1099 B Form 2012

What is the 1099 B Form

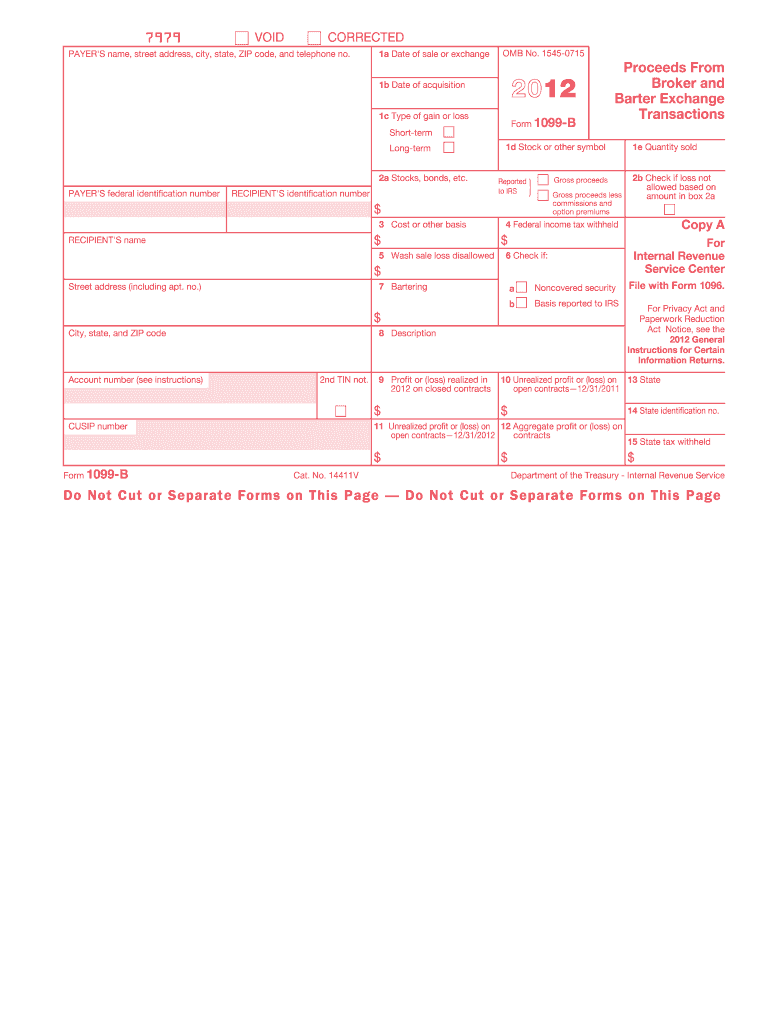

The 1099 B Form is a crucial document used in the United States to report proceeds from broker and barter exchange transactions. This form is essential for taxpayers who have sold stocks, bonds, or other securities during the tax year. It provides a detailed account of the transactions, including the date of sale, the amount received, and any related costs or fees. Understanding this form is vital for accurately reporting capital gains or losses on your tax return.

How to use the 1099 B Form

Using the 1099 B Form involves several key steps. First, taxpayers should receive this form from their broker or financial institution, typically by the end of January each year. Once you have the form, review the information for accuracy, including transaction dates and amounts. The data reported on the 1099 B Form must be transferred to your tax return, specifically to Schedule D and Form 8949, where you will calculate your capital gains or losses. Accurate reporting is essential to avoid issues with the IRS.

Steps to complete the 1099 B Form

Completing the 1099 B Form requires careful attention to detail. Follow these steps:

- Gather all necessary information about your transactions, including dates, amounts, and any costs associated with the sale.

- Fill in the form with accurate details, ensuring that all transactions are reported correctly.

- Check for any adjustments, such as wash sales, which may affect your reported gains or losses.

- Submit the completed form to the IRS along with your tax return, ensuring that you keep a copy for your records.

Legal use of the 1099 B Form

The legal use of the 1099 B Form is governed by IRS regulations. This form must be filed accurately and on time to comply with tax laws. Failure to report transactions can lead to penalties and interest on unpaid taxes. It is important to retain copies of the form and any supporting documentation for at least three years in case of an audit. Understanding the legal implications of the information reported on the 1099 B Form is essential for maintaining compliance with federal tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 B Form are critical for taxpayers. Typically, brokers must send the form to taxpayers by January thirty-first of the year following the tax year in which the transactions occurred. Additionally, the IRS requires that the form be filed by the end of February if submitting by paper, or by March thirty-first if filing electronically. Staying aware of these deadlines helps avoid penalties and ensures timely compliance with tax obligations.

Who Issues the Form

The 1099 B Form is issued by brokers and barter exchanges. Financial institutions that facilitate the buying and selling of securities are responsible for providing this form to their clients. It is essential for taxpayers to ensure they receive the form from their broker, as it contains crucial information needed for accurate tax reporting. If you do not receive a 1099 B Form and believe you should have, it is advisable to contact your broker for clarification.

Quick guide on how to complete 1099 b 2012 form

Manage 1099 B Form effortlessly on any gadget

Digital document management has gained signNow traction among companies and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and safely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle 1099 B Form on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 1099 B Form with ease

- Find 1099 B Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent portions of your documents or obscure confidential information with tools that airSlate SignNow specifically provides for such tasks.

- Create your signature using the Sign tool; it only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious document searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from your chosen device. Revise and eSign 1099 B Form while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 b 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 b 2012 form

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a 1099 B Form and why do I need it?

The 1099 B Form is crucial for reporting capital gains and losses to the IRS. It is typically issued by brokers and includes details on the sale of securities, which you need for accurate tax reporting. By using airSlate SignNow, you can easily eSign your 1099 B Form and ensure timely submission.

-

How can airSlate SignNow help me manage my 1099 B Forms?

airSlate SignNow provides a seamless platform for sending and electronically signing your 1099 B Forms. With features designed for efficiency, you can easily track, manage, and store your forms securely online. This saves time and reduces the risk of errors during tax season.

-

Is there a free trial available for using airSlate SignNow for 1099 B Forms?

Yes, airSlate SignNow offers a free trial that allows users to experience its features for managing 1099 B Forms. This trial enables you to explore its eSign capabilities at no cost, making it easy to determine how it can meet your needs before committing to a subscription.

-

What are the pricing plans for airSlate SignNow related to 1099 B Forms?

airSlate SignNow offers several pricing plans tailored for different business needs. Each plan includes features for handling 1099 B Forms, eSigning, and document management at competitive rates. You can choose a plan that fits your budget while facilitating your tax documentation needs.

-

Can I integrate airSlate SignNow with other software for managing 1099 B Forms?

Absolutely! airSlate SignNow integrates with various popular software tools, making it easier to manage your 1099 B Forms alongside your existing systems. This integration streamlines your workflow and enhances productivity, especially during tax season.

-

What security measures does airSlate SignNow have for 1099 B Forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the 1099 B Form. The platform utilizes advanced encryption and compliance with international security standards to ensure that your data remains protected while eSigning and storing your forms.

-

How does airSlate SignNow ensure compliance for 1099 B Forms?

airSlate SignNow is designed to help businesses stay compliant with all regulations concerning the 1099 B Form. The platform regularly updates its features to comply with IRS requirements, providing peace of mind as you manage your tax documentation safely and effectively.

Get more for 1099 B Form

- Claim for refund st 14 sc department of revenue scgov form

- 2020 form 1099 g certain government payments

- Application for sales tax exemption under code section form

- Income tax if an employee is paid by commission who is form

- Social security ss 5 form

- City of philadephia form

- 1 business discontinued form

- Fillable online span 307 cultures of latin america 4 fax form

Find out other 1099 B Form

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation