Form 1099 B 2015

What is the Form 1099 B

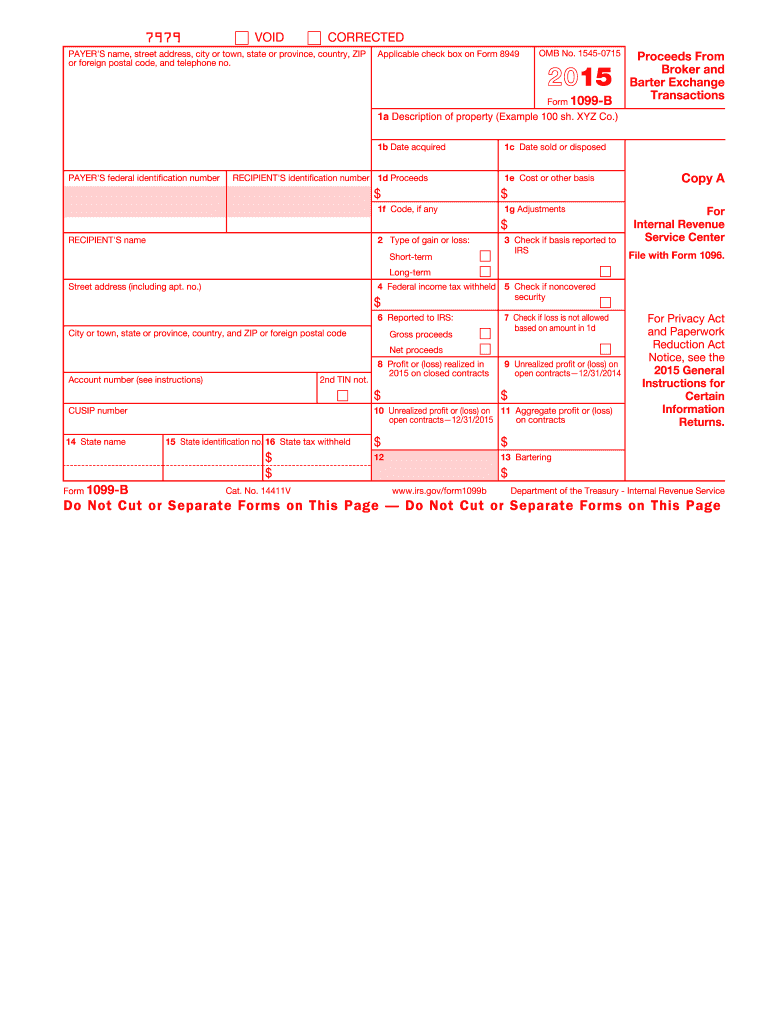

The Form 1099 B is a tax document used in the United States to report proceeds from broker and barter exchange transactions. It is essential for taxpayers who have sold stocks, bonds, or other securities during the tax year. This form provides the Internal Revenue Service (IRS) with information about the gains or losses from these transactions, ensuring accurate tax reporting. The 1099 B includes details such as the date of sale, the amount received, and the cost basis of the sold assets, which helps taxpayers calculate their taxable income.

How to use the Form 1099 B

Using the Form 1099 B involves several steps. First, taxpayers should receive this form from their broker or financial institution by the end of January each year. Once received, it is crucial to review the information for accuracy. Taxpayers should then use the data provided on the form to report capital gains or losses on their federal tax return, typically on Schedule D of Form 1040. It is important to keep a copy of the 1099 B for personal records and to ensure compliance with IRS regulations.

Steps to complete the Form 1099 B

Completing the Form 1099 B requires attention to detail. Here are the steps to follow:

- Gather all necessary transaction records, including sales and purchase dates, amounts, and any associated fees.

- Fill out the form with the broker's information, including name, address, and taxpayer identification number.

- Input the details of each transaction, including the date of sale, description of the asset, proceeds, and cost basis.

- Calculate the gain or loss for each transaction by subtracting the cost basis from the proceeds.

- Review the completed form for accuracy before submitting it to the IRS and providing copies to the relevant parties.

Key elements of the Form 1099 B

The Form 1099 B contains several key elements that are important for accurate reporting. These include:

- Broker Information: Name, address, and taxpayer identification number of the broker.

- Transaction Details: Dates of sale, descriptions of assets, and proceeds from each transaction.

- Cost Basis: The original purchase price of the sold assets, which is essential for calculating gains or losses.

- Type of Transaction: Indicates whether the transaction was a sale, exchange, or other type of disposition.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Form 1099 B. Taxpayers must ensure that the information reported on the form is accurate and complete. The IRS requires brokers to file the form electronically if they have more than two hundred transactions in a calendar year. Additionally, taxpayers should be aware of the deadlines for filing the 1099 B and reporting capital gains or losses on their tax returns. Understanding these guidelines helps prevent errors and potential penalties.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of the Form 1099 B can result in significant penalties. The IRS imposes fines for late filing, incorrect information, or failure to file altogether. These penalties can escalate depending on how late the form is submitted. Taxpayers should be diligent in ensuring all information is accurate and submitted on time to avoid these financial repercussions. Understanding the importance of compliance can help maintain good standing with the IRS and prevent unnecessary costs.

Quick guide on how to complete 2015 form 1099 b

Finish Form 1099 B effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Form 1099 B on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Form 1099 B without hassle

- Locate Form 1099 B and click Obtain Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Completed button to save your updates.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Form 1099 B and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1099 b

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1099 b

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Form 1099 B and why is it important?

Form 1099 B is a tax form used to report capital gains and losses from the sale of securities. It's essential for individuals who buy and sell stocks, bonds, or other securities, as it helps in accurately reporting your investment income to the IRS.

-

How can airSlate SignNow help with Form 1099 B?

AirSlate SignNow simplifies the process of sending and signing Form 1099 B electronically. By using our platform, businesses can ensure that the form is securely completed and sent to recipients, streamlining tax reporting and compliance.

-

What are the pricing options for using airSlate SignNow for Form 1099 B?

AirSlate SignNow offers several pricing plans that cater to different business needs when dealing with Form 1099 B. Our flexible pricing allows you to choose a plan that fits your requirements, ensuring you get the most cost-effective solution for electronic signing.

-

Is it easy to integrate Form 1099 B with other applications using airSlate SignNow?

Yes, airSlate SignNow provides seamless integration with various applications, making it easy to manage Form 1099 B alongside your existing workflows. These integrations enhance productivity by allowing you to send, sign, and track documents without switching between platforms.

-

What features does airSlate SignNow offer for handling Form 1099 B?

AirSlate SignNow offers features such as templates, in-person signing, and secure cloud storage specifically for handling Form 1099 B. These tools make it easier for businesses to manage their tax forms efficiently and securely.

-

How can airSlate SignNow improve the efficiency of sending Form 1099 B?

Using airSlate SignNow to send Form 1099 B signNowly reduces processing time and increases efficiency. Our user-friendly interface allows you to prepare and send forms quickly, eliminating the hassle of paper-based processes.

-

Are there any security measures in place when sending Form 1099 B through airSlate SignNow?

Yes, airSlate SignNow prioritizes security by using advanced encryption and secure cloud storage for all documents, including Form 1099 B. This ensures that your sensitive information is protected throughout the signing process.

Get more for Form 1099 B

- Cancellation request form mechanical breakdown protection inc

- Driver licence renewal update form land transport authority

- Edd authorization for release of records form

- Seafarers medical examinations and certificates the form

- Allergens voluntary labeling statements usda fsis form

- Png nursing council registration form

- Pbr membership application form

- Diving liability release and waiver lynnhaven dive center form

Find out other Form 1099 B

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later