1099 B Form 2017

What is the 1099 B Form

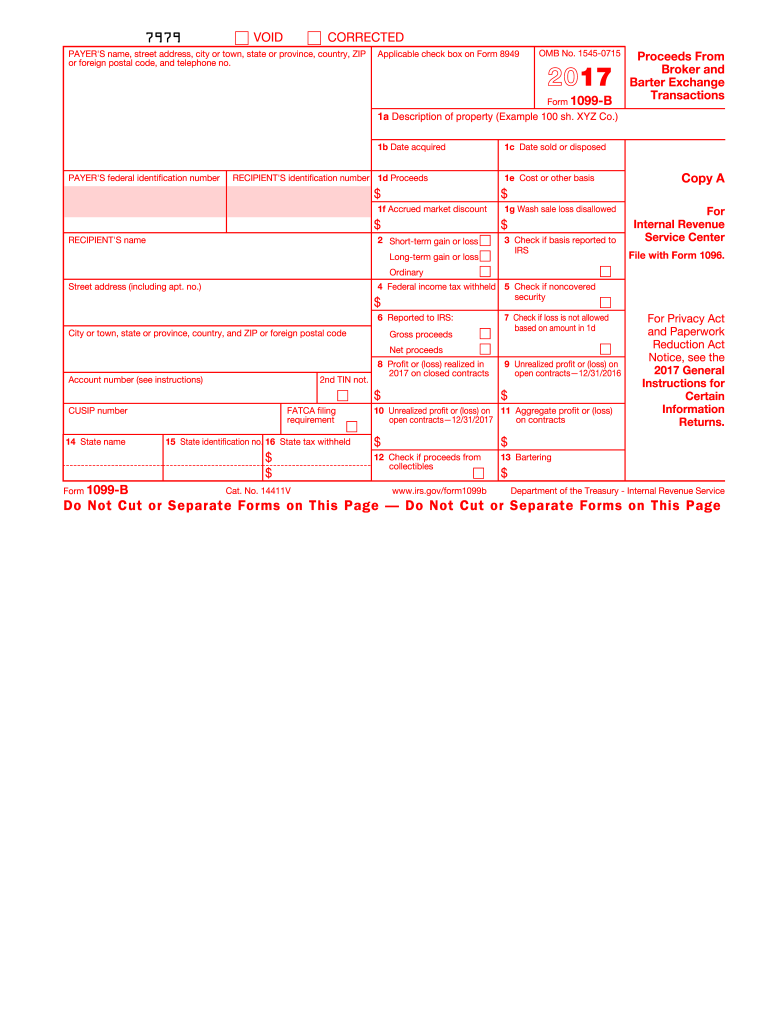

The 1099 B Form is a crucial document used in the United States for reporting proceeds from broker and barter exchange transactions. This form is typically issued by brokers to their clients, detailing the gains or losses from the sale of securities and other investments. It serves as a record for taxpayers to report their capital gains and losses on their tax returns, ensuring compliance with IRS regulations.

How to use the 1099 B Form

To effectively use the 1099 B Form, taxpayers must first receive it from their brokerage firm. Once received, individuals should review the information provided, including transaction dates, amounts, and any applicable cost basis adjustments. This information is essential for accurately reporting capital gains or losses on Form 1040. It is advisable to keep this form alongside other tax documents for reference during the filing process.

Steps to complete the 1099 B Form

Completing the 1099 B Form involves several key steps:

- Gather necessary information, including transaction details and cost basis.

- Review the form for accuracy, ensuring all transactions are reported correctly.

- Calculate total gains or losses for the reporting year.

- Transfer the relevant figures to your tax return, typically on Schedule D.

- File the completed tax return by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines for the use of the 1099 B Form. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. Key points include understanding the reporting requirements for short-term versus long-term capital gains, as well as the need to report any adjustments to the cost basis. Familiarity with IRS publications related to capital gains and losses can aid in the accurate completion of the form.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 B Form are critical for taxpayers. Generally, brokers must provide the form to clients by January thirty-first of the following tax year. Taxpayers should file their tax returns, including the information from the 1099 B Form, by April fifteenth. It is essential to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS announcements.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of the 1099 B Form can lead to significant penalties. The IRS may impose fines for late filing, incorrect information, or failure to file altogether. Taxpayers should be aware that these penalties can accumulate, leading to increased financial liability. To avoid such consequences, it is advisable to file the form accurately and on time.

Quick guide on how to complete 1099 b 2017 2018 form

Discover the easiest method to complete and sign your 1099 B Form

Are you still spending time preparing your official documents on paper instead of handling it online? airSlate SignNow offers a superior solution for completing and signing your 1099 B Form and other forms for public services. Our advanced eSignature tool provides you with all the essentials to process paperwork swiftly and in accordance with official standards - robust PDF editing, management, protection, signing, and sharing utilities all at your fingertips within an intuitive interface.

There are just a few steps required to complete and sign your 1099 B Form:

- Upload the editable template to the editor by clicking the Get Form button.

- Review what information you need to include in your 1099 B Form.

- Move through the fields using the Next feature to avoid missing anything.

- Utilize Text, Check, and Cross tools to populate the blanks with your details.

- Edit the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Redact sections that are no longer relevant.

- Click on Sign to generate a legally valid eSignature using your preferred method.

- Add the Date beside your signature and finalize your work with the Done button.

Store your finished 1099 B Form in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our system also provides flexible file sharing options. There’s no requirement to print your forms when you need to submit them to the relevant public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your profile. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct 1099 b 2017 2018 form

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the 1099 b 2017 2018 form

How to create an electronic signature for the 1099 B 2017 2018 Form in the online mode

How to make an electronic signature for the 1099 B 2017 2018 Form in Chrome

How to create an eSignature for signing the 1099 B 2017 2018 Form in Gmail

How to make an electronic signature for the 1099 B 2017 2018 Form right from your smart phone

How to make an electronic signature for the 1099 B 2017 2018 Form on iOS

How to create an eSignature for the 1099 B 2017 2018 Form on Android OS

People also ask

-

What is a 1099 B Form and why is it important?

A 1099 B Form is a tax document used to report proceeds from broker and barter exchange transactions. It is crucial for taxpayers to accurately report their capital gains or losses to the IRS. Using airSlate SignNow can simplify the process of eSigning and sending this document securely.

-

How can airSlate SignNow help with completing the 1099 B Form?

With airSlate SignNow, users can easily prepare, send, and eSign their 1099 B Form. The platform streamlines the documentation process, ensuring that all necessary signatures are collected efficiently. This not only saves time but also helps ensure compliance with tax regulations.

-

What features does airSlate SignNow offer for managing the 1099 B Form?

airSlate SignNow offers features like customizable templates, automated workflows, and real-time tracking specifically designed for documents like the 1099 B Form. These tools make it easy to manage your tax documents while ensuring they are signed and filed correctly. Plus, integration with popular software enhances usability.

-

Is airSlate SignNow cost-effective for handling the 1099 B Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the 1099 B Form and other documentation needs. Its pricing plans are designed to cater to businesses of all sizes, ensuring that everyone can access essential eSigning capabilities without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software for the 1099 B Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing users to manage their 1099 B Form alongside their financial records. This integration enhances productivity by minimizing data entry errors and streamlining the filing process.

-

What security measures does airSlate SignNow have for the 1099 B Form?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards for the 1099 B Form and all documents. This ensures that your sensitive financial information remains safe and secure throughout the signing and submission processes.

-

How does airSlate SignNow improve the efficiency of processing the 1099 B Form?

By using airSlate SignNow, businesses can signNowly enhance the efficiency of processing the 1099 B Form. Features like bulk sending, automated reminders, and easy document tracking allow for faster turnaround times on tax documents. This helps ensure that all your submissions are timely and compliant.

Get more for 1099 B Form

- Cna healthpro medical practitioners application claims made coverage form

- Beneficiary planner form

- Colony contractors supplemental application form

- Authorization designation cuna mutual group form

- Loanliner business adverse action notice form

- Surety bond gc 1450 et seq form

- Blank investigation report form

- Form oh city tax return city of geneva fill

Find out other 1099 B Form

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement