W 3 PR En Sp Transmittal of Withholding Statements Puerto Rican Version 2025-2026

What is the W-3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version

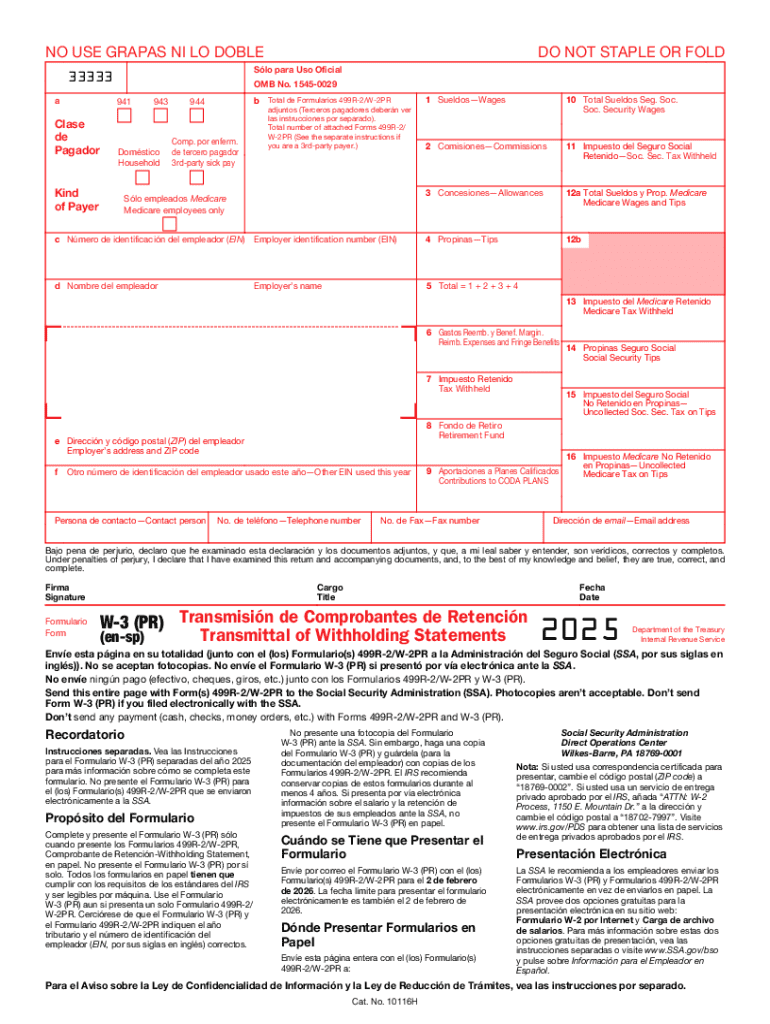

The W-3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version is a crucial tax form used by employers in Puerto Rico. This form serves as a summary of the withholding statements submitted to the Puerto Rico Department of Treasury. It consolidates information regarding income tax withheld from employees' wages throughout the year. The W-3 PR is essential for ensuring compliance with local tax regulations and provides the government with necessary data for processing tax returns.

How to use the W-3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version

Using the W-3 PR involves several steps. Employers must first complete individual withholding statements for each employee, typically using the W-2 PR form. Once these statements are prepared, the W-3 PR is filled out to summarize the total amounts withheld. This summary form must then be submitted along with the individual statements to the appropriate tax authority. It is important to ensure that all information is accurate and complete to avoid any issues with tax compliance.

Steps to complete the W-3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version

Completing the W-3 PR involves a systematic approach:

- Gather all W-2 PR forms for your employees.

- Calculate the total amounts withheld for income tax from all employees.

- Fill out the W-3 PR form, including employer information and total withholding amounts.

- Review the form for accuracy, ensuring all figures match the individual W-2 PR forms.

- Submit the completed W-3 PR along with the W-2 PR forms to the Puerto Rico Department of Treasury.

Legal use of the W-3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version

The W-3 PR is legally mandated for employers in Puerto Rico who withhold income tax from employee wages. Failure to file this form accurately and on time can result in penalties from the tax authority. It is essential for employers to understand their legal obligations regarding this form to maintain compliance with local tax laws.

Key elements of the W-3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version

Key elements of the W-3 PR include:

- Employer's name and identification number.

- Total amount of income tax withheld from all employees.

- Number of employees for whom withholding statements are submitted.

- Signature of the employer or authorized representative.

These elements are critical for ensuring that the form is processed correctly by the tax authority.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the W-3 PR. Typically, the form must be submitted by the end of January following the tax year. It is advisable for employers to keep track of these deadlines to avoid late fees and penalties. Additionally, any corrections to previously submitted forms should be made promptly to ensure compliance.

Create this form in 5 minutes or less

Find and fill out the correct w 3 pr en sp transmittal of withholding statements puerto rican version

Create this form in 5 minutes!

How to create an eSignature for the w 3 pr en sp transmittal of withholding statements puerto rican version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version?

The W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version is a form used to report annual withholding tax information to the Puerto Rican government. It summarizes the total amount of withholding for the year and is essential for compliance. Businesses must ensure accurate completion to avoid penalties.

-

How can airSlate SignNow help with the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version. Our user-friendly interface simplifies the process, ensuring that all necessary information is included and correctly formatted for submission.

-

Is there a cost associated with using airSlate SignNow for the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solutions ensure that you can manage the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version. These features streamline the document management process, making it easier for businesses to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version alongside your existing tools. This enhances productivity and ensures a smooth workflow across your business operations.

-

What are the benefits of using airSlate SignNow for the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version?

Using airSlate SignNow for the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while simplifying the eSigning process for all parties involved.

-

How secure is airSlate SignNow when handling the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data while processing the W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version. You can trust that your sensitive information is safe with us.

Get more for W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version

- Designation of beneficiary form state of new jersey

- Cmr worksheet form

- Irs reasonable accommodation forms

- Prepaid card replacement application cum acknowledgement form

- Relinquishment of rightsrevised minordocx form

- Arizona new hire reporting form goodman law firm

- Exclusive license form

- Colorado department of vital records form

Find out other W 3 PR en sp Transmittal Of Withholding Statements Puerto Rican Version

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple