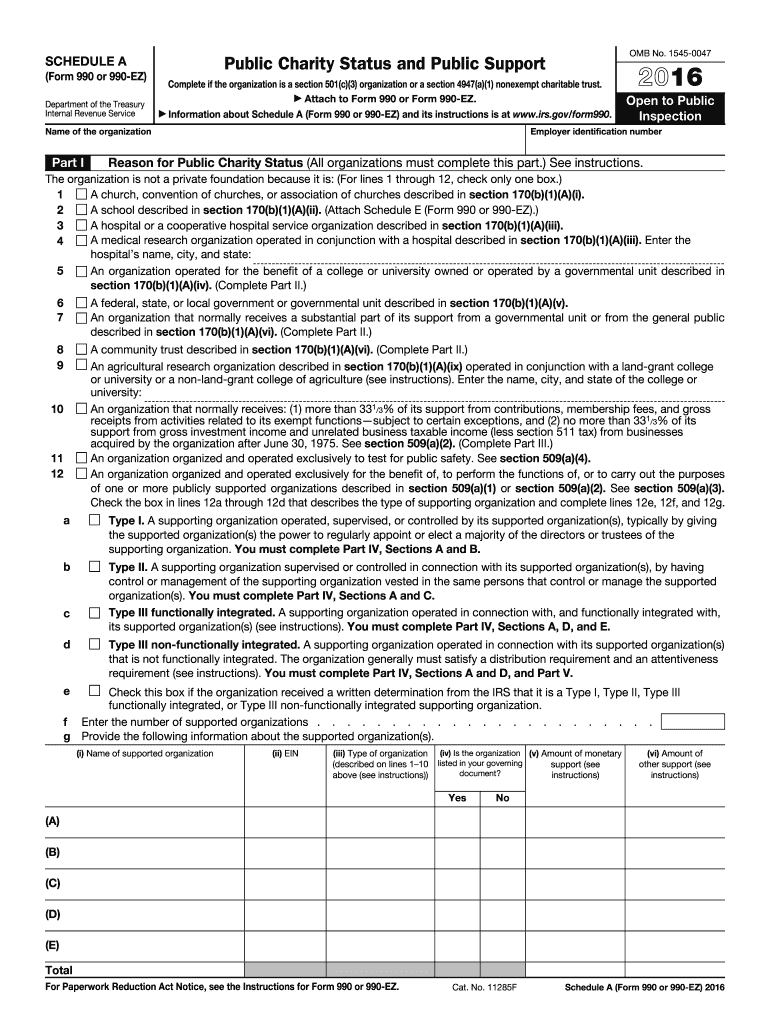

Irs Form Schedule a 2016

What is the Irs Form Schedule A

The IRS Form Schedule A is a tax form used by individual taxpayers in the United States to report itemized deductions. It is an essential part of the federal income tax return for those who choose to itemize rather than take the standard deduction. This form allows taxpayers to deduct specific expenses such as medical costs, mortgage interest, and charitable contributions, which can reduce their overall taxable income.

How to use the Irs Form Schedule A

To use the IRS Form Schedule A, taxpayers must first determine if itemizing deductions is beneficial compared to the standard deduction. If itemizing is advantageous, the taxpayer should gather all relevant documentation, including receipts and statements for deductible expenses. The form requires detailed entries for various categories of deductions, which must be accurately calculated and reported. Once completed, Schedule A is submitted along with the main tax return form, typically Form 1040.

Steps to complete the Irs Form Schedule A

Completing the IRS Form Schedule A involves several key steps:

- Gather necessary documents, including receipts for medical expenses, mortgage interest statements, and records of charitable contributions.

- Review the categories of deductions available on the form, such as medical expenses, taxes paid, and interest paid.

- Enter the total amounts for each category in the appropriate sections of the form.

- Calculate the total itemized deductions and transfer this amount to the main tax return form.

- Ensure all entries are accurate and complete before submission.

Legal use of the Irs Form Schedule A

The IRS Form Schedule A is legally recognized for reporting itemized deductions on federal income tax returns. To ensure compliance, taxpayers must adhere to IRS guidelines regarding what qualifies as a deductible expense. Accurate reporting is crucial, as incorrect or fraudulent claims can lead to penalties, including fines or audits. Using reliable documentation to support deductions is essential for legal use.

Filing Deadlines / Important Dates

Taxpayers must file the IRS Form Schedule A by the annual tax return deadline, which is typically April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. For those who need additional time, filing for an extension may be possible, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form Schedule A can be submitted through various methods. Taxpayers can e-file their returns using tax software that supports the form, which is often the quickest method. Alternatively, the form can be printed and mailed to the IRS along with the main tax return. In-person submission is generally not available, as the IRS encourages electronic filing for efficiency and speed.

Quick guide on how to complete 2016 irs form schedule a

Effortlessly Prepare Irs Form Schedule A on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed paperwork, since you can obtain the appropriate form and securely keep it on the internet. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage Irs Form Schedule A on any device using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Irs Form Schedule A with Ease

- Find Irs Form Schedule A and click Get Form to begin.

- Use the tools provided to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your selected device. Edit and electronically sign Irs Form Schedule A to ensure excellent communication at any stage of your form preparation workflow using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs form schedule a

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs form schedule a

How to generate an eSignature for the 2016 Irs Form Schedule A online

How to create an eSignature for the 2016 Irs Form Schedule A in Google Chrome

How to generate an electronic signature for signing the 2016 Irs Form Schedule A in Gmail

How to generate an eSignature for the 2016 Irs Form Schedule A right from your mobile device

How to generate an eSignature for the 2016 Irs Form Schedule A on iOS

How to generate an electronic signature for the 2016 Irs Form Schedule A on Android devices

People also ask

-

What is the Irs Form Schedule A?

The Irs Form Schedule A is a tax form used by taxpayers to report itemized deductions. It is primarily used by individuals who choose to itemize rather than take the standard deduction on their federal income tax return. Through effective completion of the Irs Form Schedule A, you can maximize your tax benefits and reduce your taxable income.

-

How can airSlate SignNow help with completing the Irs Form Schedule A?

airSlate SignNow provides a streamlined platform for completing the Irs Form Schedule A electronically. Our solution allows you to easily input your itemized deductions and securely eSign the form, ensuring accuracy and compliance. By using airSlate SignNow, you can save time and reduce the complexity typically associated with tax-form processes.

-

Is there a cost associated with using airSlate SignNow for Irs Form Schedule A?

Yes, airSlate SignNow offers several pricing plans to accommodate different needs, including those specifically for handling tax documents like the Irs Form Schedule A. Our plans are designed to be cost-effective, providing comprehensive features at competitive rates. You can choose the plan that best fits your business' requirements and budget.

-

What features are available in airSlate SignNow for managing the Irs Form Schedule A?

airSlate SignNow comes with a variety of features to assist with the Irs Form Schedule A, including customizable templates, eSignature options, and secure document storage. These features ensure that you can prepare and sign your tax documentation efficiently and securely. Additionally, integrated compliance checks help verify that your form meets IRS standards.

-

Can I collaborate with my accountant using airSlate SignNow on the Irs Form Schedule A?

Absolutely! airSlate SignNow allows for easy collaboration between you and your accountant when completing the Irs Form Schedule A. You can share documents for review, receive feedback, and eSign together in real-time, making the tax preparation process more efficient and aligned with professional guidance.

-

What benefits does airSlate SignNow provide for handling Irs Form Schedule A?

Using airSlate SignNow to handle the Irs Form Schedule A eliminates the hassles of paper forms and manual signatures. Our platform enhances productivity by making it easier to track the status of your documents and reducing errors associated with traditional filing methods. This solution is designed to simplify your tax process, ultimately saving you time and money.

-

What integrations does airSlate SignNow offer for Irs Form Schedule A processing?

airSlate SignNow offers seamless integrations with various accounting and tax software, enhancing your ability to manage the Irs Form Schedule A alongside other financial documents. With capabilities to connect to popular platforms, you can streamline your workflows and ensure that all necessary information is readily available. This makes it simpler to prepare your taxes and maintain accurate records.

Get more for Irs Form Schedule A

- Extendicare careers form

- Document2 instructions for form 5310 application for determination upon termination files ali aba

- Air appraisal certification form

- Va form 26 1817 militarycom

- Mv 27b online 2007 form

- Application for residents 10 2850b va form

- Responsible managing employee office hawaii form

- Form 103 metro 2001

Find out other Irs Form Schedule A

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document