Form 1040 V 2024

What is the Form 1040 V

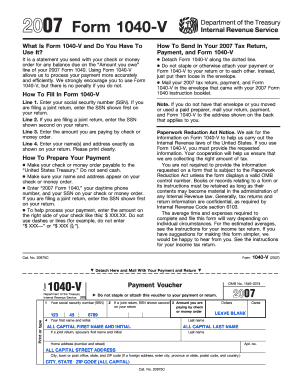

The Form 1040 V is a payment voucher used by individuals to submit their tax payments to the Internal Revenue Service (IRS). This form is typically utilized when taxpayers owe money on their federal income tax return. It allows for a streamlined process to ensure that payments are correctly applied to the taxpayer's account. The Form 1040 V includes essential information such as the taxpayer's name, address, and Social Security number, along with the payment amount. Using this form helps the IRS to accurately process payments and reduces the likelihood of errors in payment application.

How to use the Form 1040 V

To effectively use the Form 1040 V, begin by filling out the required information accurately. This includes your name, address, and Social Security number. Next, indicate the amount you are paying. It is important to ensure that this amount matches the amount owed as stated on your tax return. After completing the form, enclose it with your payment, whether it is a check or money order. Make sure to send it to the appropriate IRS address, which can vary based on your location and whether you are including a payment with your return or sending it separately.

Steps to complete the Form 1040 V

Completing the Form 1040 V involves several straightforward steps:

- Gather your tax return to determine the amount owed.

- Obtain a copy of the Form 1040 V from the IRS website or through tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the payment amount as indicated on your tax return.

- Review the form for accuracy to avoid any processing delays.

- Attach your payment, ensuring it is made out to the "United States Treasury."

- Mail the completed form and payment to the designated IRS address for your state.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 1040 V. Generally, payments are due on the same date as your federal income tax return, which is typically April 15 of each year. If you are unable to file your return by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these dates ensures compliance and helps in managing your tax obligations effectively.

IRS Guidelines

The IRS provides specific guidelines for using the Form 1040 V to ensure that payments are processed efficiently. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on how to fill it out correctly. The guidelines include information on acceptable payment methods, the importance of including the form with your payment, and how to address any discrepancies in payment amounts. Familiarizing yourself with these guidelines can help prevent issues with your tax payments.

Required Documents

When submitting the Form 1040 V, it is essential to include certain documents to ensure proper processing. You should have a copy of your completed Form 1040, which indicates the amount owed. Additionally, include your payment, whether it is a check or money order, made payable to the "United States Treasury." If you are making a payment for a prior year or an estimated tax payment, ensure that you indicate this clearly on the Form 1040 V to avoid confusion.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 v 40494002

Create this form in 5 minutes!

How to create an eSignature for the form 1040 v 40494002

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 V and how can airSlate SignNow help?

Form 1040 V is a payment voucher used when submitting your federal income tax return. airSlate SignNow simplifies the process by allowing you to easily eSign and send your Form 1040 V electronically, ensuring timely submission and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 1040 V?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage your Form 1040 V and other documents without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing Form 1040 V?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for Form 1040 V. These tools streamline the signing process, making it easier for you to manage your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for Form 1040 V?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your Form 1040 V alongside your other business tools. This integration enhances your workflow and ensures that all your documents are in one place.

-

How does airSlate SignNow ensure the security of my Form 1040 V?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your Form 1040 V and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for Form 1040 V?

Using airSlate SignNow for your Form 1040 V offers numerous benefits, including faster processing times, reduced paperwork, and enhanced accuracy. Our platform allows you to eSign documents quickly, helping you meet deadlines and avoid penalties.

-

Can I access my Form 1040 V from multiple devices with airSlate SignNow?

Yes, airSlate SignNow is designed for accessibility across multiple devices. You can access, edit, and eSign your Form 1040 V from your computer, tablet, or smartphone, making it convenient to manage your tax documents on the go.

Get more for Form 1040 V

- Adult day services andor assisted housing mainegov form

- Forms ampampamp applicationsofi dhhs maine

- Individual identification card application instructions form

- Foc 13a complaint and notice for health care expense payment form

- Office of the registrar division of student affairs personal form

- Radon disclosure form

- Msba real property forms

- How to file a complaint with the missouri department of form

Find out other Form 1040 V

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer