Form 1099 B Proceeds from Broker and Barter Exchange Transactions 2022

What is the Form 1099 B Proceeds From Broker And Barter Exchange Transactions

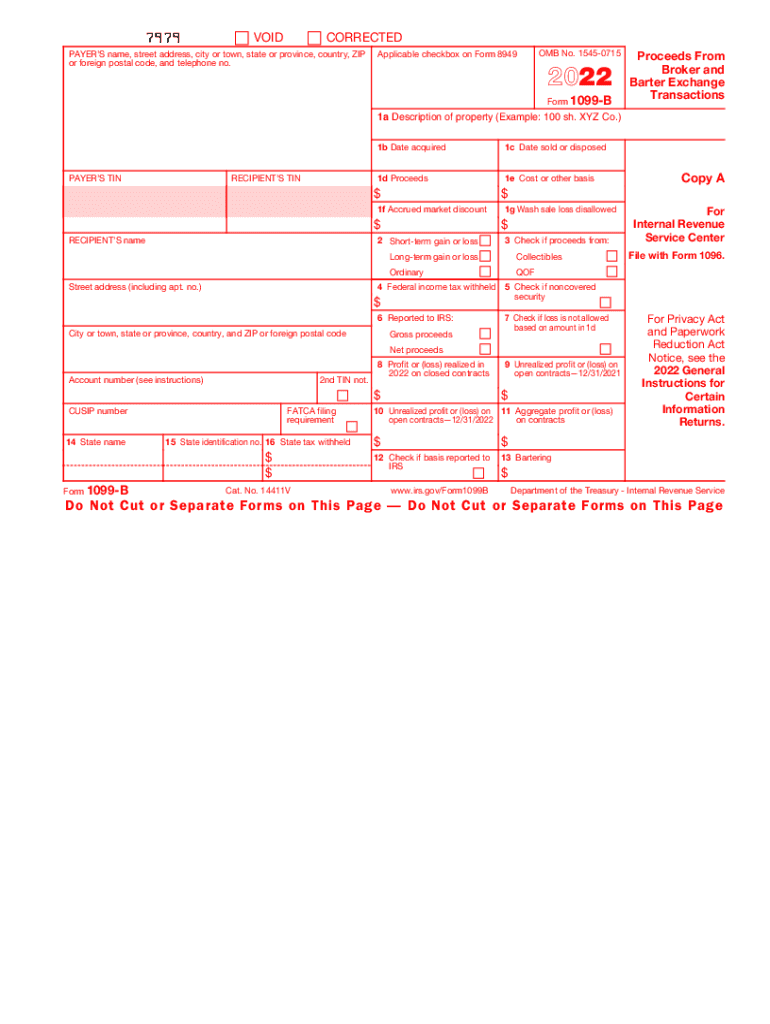

The Form 1099 B is a crucial document used to report proceeds from broker and barter exchange transactions. This form is primarily issued by brokers to their clients, detailing the sales of securities and other transactions that may affect a taxpayer's income. The information provided on the 1099 B includes details such as the date of the transaction, the amount realized from the sale, and any associated costs or adjustments. Understanding this form is essential for accurate tax reporting and compliance with IRS regulations.

Steps to complete the Form 1099 B Proceeds From Broker And Barter Exchange Transactions

Completing the Form 1099 B requires careful attention to detail to ensure accuracy. Here are the steps to follow:

- Gather all relevant transaction records from your brokerage account, including purchase dates, sale dates, and amounts.

- Identify the type of transactions reported, such as sales of stocks, bonds, or barter exchanges.

- Fill out the form with the appropriate details, including your name, address, and taxpayer identification number.

- Report the gross proceeds from each transaction in the designated sections of the form.

- Include any adjustments, such as wash sales, that may affect the reported amounts.

- Review the completed form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 1099 B. Taxpayers must ensure that they comply with these guidelines to avoid penalties. Key points include:

- The form must be filed by the deadline, usually by the end of February for paper filings and by March for electronic submissions.

- Each transaction must be accurately reported to reflect the true financial activity of the taxpayer.

- Taxpayers should retain copies of the form and any supporting documentation for at least three years in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 B are critical for compliance. The IRS typically requires that this form be submitted by:

- February 28 for paper filings.

- March 31 for electronic submissions.

Taxpayers should be aware of these deadlines to avoid late filing penalties.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of the Form 1099 B can lead to significant penalties. The IRS imposes fines based on the delay in filing and the size of the business. Penalties may include:

- Failure to file on time: $50 to $550 per form, depending on how late the form is filed.

- Failure to provide correct payee statements: similar penalties apply for inaccuracies.

- Continued non-compliance may lead to further legal action or increased scrutiny from the IRS.

Who Issues the Form

The Form 1099 B is typically issued by brokers or barter exchanges. These entities are responsible for providing accurate transaction details to both the taxpayer and the IRS. Taxpayers should expect to receive their forms from their brokerage firms, which may issue them electronically or via mail, depending on the taxpayer's preferences.

Quick guide on how to complete 2022 form 1099 b proceeds from broker and barter exchange transactions

Complete Form 1099 B Proceeds From Broker And Barter Exchange Transactions seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents quickly without delays. Manage Form 1099 B Proceeds From Broker And Barter Exchange Transactions on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 1099 B Proceeds From Broker And Barter Exchange Transactions with ease

- Find Form 1099 B Proceeds From Broker And Barter Exchange Transactions and select Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Confirm the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that require new copies to be printed. airSlate SignNow manages your document administration needs in just a few clicks from any device you prefer. Modify and eSign Form 1099 B Proceeds From Broker And Barter Exchange Transactions and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1099 b proceeds from broker and barter exchange transactions

Create this form in 5 minutes!

People also ask

-

What is the purpose of the 1099 2017 1099b form?

The 1099 2017 1099b form is essential for reporting various types of income, including capital gains and losses from securities transactions. It helps taxpayers accurately report their earnings to the IRS. Using airSlate SignNow can simplify the eSigning process of these forms, ensuring timely submission.

-

How can airSlate SignNow help with managing 1099 2017 1099b documentation?

airSlate SignNow streamlines the process of preparing and signing 1099 2017 1099b forms with its user-friendly interface. You can easily upload documents, add eSignature fields, and send them out for signing. This reduces paperwork and helps manage your tax documents efficiently.

-

Is there a pricing plan for businesses needing 1099 2017 1099b document processing?

Yes, airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes. The plans are designed to accommodate those who frequently deal with 1099 2017 1099b forms, allowing for bulk signing and document management at competitive rates. Each plan includes features that enhance productivity and reduce administrative costs.

-

What features make airSlate SignNow suitable for handling 1099 2017 1099b forms?

AirSlate SignNow boasts features such as customizable templates, document routing, and secure cloud storage to assist in handling 1099 2017 1099b forms seamlessly. The platform also offers tracking capabilities, allowing users to monitor the status of their documents in real-time. These features make it a robust choice for managing financial documents.

-

Can airSlate SignNow integrate with accounting software for 1099 2017 1099b management?

Absolutely! airSlate SignNow integrates with various accounting software systems to facilitate the management of 1099 2017 1099b forms. This integration ensures that your data flows seamlessly between platforms, reducing manual entry errors and enhancing overall efficiency in your financial processes.

-

How secure is the process of signing 1099 2017 1099b forms with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like 1099 2017 1099b forms. The platform uses advanced encryption protocols and complies with industry standards to ensure that your documents remain secure. You can trust that your data and signatures are protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for 1099 2017 1099b forms over traditional methods?

Using airSlate SignNow eliminates the need for printing, scanning, and mailing documents for 1099 2017 1099b forms. This digital solution speeds up the signing process, reduces the risk of paperwork being lost, and cuts down on overall costs. Additionally, you can access documents anytime and anywhere, making it a smart choice for modern businesses.

Get more for Form 1099 B Proceeds From Broker And Barter Exchange Transactions

- Petitioners and respondents community property and liabilities schedule new mexico form

- Petitioners and respondents separate property and liabilities schedule new mexico form

- New mexico dissolution form

- Nm dissolution form

- Marital agreement 497320102 form

- New mexico marital agreement form

- New mexico parenting form

- New mexico decree 497320105 form

Find out other Form 1099 B Proceeds From Broker And Barter Exchange Transactions

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile