Form 1099 MISC Irs Gov 2020

What is the 1099 B Form 2019?

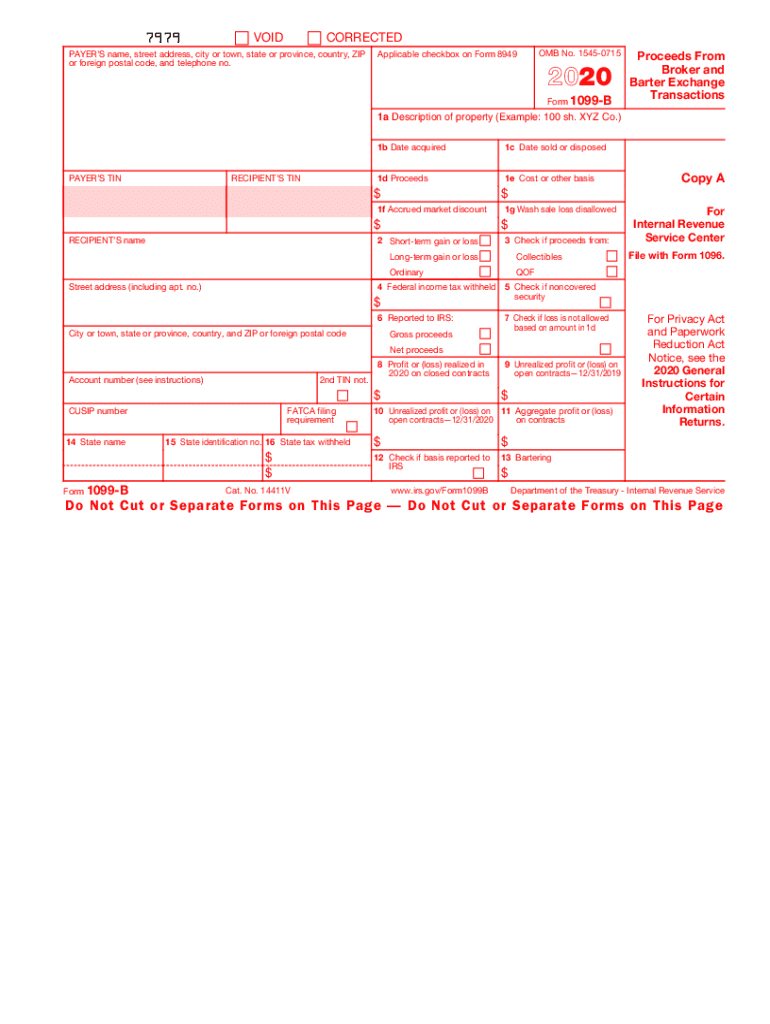

The 1099 B form 2019 is a tax document used to report proceeds from broker and barter exchange transactions. This form is essential for taxpayers who have sold stocks, bonds, or other securities during the tax year. It provides the Internal Revenue Service (IRS) with information about the gains or losses incurred from these transactions, ensuring that individuals accurately report their income on their tax returns. The 1099 B form includes details such as the date of the transaction, the amount received, and any related costs or adjustments that may affect the taxable amount.

How to Obtain the 1099 B Form 2019

Taxpayers can obtain the 1099 B form 2019 from their brokerage firms or financial institutions. Most brokers will automatically generate and send this form to clients who have engaged in reportable transactions during the year. If you do not receive your form, you can request it directly from your broker. Additionally, the IRS provides downloadable versions of tax forms on its official website, allowing individuals to access the 1099 B form for their records or to understand its layout and requirements.

Steps to Complete the 1099 B Form 2019

Completing the 1099 B form 2019 involves several key steps:

- Gather all necessary information about your transactions, including dates, amounts, and any associated costs.

- Fill out the form with accurate details, ensuring that all entries reflect the correct figures from your brokerage statements.

- Review the form for accuracy, checking for any discrepancies that could lead to issues with the IRS.

- Submit the completed form to the IRS along with your tax return, ensuring you meet all filing deadlines.

IRS Guidelines for the 1099 B Form 2019

The IRS has specific guidelines regarding the 1099 B form 2019 that taxpayers must follow. These guidelines include:

- Filing deadlines: The form must be submitted by the designated date, typically by the end of February for paper submissions and by mid-March for electronic submissions.

- Accuracy: Taxpayers must ensure that all reported information is correct to avoid penalties or audits.

- Recipient copies: A copy of the 1099 B form must be provided to the recipient, typically the taxpayer, by the same filing deadline.

Penalties for Non-Compliance with the 1099 B Form 2019

Failure to comply with the requirements for the 1099 B form 2019 can result in significant penalties. The IRS may impose fines for late filing, failure to file, or inaccuracies in the reported information. These penalties can vary based on how late the form is submitted and the severity of the errors. It is crucial for taxpayers to understand these potential consequences and ensure timely and accurate reporting to avoid unnecessary financial burdens.

Digital vs. Paper Version of the 1099 B Form 2019

Taxpayers have the option to file the 1099 B form 2019 in either digital or paper format. The digital version is often preferred due to its convenience and speed, allowing for quicker processing by the IRS. Electronic filing also reduces the risk of errors associated with manual entry. However, some individuals may still opt for paper filing due to personal preference or lack of access to digital tools. Regardless of the method chosen, it is essential to follow IRS guidelines for submission to ensure compliance.

Quick guide on how to complete 2020 form 1099 misc irsgov

Complete Form 1099 MISC Irs gov with ease on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents efficiently without hassles. Handle Form 1099 MISC Irs gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form 1099 MISC Irs gov effortlessly

- Find Form 1099 MISC Irs gov and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searching, or errors that require new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 1099 MISC Irs gov and guarantee clear communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1099 misc irsgov

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1099 misc irsgov

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 1099 B form 2019 and why is it important?

The 1099 B form 2019 is a tax document used to report proceeds from broker and barter exchange transactions. It's crucial for tracking gains or losses from the sale of securities, ensuring compliance with IRS regulations. Accurate completion of this form helps avoid tax issues and penalties.

-

How can airSlate SignNow assist with completing the 1099 B form 2019?

airSlate SignNow provides an intuitive platform that makes it easy to eSign and send the 1099 B form 2019. Users can upload their forms, fill in the necessary information, and send them securely to the relevant parties. This streamlines the process and ensures you stay organized.

-

Are there any costs associated with using airSlate SignNow for the 1099 B form 2019?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling documents like the 1099 B form 2019. There are cost-effective options available that provide excellent value for features including unlimited eSignatures and document storage.

-

What features does airSlate SignNow offer for managing the 1099 B form 2019?

The platform includes features such as document templates, secure eSigning, and real-time tracking for the 1099 B form 2019. These features optimize your workflow, enhance security, and make collaboration with clients or colleagues seamless and efficient.

-

Can I integrate airSlate SignNow with other applications for processing the 1099 B form 2019?

Yes, airSlate SignNow seamlessly integrates with various applications to help you manage the 1099 B form 2019 more effectively. Integrations with popular tools like Google Drive and Dropbox enhance your document management process, ensuring all your paperwork is in one place.

-

What are the benefits of using airSlate SignNow for the 1099 B form 2019?

Using airSlate SignNow for the 1099 B form 2019 offers benefits such as time savings, reduced paper usage, and enhanced security. The ability to eSign documents electronically means you can complete transactions faster and keep all your records organized and accessible.

-

Is it easy to eSign the 1099 B form 2019 with airSlate SignNow?

Absolutely! airSlate SignNow's user-friendly interface allows you to easily eSign the 1099 B form 2019 in just a few clicks. The process is quick and straightforward, making it suitable for users of all tech skill levels.

Get more for Form 1099 MISC Irs gov

- Bill of sale without warranty by individual seller texas form

- Bill of sale without warranty by corporate seller texas form

- Reaffirmation agreement texas form

- Verification of mailing list texas form

- Texas creditors form

- Tx creditors form

- Verification of creditors matrix texas form

- Verification of creditors matrix texas 497327704 form

Find out other Form 1099 MISC Irs gov

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself