1099 B 2023

What is the 1099 B

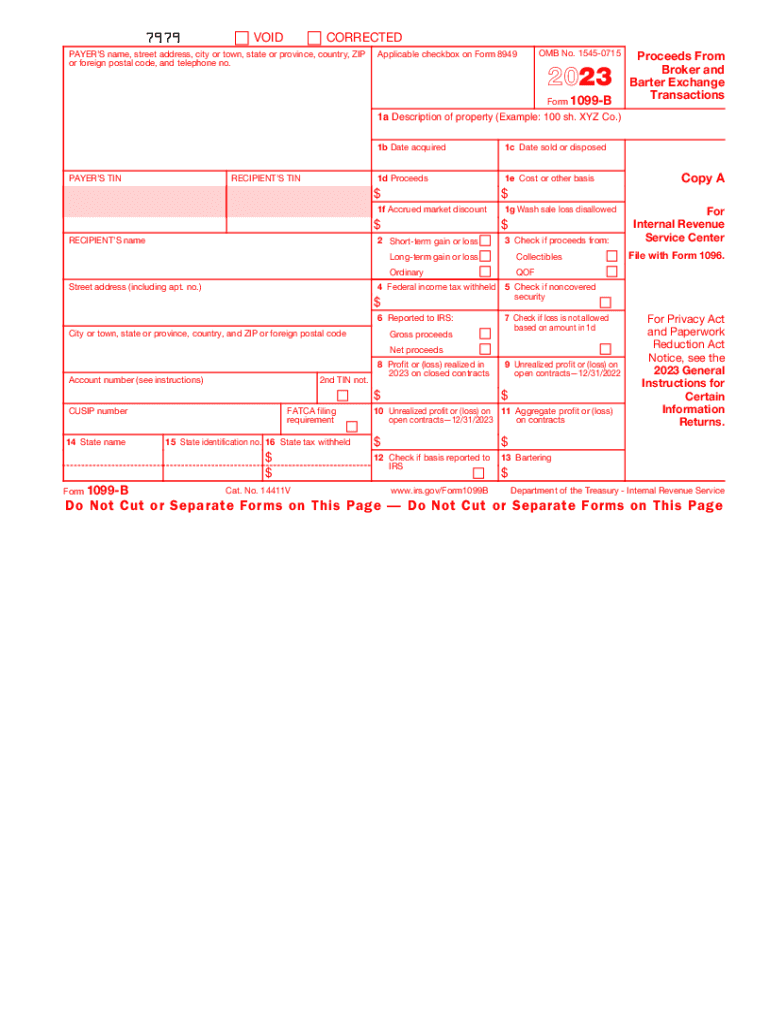

The 1099 B form is an important tax document used in the United States to report proceeds from broker and barter exchange transactions. This form is typically issued by brokers to their clients, detailing the sales of securities, commodities, and other financial instruments. The information provided on the 1099 B includes the gross proceeds from sales, the cost basis of the sold assets, and any adjustments necessary for accurate reporting. Understanding the 1099 B is crucial for taxpayers as it helps them accurately report income and capital gains on their tax returns.

How to obtain the 1099 B

To obtain the 1099 B form, taxpayers typically receive it directly from their brokerage firm or financial institution. Brokers are required to send out this form by January thirty-first of the year following the tax year in which the transactions occurred. If you do not receive your 1099 B by this deadline, you should contact your broker to request a copy. Additionally, some brokers may provide access to digital versions of the form through their online platforms, allowing for easier retrieval and management of tax documents.

Steps to complete the 1099 B

Completing the 1099 B requires careful attention to detail to ensure accurate reporting. Here are the steps involved:

- Gather all relevant transaction records, including purchase and sale confirmations.

- Identify the gross proceeds from each transaction as reported on the 1099 B.

- Calculate the cost basis for each asset sold, which is essential for determining capital gains or losses.

- Fill out the 1099 B form with the necessary information, ensuring all details are correct.

- Submit the completed form to the IRS along with your tax return by the appropriate deadline.

Key elements of the 1099 B

The 1099 B form contains several key elements that are essential for accurate tax reporting. These include:

- Gross Proceeds: The total amount received from the sale of securities.

- Cost Basis: The original value of the asset, which is necessary for calculating gains or losses.

- Transaction Dates: Dates when the transactions occurred, which help in determining the holding period of the assets.

- Adjustment Codes: Any necessary adjustments that may affect the reported amounts.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 1099 B form. Taxpayers must ensure that they accurately report all transactions and adhere to the deadlines set forth by the IRS. It is important to keep copies of the 1099 B for personal records and to verify the information reported on your tax return. If discrepancies arise, it is advisable to contact the broker for clarification and correction.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 B form are crucial for taxpayers to remember. Brokers must provide the form to clients by January thirty-first. Taxpayers should then report the information from the 1099 B on their tax returns, which are typically due by April fifteenth. If additional time is needed, taxpayers can file for an extension, but it is essential to ensure that all income is reported accurately by the deadline to avoid penalties.

Quick guide on how to complete 1099 b

Effortlessly Prepare 1099 B on Any Device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 1099 B on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to Modify and eSign 1099 B with Ease

- Obtain 1099 B and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 1099 B and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 b

Create this form in 5 minutes!

How to create an eSignature for the 1099 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 b form and when do I need it?

A 1099 b form reports proceeds from broker and barter exchange transactions. You typically need it when you have sold stocks, bonds, or other investment gains during the year. Properly managing your 1099 b ensures accurate tax reporting and compliance.

-

How can airSlate SignNow help with signing a 1099 b form?

With airSlate SignNow, you can easily eSign your 1099 b forms quickly and securely. Our platform simplifies the signing process, ensuring your documents are legally binding and safely stored. This efficiency saves you time when handling important tax documents.

-

Is airSlate SignNow compliant with IRS regulations for 1099 b?

Yes, airSlate SignNow is fully compliant with IRS regulations for electronic signatures on documents like the 1099 b. Our solution adheres to the laws that govern electronic signatures, ensuring that your signed documents are valid and recognized.

-

What features does airSlate SignNow offer for managing 1099 b forms?

AirSlate SignNow provides features such as customizable templates for 1099 b forms, automated reminder notifications, and secure document storage. You can track document status in real time, ensuring you never miss a deadline related to your 1099 b submissions.

-

Can I integrate airSlate SignNow with accounting software for 1099 b filing?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your 1099 b forms and filing process. Integrations help streamline your workflow, reducing the chances of errors and saving time.

-

What are the pricing options for airSlate SignNow pertaining to 1099 b documents?

airSlate SignNow offers various pricing tiers suitable for businesses of all sizes when handling 1099 b documents. Our plans provide cost-effective solutions tailored to your needs, ensuring you have access to all essential features without overspending.

-

How secure is airSlate SignNow when handling sensitive 1099 b information?

Security is a top priority at airSlate SignNow, especially when handling sensitive information found in 1099 b forms. We utilize industry-standard encryption and compliance measures to ensure your data remains confidential and protected throughout the signing process.

Get more for 1099 B

- Trench permit application taunton massachusetts form

- Request medical records urgent care form

- From birds to people the west nile virus story form

- Replacement duplicate title form

- Form 8916

- T2sch125 form

- Mri ct ultrasound x ray touchstone medical imaging form

- Work made for hire agreement template form

Find out other 1099 B

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy