Form W 3PR Internal Revenue Service 2020

What is the Form W-3PR?

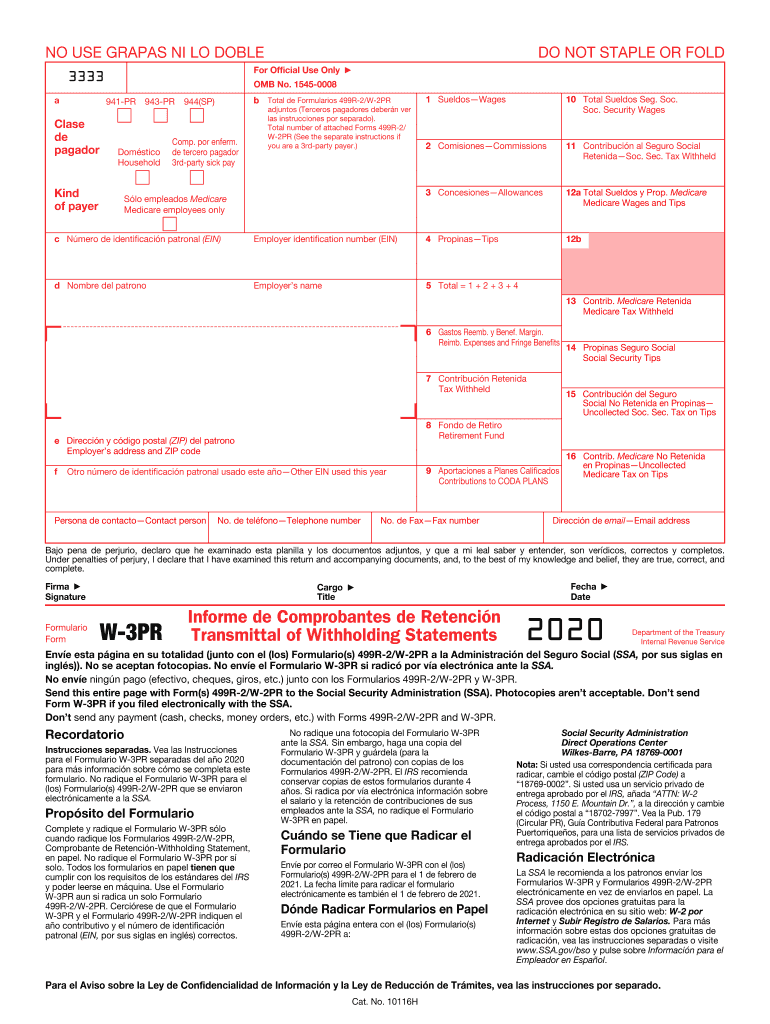

The Form W-3PR is a transmittal form used by employers in Puerto Rico to report annual wage and tax information to the Internal Revenue Service (IRS). This form summarizes the information reported on Forms W-2PR, which are issued to employees. The W-3PR ensures that the IRS receives an accurate overview of the total wages paid and the taxes withheld for the year. It is essential for compliance with federal tax regulations and helps maintain accurate records for both employers and employees.

How to Use the Form W-3PR

To effectively use the Form W-3PR, employers must first complete the individual Forms W-2PR for each employee. Once these forms are filled out, the total amounts from all W-2PR forms are transferred to the W-3PR. This includes total wages, federal income tax withheld, and other relevant tax information. After completing the W-3PR, employers must submit it to the IRS along with the W-2PR forms. This process ensures that the IRS has a complete record of wage and tax information for all employees in Puerto Rico.

Steps to Complete the Form W-3PR

Completing the Form W-3PR involves several key steps:

- Gather all completed Forms W-2PR for your employees.

- Calculate the total wages paid and total taxes withheld for all employees.

- Fill in the appropriate fields on the W-3PR, including employer information and totals from the W-2PR forms.

- Review the form for accuracy to ensure all information is correct.

- Submit the W-3PR along with all W-2PR forms to the IRS by the designated deadline.

Legal Use of the Form W-3PR

The Form W-3PR is legally required for employers in Puerto Rico to report wages and taxes to the IRS. Failure to file this form, or inaccuracies in the information provided, can result in penalties and fines. It is crucial for employers to understand the legal implications of submitting the W-3PR, as it serves as an official record of compliance with federal tax laws. Proper use of this form helps protect both the employer and employees from potential legal issues related to tax reporting.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form W-3PR. Typically, the form is due by the end of January following the tax year being reported. It is important to check for any updates or changes to deadlines each year, as the IRS may adjust these dates. Timely submission is essential to avoid penalties and ensure compliance with federal regulations.

Required Documents

To complete the Form W-3PR, employers need the following documents:

- Completed Forms W-2PR for each employee.

- Employer identification number (EIN).

- Accurate records of total wages paid and taxes withheld.

Having these documents ready will streamline the process of filling out the W-3PR and ensure accuracy in reporting.

Quick guide on how to complete 2020 form w 3pr internal revenue service

Complete Form W 3PR Internal Revenue Service seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form W 3PR Internal Revenue Service on any platform using the airSlate SignNow Android or iOS apps and streamline any document-related operation today.

How to edit and eSign Form W 3PR Internal Revenue Service effortlessly

- Obtain Form W 3PR Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Edit and eSign Form W 3PR Internal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form w 3pr internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 form w 3pr internal revenue service

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Form W 3PR Internal Revenue Service used for?

The Form W 3PR Internal Revenue Service is used for reporting the total wages, tips, and other compensation paid to employees in Puerto Rico. This form summarizes the information from all W-2 forms and is essential for employers to comply with tax reporting requirements. Accurate completion of Form W 3PR is crucial for ensuring proper tax processing.

-

How can airSlate SignNow help with Form W 3PR Internal Revenue Service submissions?

airSlate SignNow simplifies the process of preparing and signing Form W 3PR Internal Revenue Service by providing an easy-to-use platform for document management. Users can create, edit, and eSign the form electronically, ensuring that all necessary information is accurately filled out and securely submitted to the IRS. This streamlines the compliance process for businesses.

-

Is there a cost associated with using airSlate SignNow for Form W 3PR Internal Revenue Service?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs. These plans provide access to features that facilitate the completion and submission of Form W 3PR Internal Revenue Service efficiently. Consider our subscription options to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing Form W 3PR Internal Revenue Service?

airSlate SignNow includes features such as document templates, electronic signatures, and secure cloud storage, all designed to enhance the management of Form W 3PR Internal Revenue Service. Additionally, the platform allows for real-time collaboration and tracking, making it easier to complete tax forms accurately and on time.

-

Can I integrate airSlate SignNow with other tools for Form W 3PR Internal Revenue Service?

Absolutely! airSlate SignNow offers integrations with various business applications, allowing you to streamline your workflow when handling Form W 3PR Internal Revenue Service. Whether you use accounting software or HR management systems, our platform can easily connect to optimize your processes.

-

What are the benefits of using airSlate SignNow for Form W 3PR Internal Revenue Service?

Using airSlate SignNow for Form W 3PR Internal Revenue Service provides several benefits, including improved efficiency, reduced errors, and enhanced compliance. The platform's user-friendly interface and automation features help save time and ensure that your tax documentation is handled accurately and securely.

-

How secure is airSlate SignNow for handling Form W 3PR Internal Revenue Service?

airSlate SignNow prioritizes security and compliance, employing robust encryption and secure cloud storage for handling Form W 3PR Internal Revenue Service. Our platform adheres to industry standards, ensuring that all sensitive information is protected during the document management process.

Get more for Form W 3PR Internal Revenue Service

- D instructions 2018 2019 form

- Bmi publisher form

- Foia request disapproval form

- Form newsletters

- Form 480 puerto rico

- Blank law enforcement theft reports form

- Vha handbook 11406 72106 purchased home health care services procedures eligibility determination health services accessibility form

- Consolidated omnibus budget reconciliation act ampquotcobraampquot pers hbd 85 rev 1017 consolidated omnibus budget form

Find out other Form W 3PR Internal Revenue Service

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe