Form 1099 B 2016

What is the Form 1099 B

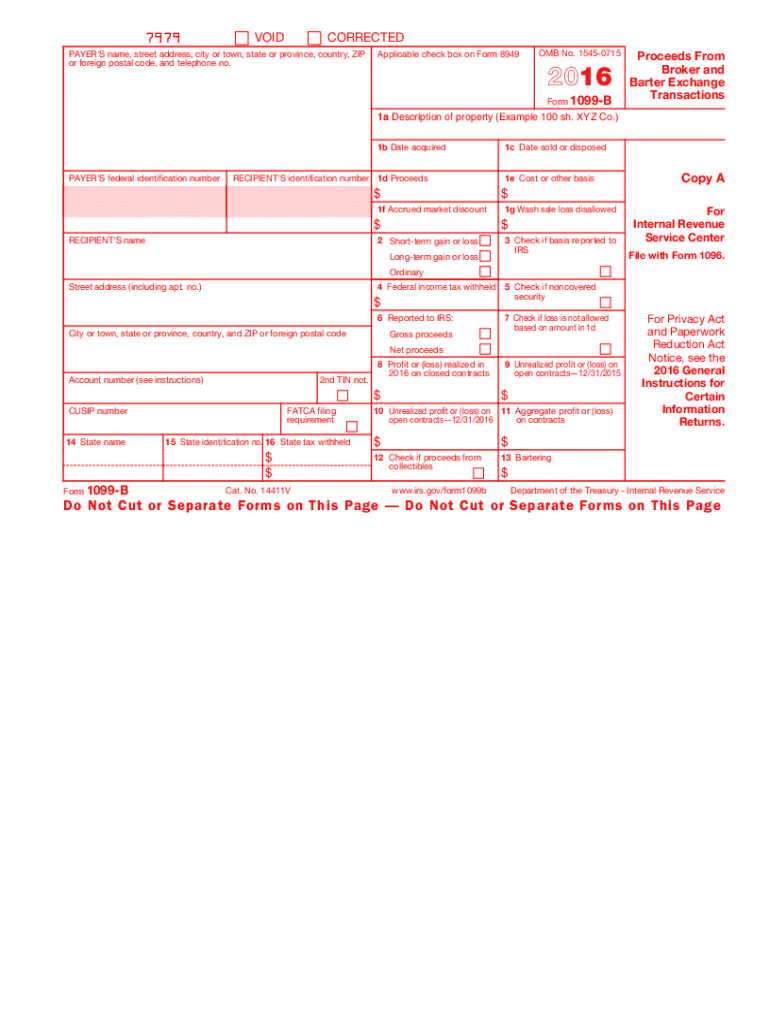

The Form 1099 B is a crucial tax document used in the United States to report proceeds from broker and barter exchange transactions. This form is typically issued by brokers to individuals who have sold stocks, bonds, or other securities during the tax year. It provides essential information regarding the gains or losses from these transactions, which taxpayers must report on their income tax returns. Understanding the details of this form is vital for accurate tax reporting and compliance with IRS regulations.

How to use the Form 1099 B

Using the Form 1099 B involves several steps to ensure accurate reporting of your financial transactions. First, gather all transactions that occurred during the tax year that involve the sale of securities. Next, review the information provided on the form, including details such as the date of sale, the amount received, and any commissions or fees deducted. This information will help you calculate your capital gains or losses, which must be reported on your tax return. It is essential to keep this form for your records, as it may be needed for future reference or audits.

Steps to complete the Form 1099 B

Completing the Form 1099 B requires careful attention to detail. Follow these steps:

- Obtain the form from your broker or download it from the IRS website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Enter the details of each transaction, including the date of sale, description of the security, amount received, and any adjustments for commissions or fees.

- Calculate your total capital gains or losses based on the information provided.

- Review the completed form for accuracy before submitting it to the IRS and providing copies to any involved parties.

Key elements of the Form 1099 B

The Form 1099 B contains several key elements that are essential for proper reporting. These include:

- Transaction details: Information about each sale, including dates and amounts.

- Cost basis: The original value of the securities sold, which is necessary for calculating gains or losses.

- Proceeds: The total amount received from the sale of securities.

- Type of transaction: Indication of whether the sale was a short-term or long-term transaction, which affects tax rates.

IRS Guidelines

The IRS provides specific guidelines for the use of the Form 1099 B, which are important for compliance. Taxpayers must ensure that all information reported is accurate and complete. The IRS requires brokers to issue this form by the end of January following the tax year in which the transactions occurred. Additionally, taxpayers should be aware of the different reporting requirements for short-term versus long-term capital gains, as these can significantly impact tax liabilities.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 1099 B is essential for compliance. The IRS mandates that brokers must provide the form to recipients by January thirty-first of the year following the transactions. Additionally, brokers must file the form with the IRS by the end of February if filing by paper, or by the end of March if filing electronically. Taxpayers should ensure they receive their forms in a timely manner to prepare their tax returns accurately.

Quick guide on how to complete 2016 form 1099 b

Fill out Form 1099 B effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the accurate format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1099 B on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest method to modify and electronically sign Form 1099 B with ease

- Locate Form 1099 B and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow addresses your requirements in document management with just a few clicks from any device of your preference. Modify and electronically sign Form 1099 B and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1099 b

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1099 b

How to create an electronic signature for the 2016 Form 1099 B in the online mode

How to create an eSignature for your 2016 Form 1099 B in Chrome

How to make an eSignature for putting it on the 2016 Form 1099 B in Gmail

How to generate an electronic signature for the 2016 Form 1099 B straight from your smartphone

How to generate an eSignature for the 2016 Form 1099 B on iOS devices

How to generate an eSignature for the 2016 Form 1099 B on Android

People also ask

-

What is Form 1099 B and why is it important?

Form 1099 B is a tax form used to report proceeds from broker and barter exchange transactions. It's crucial for accurately reporting capital gains and losses to the IRS. Understanding Form 1099 B is essential for taxpayers who buy and sell securities, ensuring compliance and accurate tax filings.

-

How can airSlate SignNow help me with Form 1099 B?

airSlate SignNow provides an efficient platform for electronically signing and sending Form 1099 B. Our user-friendly interface streamlines the process, allowing you to manage documentation quickly and securely. With airSlate SignNow, you can ensure your Form 1099 B is signed and sent on time, reducing stress during tax season.

-

Is there a cost associated with using airSlate SignNow for Form 1099 B?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Our cost-effective solution provides access to features that simplify the management of Form 1099 B and other documents. You can choose a plan that suits your needs and budget while enjoying the benefits of our eSignature capabilities.

-

What features does airSlate SignNow offer for managing Form 1099 B?

airSlate SignNow offers features such as customizable templates, bulk sending, and secure signing for Form 1099 B. Our platform ensures that all documents are stored securely and accessible anytime, making it easy to track the status of your filings. These features enhance efficiency and organization when handling tax documents.

-

Can I integrate airSlate SignNow with my accounting software for Form 1099 B?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easy to manage Form 1099 B alongside your financial data. This integration allows for a smoother workflow, enabling automatic population of necessary fields and reducing manual errors. Simplify your tax preparation process with our compatible integrations.

-

How does airSlate SignNow ensure the security of my Form 1099 B?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Form 1099 B and other sensitive documents. Additionally, our platform complies with industry standards, ensuring that your data remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form 1099 B over traditional methods?

Using airSlate SignNow for Form 1099 B offers numerous benefits over traditional paper methods. It saves time and reduces the risk of human error with automated processes, while also providing a more environmentally friendly solution. Plus, the convenience of electronic signatures means you can obtain approvals and send documents from anywhere.

Get more for Form 1099 B

- Application for examination employment jefferson county form

- South carolina department of health and human services coverageforall form

- Jamba juice application printable form

- Blank small business certificate from sba form

- Double jj application form

- Tennessee form bk497

- Tax custhelp comappanswershow and where do i file form it 2663 nonresident real

- Spritzschema vorlage form

Find out other Form 1099 B

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form