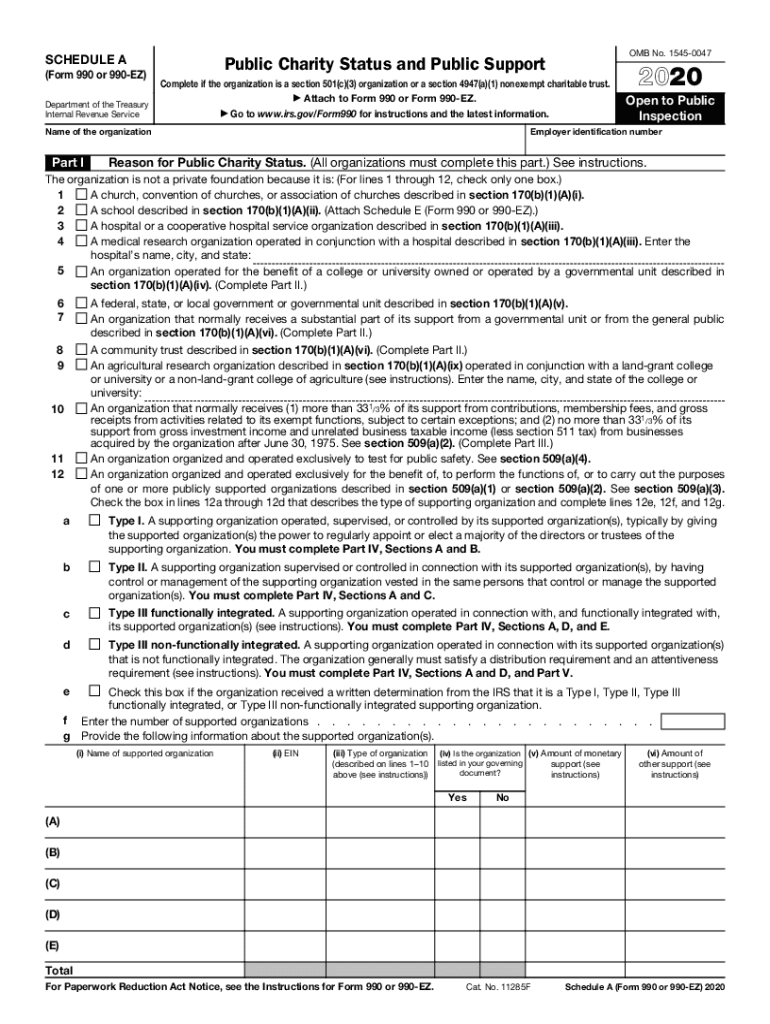

Reason for Public Charity Status 2020

What is the reason for public charity status?

The reason for public charity status is primarily to ensure that organizations operate for charitable purposes and serve the public good. This status allows organizations to receive tax-deductible contributions, which can significantly enhance their fundraising capabilities. Public charities are typically required to demonstrate that they receive a substantial portion of their funding from the general public or government sources, rather than from a few private individuals or entities. This requirement helps to ensure accountability and transparency in how funds are used.

Eligibility criteria for public charity status

To qualify for public charity status, an organization must meet specific eligibility criteria set by the IRS. Generally, these criteria include:

- The organization must be organized and operated exclusively for charitable, educational, religious, or scientific purposes.

- It must not be a private foundation, which is typically funded by a single source.

- The organization must demonstrate that it receives a significant portion of its support from the public or government.

Meeting these criteria is essential for organizations seeking to obtain and maintain their public charity status.

Steps to complete the Reason for Public Charity Status

Completing the Reason for Public Charity Status involves several steps. Organizations must:

- Determine eligibility based on IRS criteria.

- Prepare the necessary documentation, including the organization’s mission statement and financial records.

- Complete and submit IRS Form 1023 or Form 1023-EZ, which is the application for recognition of exemption.

- Respond to any inquiries from the IRS regarding the application.

Following these steps carefully can facilitate a smoother approval process for public charity status.

IRS guidelines for public charity status

The IRS provides specific guidelines that organizations must follow to maintain their public charity status. These guidelines include:

- Regularly filing Form 990, which provides information on the organization’s finances, governance, and compliance with public charity requirements.

- Ensuring that the organization continues to operate primarily for charitable purposes.

- Maintaining transparency in financial reporting and governance practices.

Adhering to these guidelines is crucial for organizations to retain their tax-exempt status and avoid penalties.

Filing deadlines and important dates

Organizations seeking public charity status must be aware of filing deadlines to ensure compliance. Key dates include:

- The application for public charity status should be submitted within 27 months of the organization’s formation to receive retroactive tax-exempt status.

- Annual Form 990 filings are typically due on the 15th day of the fifth month after the end of the organization’s fiscal year.

Staying informed of these deadlines helps organizations maintain their compliance and avoid unnecessary penalties.

Penalties for non-compliance

Failing to comply with IRS regulations regarding public charity status can result in significant penalties. These may include:

- Loss of tax-exempt status, which would require the organization to pay taxes on its income.

- Fines for late or incomplete filings of Form 990.

- Potential legal action if the organization is found to be operating outside of its stated charitable purposes.

Understanding these penalties underscores the importance of compliance for organizations seeking to maintain their public charity status.

Quick guide on how to complete reason for public charity status

Easily Create Reason For Public Charity Status on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and electronically sign your documents without delays. Handle Reason For Public Charity Status on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task right now.

The easiest method to modify and electronically sign Reason For Public Charity Status effortlessly

- Obtain Reason For Public Charity Status and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Reason For Public Charity Status and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reason for public charity status

Create this form in 5 minutes!

How to create an eSignature for the reason for public charity status

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is Form 990 Schedule A 2018 and why is it important?

Form 990 Schedule A 2018 is a supplemental form used by tax-exempt organizations to provide additional information about their public charity status. It's crucial for compliance with IRS regulations and helps organizations demonstrate their eligibility for tax-exempt status, making it necessary for transparency in fundraising activities.

-

How can airSlate SignNow assist with Form 990 Schedule A 2018?

airSlate SignNow offers an efficient way to prepare and eSign Form 990 Schedule A 2018. By using our platform, organizations can streamline document management, ensuring that eSigning and sending is quick and secure, thus simplifying the filing process.

-

What features does airSlate SignNow provide for handling Form 990 Schedule A 2018?

With airSlate SignNow, you have features such as drag-and-drop document upload, customizable templates, and real-time tracking, which are all useful for handling Form 990 Schedule A 2018. These tools enhance the efficiency of document workflows and keep your filing process on track.

-

Is there a pricing plan for airSlate SignNow specifically for organizations filing Form 990 Schedule A 2018?

airSlate SignNow offers several pricing plans that cater to different organizational needs, including those filing Form 990 Schedule A 2018. Our plans are designed to be cost-effective while providing essential features like unlimited eSigning, making it an excellent choice for nonprofits.

-

Can I integrate airSlate SignNow with other software for Form 990 Schedule A 2018?

Yes, airSlate SignNow seamlessly integrates with various software systems such as CRM platforms and accounting tools. This capability is especially beneficial for organizations managing Form 990 Schedule A 2018, as it allows for seamless data transfer and enhances operational efficiency.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule A 2018?

By using airSlate SignNow for Form 990 Schedule A 2018, organizations benefit from improved efficiency, reduced paperwork, and enhanced compliance. Our eSigning solution ensures that documents are signed and filed promptly, helping organizations to focus on their mission rather than administrative tasks.

-

What is the process for eSigning Form 990 Schedule A 2018 with airSlate SignNow?

The process for eSigning Form 990 Schedule A 2018 with airSlate SignNow is simple and user-friendly. Users can upload the form, add signers, and send it for eSignature—all in a matter of minutes, ensuring a swift completion of the filing process.

Get more for Reason For Public Charity Status

- Wisconsin landlord form

- Letter from tenant to landlord about sexual harassment wisconsin form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children wisconsin form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure wisconsin form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497430599 form

- Wisconsin tenant landlord 497430600 form

- Wi tenant landlord form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497430602 form

Find out other Reason For Public Charity Status

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors