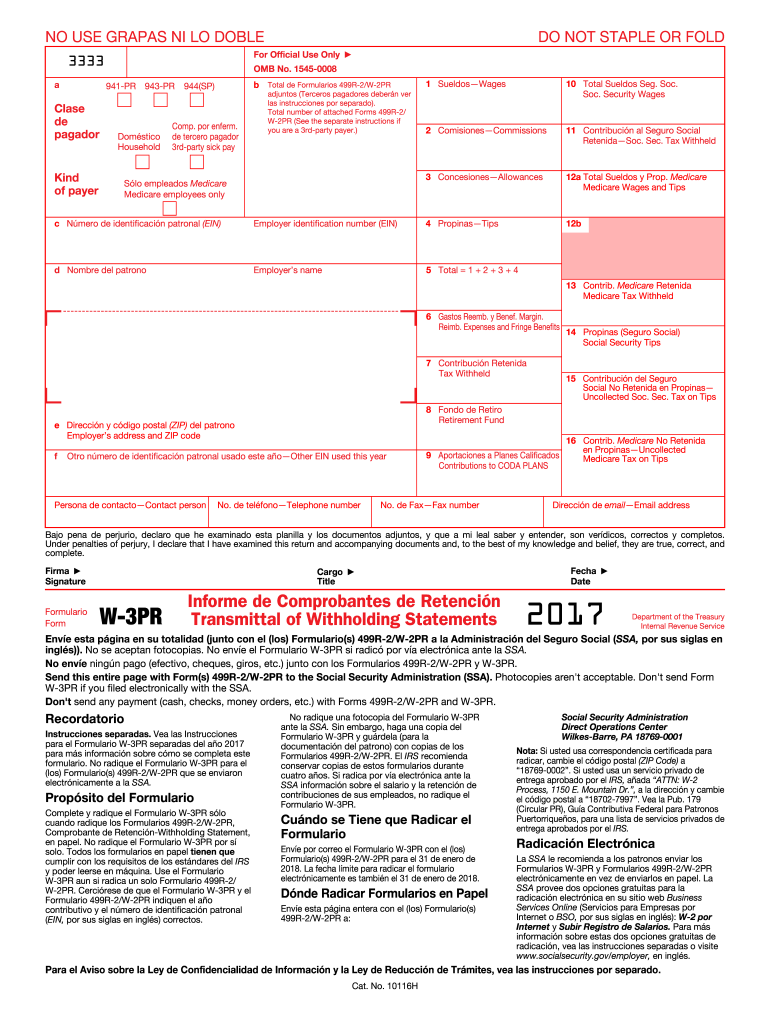

The W3pr form, officially known as the Form W-3PR, is a tax form used in Puerto Rico for reporting annual wage and tax information. This form is essential for employers who need to summarize the wages paid and taxes withheld for their employees throughout the year. It serves as a transmittal form to the Puerto Rico Department of the Treasury, ensuring that all necessary information is compiled accurately and submitted in a timely manner.

How to use the W3pr

To effectively use the W3pr form, employers must first gather all relevant wage and tax data for their employees. This includes total wages, withholding amounts, and any applicable deductions. Once the data is compiled, it should be entered into the W3pr form accurately. After completing the form, employers can submit it alongside the individual W-2 forms for each employee, ensuring compliance with local tax regulations.

Steps to complete the W3pr

Completing the W3pr form involves several key steps:

- Gather necessary information: Collect all wage and tax details for each employee.

- Fill out the form: Input the total wages paid and taxes withheld in the designated fields.

- Review for accuracy: Double-check all entries to ensure there are no errors.

- Submit the form: File the W3pr with the Puerto Rico Department of the Treasury, along with any required W-2 forms.

Legal use of the W3pr

The legal use of the W3pr form is mandated by the Puerto Rico Department of the Treasury. Employers are required to file this form annually to report wages and taxes withheld for their employees. Failure to submit the W3pr can result in penalties, including fines and potential legal repercussions. It is crucial for employers to adhere to filing deadlines and ensure that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines associated with the W3pr form. The annual filing deadline typically aligns with the federal tax deadline, which is April 15. However, employers should verify any state-specific deadlines that may apply. Timely submission is critical to avoid penalties and ensure compliance with tax regulations.

Required Documents

To complete the W3pr form, employers will need several documents, including:

- Employee W-2 forms: These provide detailed wage and tax information for each employee.

- Payroll records: Accurate payroll records are essential for compiling total wages and withholdings.

- Tax identification numbers: Employers must include their own tax ID as well as those of their employees.

Form Submission Methods (Online / Mail / In-Person)

The W3pr form can be submitted through various methods, depending on the preferences of the employer and the guidelines set by the Puerto Rico Department of the Treasury. Options typically include:

- Online submission: Employers may have the option to file electronically through the department's online portal.

- Mail: The form can be printed and mailed to the appropriate tax office.

- In-person: Some employers may choose to deliver the form directly to a local tax office.

Quick guide on how to complete w3pr 2017 form

Uncover the easiest method to complete and sign your W3pr

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and sign your W3pr and related forms for public services. Our intelligent electronic signature tool gives you everything required to handle documents swiftly and according to official standards - powerful PDF editing, managing, securing, signing, and sharing capabilities all available within a user-friendly interface.

Just a few steps are needed to finish filling out and signing your W3pr:

- Insert the editable template into the editor using the Get Form button.

- Review what information you must provide in your W3pr.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the sections with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is truly signNow or Cover fields that are no longer relevant.

- Press Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and finalize your task with the Done button.

Store your finished W3pr in the Documents section of your profile, download it, or export it to your preferred cloud storage. Our tool also provides versatile file sharing options. There’s no need to print your forms when filing them with the appropriate public office - handle it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct w3pr 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the w3pr 2017 form

How to generate an electronic signature for your W3pr 2017 Form in the online mode

How to create an electronic signature for the W3pr 2017 Form in Google Chrome

How to make an eSignature for signing the W3pr 2017 Form in Gmail

How to generate an eSignature for the W3pr 2017 Form straight from your mobile device

How to create an eSignature for the W3pr 2017 Form on iOS

How to generate an eSignature for the W3pr 2017 Form on Android OS

People also ask

-

What is W3pr and how does it relate to airSlate SignNow?

W3pr is a powerful feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows by integrating advanced functionalities that make sending and signing documents more efficient. With W3pr, businesses can signNowly reduce turnaround times and improve overall productivity.

-

How does W3pr improve document security in airSlate SignNow?

W3pr ensures that all documents signed through airSlate SignNow are secured using advanced encryption methods. This feature guarantees that sensitive information remains protected throughout the signing process. By utilizing W3pr, businesses can have peace of mind knowing their documents are safe and compliant with industry standards.

-

What are the pricing plans for using W3pr with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that incorporate the W3pr feature, catering to businesses of all sizes. Each plan is designed to provide essential eSigning functionalities while ensuring cost-effectiveness. You can choose a plan that best fits your needs and budget, making it easy to leverage the benefits of W3pr.

-

Can W3pr be integrated with other applications?

Yes, W3pr can seamlessly integrate with various third-party applications, enhancing the overall functionality of airSlate SignNow. This includes popular CRM and project management tools, allowing for a more connected workflow. By integrating W3pr, businesses can automate processes and improve collaboration between teams.

-

What benefits does W3pr offer for remote teams using airSlate SignNow?

W3pr offers signNow benefits for remote teams by facilitating easy document sharing and eSigning from anywhere. This feature ensures that team members can collaborate efficiently, regardless of their location. With W3pr, remote teams can maintain productivity and streamline their workflows with minimal effort.

-

Is W3pr user-friendly for individuals new to airSlate SignNow?

Absolutely! W3pr is designed with user-friendliness in mind, making it accessible for individuals who are new to airSlate SignNow. With intuitive navigation and straightforward functionalities, even those with minimal tech experience can easily send and sign documents using W3pr.

-

What types of documents can be processed with W3pr in airSlate SignNow?

W3pr supports a wide range of document types, including contracts, agreements, and forms within airSlate SignNow. This versatility allows businesses to handle various documentation needs efficiently. Users can customize templates and workflows to suit different types of documents, maximizing the effectiveness of W3pr.

Get more for W3pr

- Statement of credit denial termination or change form

- Mastercarddisputesbecuorg form

- What is a credit union fiduciary account 2012 form

- Becu automatic payment form

- J p morgan chase personal financial statement form

- Home credit application form

- Form 1120 nd rev december

- Form 8865 schedule k 2 and k 3 international tax

Find out other W3pr

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form