Form W 3PR Internal Revenue Service 2020

What is the Form W-3PR?

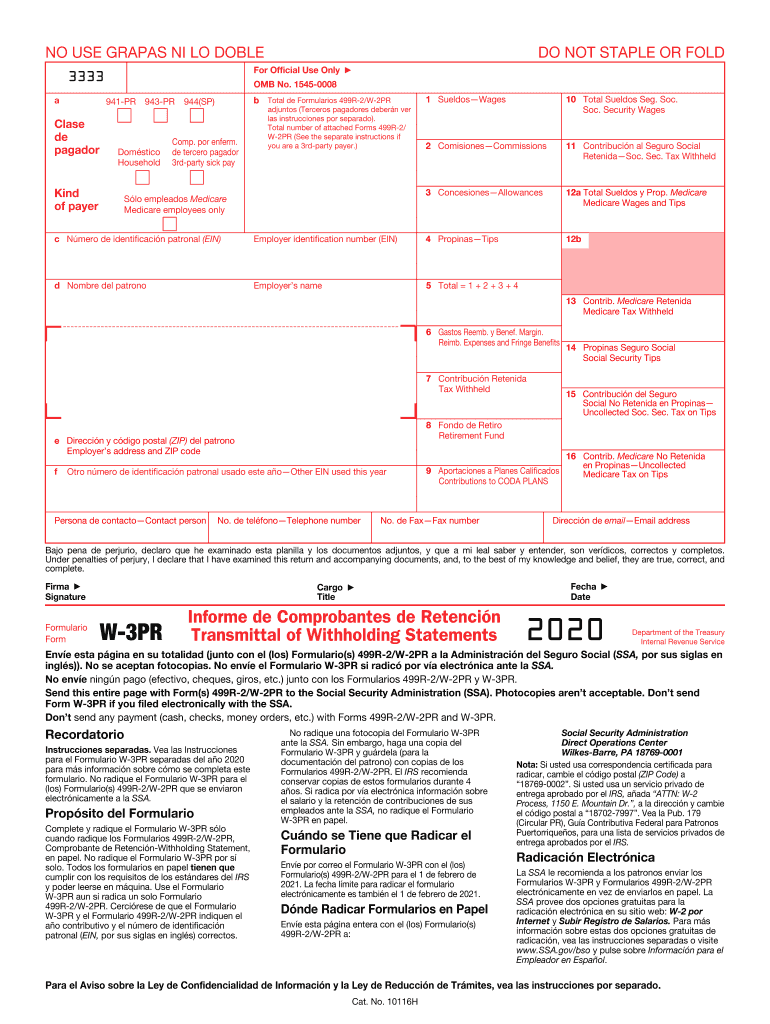

The Form W-3PR is a transmittal form used by employers in Puerto Rico to report annual wage and tax information to the Internal Revenue Service (IRS). This form summarizes the information reported on Forms W-2PR, which are issued to employees. The W-3PR ensures that the IRS receives an accurate overview of the total wages paid and the taxes withheld for the year. It is essential for compliance with federal tax regulations and helps maintain accurate records for both employers and employees.

How to Use the Form W-3PR

To effectively use the Form W-3PR, employers must first complete the individual Forms W-2PR for each employee. Once these forms are filled out, the total amounts from all W-2PR forms are transferred to the W-3PR. This includes total wages, federal income tax withheld, and other relevant tax information. After completing the W-3PR, employers must submit it to the IRS along with the W-2PR forms. This process ensures that the IRS has a complete record of wage and tax information for all employees in Puerto Rico.

Steps to Complete the Form W-3PR

Completing the Form W-3PR involves several key steps:

- Gather all completed Forms W-2PR for your employees.

- Calculate the total wages paid and total taxes withheld for all employees.

- Fill in the appropriate fields on the W-3PR, including employer information and totals from the W-2PR forms.

- Review the form for accuracy to ensure all information is correct.

- Submit the W-3PR along with all W-2PR forms to the IRS by the designated deadline.

Legal Use of the Form W-3PR

The Form W-3PR is legally required for employers in Puerto Rico to report wages and taxes to the IRS. Failure to file this form, or inaccuracies in the information provided, can result in penalties and fines. It is crucial for employers to understand the legal implications of submitting the W-3PR, as it serves as an official record of compliance with federal tax laws. Proper use of this form helps protect both the employer and employees from potential legal issues related to tax reporting.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form W-3PR. Typically, the form is due by the end of January following the tax year being reported. It is important to check for any updates or changes to deadlines each year, as the IRS may adjust these dates. Timely submission is essential to avoid penalties and ensure compliance with federal regulations.

Required Documents

To complete the Form W-3PR, employers need the following documents:

- Completed Forms W-2PR for each employee.

- Employer identification number (EIN).

- Accurate records of total wages paid and taxes withheld.

Having these documents ready will streamline the process of filling out the W-3PR and ensure accuracy in reporting.

Quick guide on how to complete 2020 form w 3pr internal revenue service

Complete Form W 3PR Internal Revenue Service seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form W 3PR Internal Revenue Service on any platform using the airSlate SignNow Android or iOS apps and streamline any document-related operation today.

How to edit and eSign Form W 3PR Internal Revenue Service effortlessly

- Obtain Form W 3PR Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Edit and eSign Form W 3PR Internal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form w 3pr internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 form w 3pr internal revenue service

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a Puerto Rico W-2 form?

A Puerto Rico W-2 form is a tax document that employers in Puerto Rico issue to report wages paid and taxes withheld for their employees. It’s essential for filing your annual tax return in Puerto Rico. Using airSlate SignNow, you can easily create and send your Puerto Rico W-2 form securely and efficiently.

-

How can airSlate SignNow help with Puerto Rico W-2 forms?

airSlate SignNow simplifies the process of preparing and eSigning Puerto Rico W-2 forms. Our platform provides templates and tools to ensure compliance with local tax regulations, streamlining the completion and submission of these critical documents for both employers and employees.

-

What are the pricing options for using airSlate SignNow for Puerto Rico W-2 forms?

airSlate SignNow offers various pricing plans to fit different business needs, starting with a cost-effective solution for small businesses. Our plans include features for managing Puerto Rico W-2 forms, and you can choose a plan that scales as your business grows.

-

Are there any specific features for handling Puerto Rico W-2 forms?

Yes, airSlate SignNow includes features tailored for handling Puerto Rico W-2 forms, such as customizable templates, secure eSigning, and document tracking. These features help ensure that your forms are completed accurately and delivered on time.

-

What benefits do I get by using airSlate SignNow for my Puerto Rico W-2 forms?

Using airSlate SignNow for your Puerto Rico W-2 forms means you get a secure, user-friendly platform that enhances efficiency. You can reduce the time spent on paperwork, minimize errors, and ensure compliance with local regulations, ultimately streamlining your payroll process.

-

Can I integrate airSlate SignNow with other software for Puerto Rico W-2 forms?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to seamlessly connect your payroll and accounting systems. This integration helps you manage your Puerto Rico W-2 forms more effectively and keeps your data organized.

-

Is airSlate SignNow compliant with Puerto Rico tax regulations regarding W-2 forms?

Yes, airSlate SignNow is designed to comply with tax regulations in Puerto Rico. Our templates and features are continuously updated to meet current legal requirements for Puerto Rico W-2 forms, ensuring that your documents are compliant and ready for submission.

Get more for Form W 3PR Internal Revenue Service

- Register it in the state of michigan form

- Property indicated on tax maps by an identification number form

- Cms 460 medicare participating physician or supplier agreement medicare participating physician or supplier agreement form

- Defendants names list all form

- Ares ops manual 2011 2018 form

- Transfer by affidavit state bar of wisconsin form

- Form tc309 accountants certification nysscpa

- Uia 1583 record of work search state of michigan form

Find out other Form W 3PR Internal Revenue Service

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure