Form W 3 PR Transmittal of Withholding Statements Puerto Rico 2016

What is the Form W-3 PR Transmittal of Withholding Statements Puerto Rico

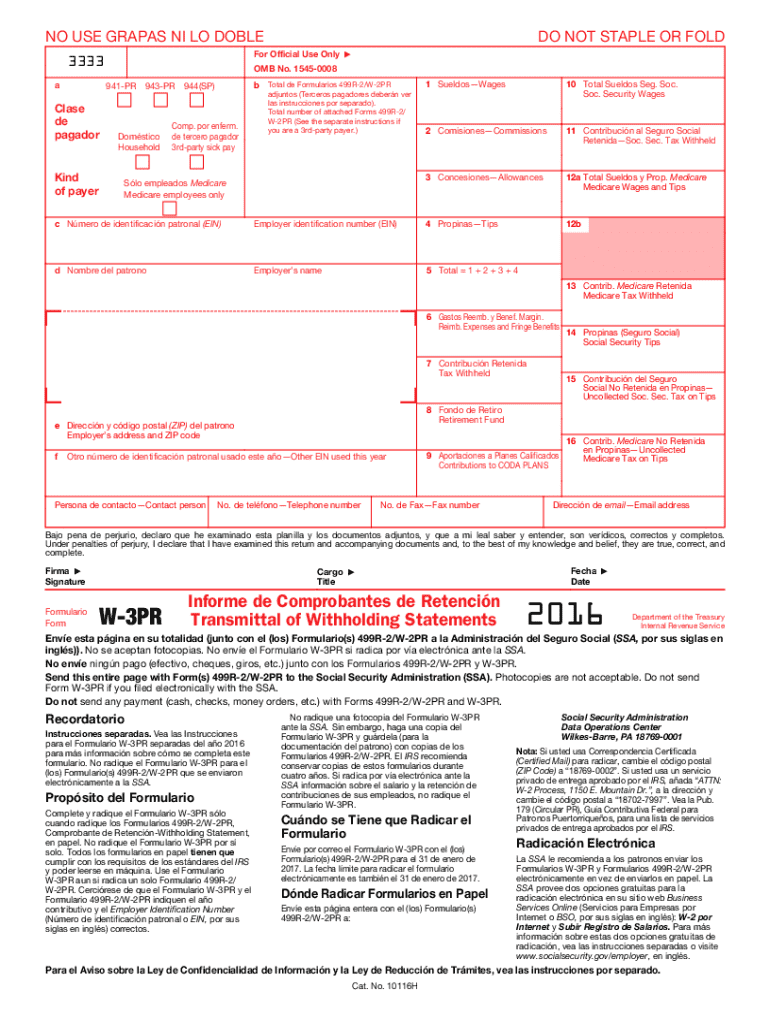

The Form W-3 PR is a crucial document used in Puerto Rico for the transmittal of withholding statements. It serves as a summary of the information reported on Forms W-2 PR, which are issued to employees by their employers. This form consolidates the withholding information for the tax year and is submitted to the Puerto Rico Department of the Treasury. Understanding the purpose of Form W-3 PR is essential for employers to ensure compliance with local tax regulations and to facilitate accurate reporting of withheld taxes.

Steps to Complete the Form W-3 PR Transmittal of Withholding Statements Puerto Rico

Completing the Form W-3 PR involves several important steps to ensure accuracy and compliance. First, gather all relevant Forms W-2 PR issued to employees. Next, enter the total number of Forms W-2 PR included in the submission. This is followed by calculating the total amount of wages, tips, and other compensation reported on these forms. Ensure that the total withholding amounts for federal income tax, Social Security, and Medicare taxes are accurately reflected. Finally, sign and date the form before submission to the Puerto Rico Department of the Treasury.

How to Obtain the Form W-3 PR Transmittal of Withholding Statements Puerto Rico

The Form W-3 PR can be obtained through the official website of the Puerto Rico Department of the Treasury. It is available for download in a PDF format, which can be printed and filled out manually. Additionally, employers may also request physical copies directly from the Department of the Treasury if needed. It is important to ensure that you are using the most current version of the form to comply with the latest regulations.

Legal Use of the Form W-3 PR Transmittal of Withholding Statements Puerto Rico

The legal use of Form W-3 PR is governed by the tax laws of Puerto Rico. Employers are required to submit this form along with the corresponding Forms W-2 PR to report the total amount of withholding for the tax year. Failure to submit the form accurately and on time can result in penalties. Therefore, understanding the legal implications and ensuring compliance with submission deadlines is essential for all employers operating in Puerto Rico.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-3 PR are critical for compliance. Employers must submit the form to the Puerto Rico Department of the Treasury by the specified due date, typically by the end of January following the tax year. It is essential to stay informed about any changes to these deadlines, as they may vary based on specific circumstances or updates to tax regulations. Marking these dates on your calendar can help avoid late submissions and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form W-3 PR. The form can be submitted online through the Puerto Rico Department of the Treasury's electronic filing system, which is often the most efficient method. Alternatively, employers may choose to mail the completed form to the appropriate address provided by the Department. In-person submissions may also be possible at designated tax offices. Each method has its own processing times and requirements, so it is advisable to choose the method that best suits your needs.

Quick guide on how to complete 2016 form w 3 pr transmittal of withholding statements puerto rico

Complete Form W 3 PR Transmittal Of Withholding Statements Puerto Rico effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents swiftly without delays. Manage Form W 3 PR Transmittal Of Withholding Statements Puerto Rico across any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Form W 3 PR Transmittal Of Withholding Statements Puerto Rico with ease

- Obtain Form W 3 PR Transmittal Of Withholding Statements Puerto Rico and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Form W 3 PR Transmittal Of Withholding Statements Puerto Rico and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form w 3 pr transmittal of withholding statements puerto rico

Create this form in 5 minutes!

How to create an eSignature for the 2016 form w 3 pr transmittal of withholding statements puerto rico

How to create an electronic signature for your 2016 Form W 3 Pr Transmittal Of Withholding Statements Puerto Rico in the online mode

How to make an eSignature for the 2016 Form W 3 Pr Transmittal Of Withholding Statements Puerto Rico in Chrome

How to make an electronic signature for putting it on the 2016 Form W 3 Pr Transmittal Of Withholding Statements Puerto Rico in Gmail

How to generate an eSignature for the 2016 Form W 3 Pr Transmittal Of Withholding Statements Puerto Rico straight from your smart phone

How to generate an eSignature for the 2016 Form W 3 Pr Transmittal Of Withholding Statements Puerto Rico on iOS

How to generate an electronic signature for the 2016 Form W 3 Pr Transmittal Of Withholding Statements Puerto Rico on Android OS

People also ask

-

What is the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico?

The Form W 3 PR Transmittal Of Withholding Statements Puerto Rico is an essential document for reporting withholding tax information to the Internal Revenue Service in Puerto Rico. This form summarizes the wages and taxes withheld from employees in the territory, ensuring compliance with local tax laws. Utilizing airSlate SignNow can streamline the process of preparing and transmitting this form.

-

How does airSlate SignNow help with the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico?

airSlate SignNow enables businesses to create, sign, and send the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico seamlessly. With its user-friendly interface, you can easily fill out and eSign your forms, saving time and reducing errors. This ensures that your tax documentation is processed quickly and efficiently.

-

Are there any costs associated with using airSlate SignNow for the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The plans are designed to be cost-effective, providing features that facilitate the efficient management of forms like the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico. Be sure to check for any promotions that may be available.

-

What features does airSlate SignNow offer for handling Form W 3 PR Transmittal Of Withholding Statements Puerto Rico?

airSlate SignNow includes features such as eSignature capabilities, document templates, and integrations with various software tools. These features simplify the preparation and submission of the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico, enhancing your overall workflow. You can also track the status of your documents in real time.

-

Can I integrate airSlate SignNow with other software for my Form W 3 PR Transmittal Of Withholding Statements Puerto Rico?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software that streamline the process of managing the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico. This helps ensure that your data is synchronized across platforms, reducing the chances of errors and improving efficiency.

-

Is airSlate SignNow secure for handling Form W 3 PR Transmittal Of Withholding Statements Puerto Rico?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption protocols to protect all documents, including the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico. You can trust that your sensitive data will remain secure while being eSigned and transmitted.

-

How can I get support for issues related to the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico?

airSlate SignNow provides robust customer support to assist with any questions or issues related to the Form W 3 PR Transmittal Of Withholding Statements Puerto Rico. You can access online resources, chat support, or contact their help desk for immediate assistance. Their knowledgeable team is ready to help you navigate any challenges.

Get more for Form W 3 PR Transmittal Of Withholding Statements Puerto Rico

Find out other Form W 3 PR Transmittal Of Withholding Statements Puerto Rico

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading