Sales and Other Dispositions of Capital Assets IRS Gov 2013

What is the Sales And Other Dispositions Of Capital Assets IRS gov

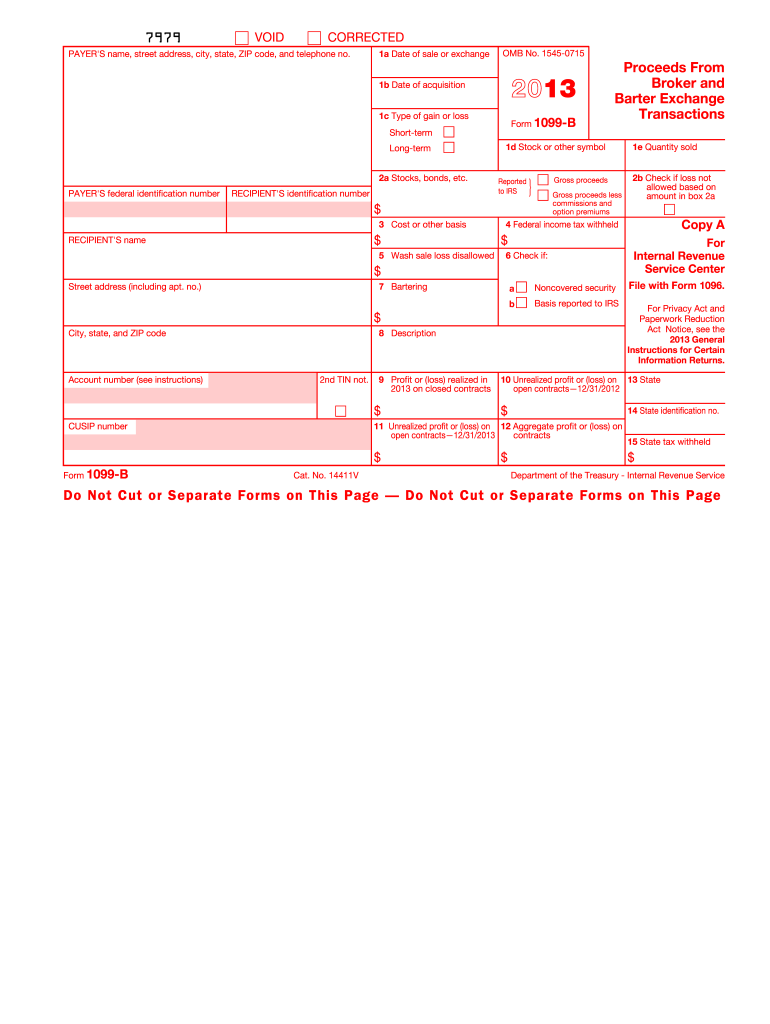

The Sales And Other Dispositions Of Capital Assets IRS gov form is a tax document used to report gains or losses from the sale of capital assets. Capital assets include property, stocks, bonds, and other investments that are not inventory. This form is essential for taxpayers who have sold assets during the tax year and need to calculate their capital gains or losses for accurate tax reporting. Understanding this form is crucial for ensuring compliance with IRS regulations and accurately reflecting your financial situation on your tax return.

Steps to complete the Sales And Other Dispositions Of Capital Assets IRS gov

Completing the Sales And Other Dispositions Of Capital Assets IRS gov form involves several key steps:

- Gather necessary information: Collect details about the assets sold, including purchase dates, sale dates, sale prices, and costs associated with the sale.

- Determine your basis: Calculate the basis of each asset, which typically includes the purchase price plus any improvements made.

- Calculate gains or losses: Subtract the basis from the sale price to determine if you have a gain or loss.

- Complete the form: Fill out the form accurately, reporting each transaction and the corresponding gain or loss.

- Review for accuracy: Double-check all entries for correctness before submission.

Legal use of the Sales And Other Dispositions Of Capital Assets IRS gov

The legal use of the Sales And Other Dispositions Of Capital Assets IRS gov form is critical for compliance with federal tax laws. This form must be filed by individuals and entities who have engaged in transactions involving capital assets. Failing to report these transactions can result in penalties and interest from the IRS. Additionally, the form serves as a legal record of your financial activities related to asset sales, which may be required for audits or other legal proceedings.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Sales And Other Dispositions Of Capital Assets IRS gov form. Generally, this form must be submitted along with your annual tax return by April fifteenth of the following year. If you are unable to meet this deadline, you may file for an extension, but be aware that any taxes owed are still due by the original deadline to avoid penalties.

Examples of using the Sales And Other Dispositions Of Capital Assets IRS gov

Examples of using the Sales And Other Dispositions Of Capital Assets IRS gov form include:

- Reporting the sale of stocks or bonds that have appreciated in value.

- Documenting the sale of real estate property, such as a rental home or land.

- Claiming losses from the sale of collectibles or personal property.

Each of these scenarios requires accurate reporting to ensure compliance and proper tax treatment of the gains or losses incurred.

Form Submission Methods (Online / Mail / In-Person)

The Sales And Other Dispositions Of Capital Assets IRS gov form can be submitted through various methods. Taxpayers have the option to file electronically using tax software that supports this form, which is often the most efficient method. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not available for this form, as it is primarily handled through electronic or postal channels. Ensure that you follow the correct submission method to avoid delays in processing.

Quick guide on how to complete sales and other dispositions of capital assets irsgov

Effortlessly prepare Sales And Other Dispositions Of Capital Assets IRS gov on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your files swiftly without delays. Handle Sales And Other Dispositions Of Capital Assets IRS gov on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and electronically sign Sales And Other Dispositions Of Capital Assets IRS gov with ease

- Obtain Sales And Other Dispositions Of Capital Assets IRS gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Sales And Other Dispositions Of Capital Assets IRS gov and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales and other dispositions of capital assets irsgov

Create this form in 5 minutes!

How to create an eSignature for the sales and other dispositions of capital assets irsgov

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What are Sales And Other Dispositions Of Capital Assets IRS gov?

Sales And Other Dispositions Of Capital Assets IRS gov refers to the tax rules that govern how individuals and businesses report gains or losses from selling capital assets. Understanding these regulations is essential for compliance and tax planning. Our platform helps you manage your documents related to these transactions seamlessly.

-

How can airSlate SignNow assist with Sales And Other Dispositions Of Capital Assets IRS gov?

airSlate SignNow simplifies the process of preparing and signing documents related to Sales And Other Dispositions Of Capital Assets IRS gov. Our eSignature solution ensures that your documents are legally binding and securely stored. You can easily manage your tax-related paperwork without hassle.

-

Is airSlate SignNow a cost-effective solution for handling Sales And Other Dispositions Of Capital Assets IRS gov documents?

Yes, airSlate SignNow offers a cost-effective solution for managing your Sales And Other Dispositions Of Capital Assets IRS gov documentation. With competitive pricing plans and essential features included, you can optimize your document processes without breaking the bank. Our software provides excellent value for your investment.

-

What features does airSlate SignNow provide to assist with tax documentation?

airSlate SignNow includes features like customizable templates, secure storage, and multi-party signing to streamline your tax documentation, including Sales And Other Dispositions Of Capital Assets IRS gov. These tools allow you to create and manage your necessary documents quickly and efficiently, reducing the time spent on administrative tasks.

-

Can I integrate airSlate SignNow with other financial software for tax purposes?

Absolutely! airSlate SignNow offers integrations with various financial software platforms to enhance your workflow related to Sales And Other Dispositions Of Capital Assets IRS gov. By integrating your systems, you can automate data flow, ensuring accuracy and saving time on manual data entry.

-

What benefits does eSigning provide for tax-related documents?

eSigning offers numerous benefits for tax-related documents, especially concerning Sales And Other Dispositions Of Capital Assets IRS gov. It accelerates the signing process, ensures document security, and provides a clear audit trail for compliance purposes. With airSlate SignNow, you can achieve a faster turnaround time on your tax documentation.

-

How secure is the signing process with airSlate SignNow?

Security is a top priority at airSlate SignNow when it comes to handling documents related to Sales And Other Dispositions Of Capital Assets IRS gov. Our platform uses bank-level encryption and adheres to strict compliance standards, ensuring your documents are safe during transmission and storage.

Get more for Sales And Other Dispositions Of Capital Assets IRS gov

- Sample volunteer application for nonprofit organizations volunteer recruitment form

- Global adverse event and special situation reporting roche pro form

- Ielts certificate pdf 22286303 form

- To be read and signed by parentguardian of a minor form

- G 31uasl 20200304 applicationglobal aerospace aviation form

- Mta bsc work procedure c2fo form

- Cover page for sba form

- L2 waiver form

Find out other Sales And Other Dispositions Of Capital Assets IRS gov

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast