Schedule a Form 990 Public Charity Status and Public Support 2021

What is the Schedule A Form 990 Public Charity Status and Public Support

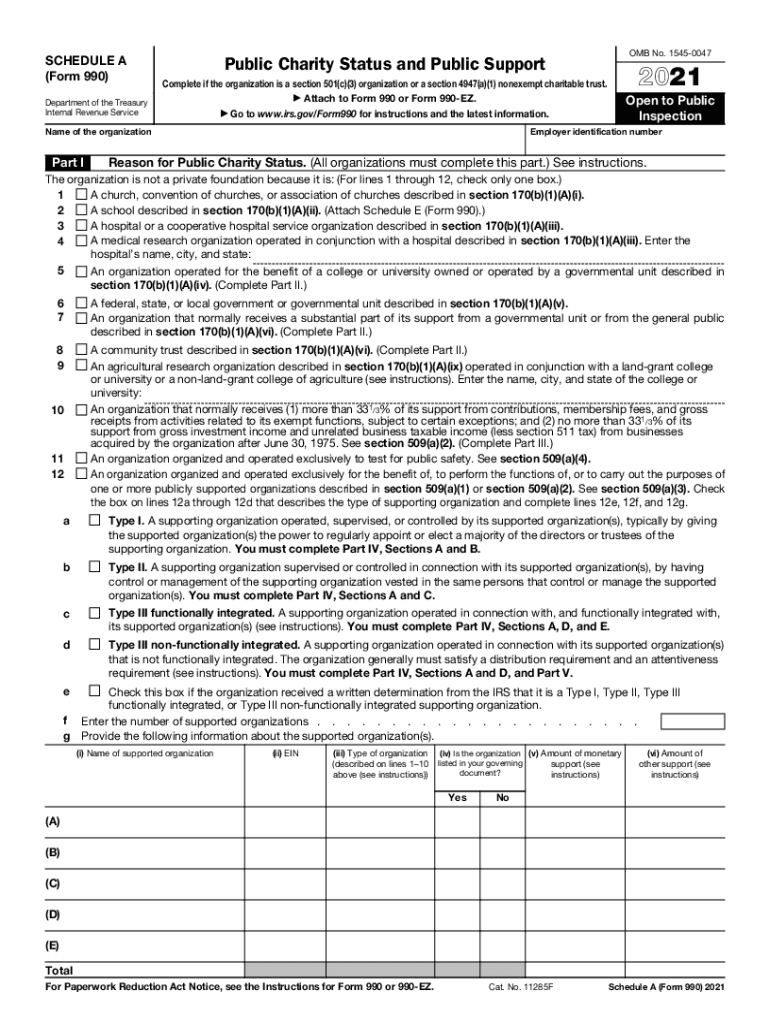

The Schedule A Form 990 is a critical document for organizations seeking to establish their public charity status and demonstrate their public support. This form is part of the IRS Form 990 series, which tax-exempt organizations must file annually. It provides detailed information about the organization's sources of income, the nature of its activities, and its compliance with public support tests. Understanding this form is essential for non-profits to maintain their tax-exempt status and to ensure transparency with stakeholders.

Steps to Complete the Schedule A Form 990 Public Charity Status and Public Support

Completing the Schedule A Form 990 involves several key steps that ensure accuracy and compliance with IRS regulations. First, gather all necessary financial documents, including income statements and records of donations. Next, accurately fill out the sections related to public support, detailing contributions from the public and government sources. It's important to perform calculations for the public support test to verify that the organization meets the required thresholds. Finally, review the completed form for any discrepancies before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule A Form 990, which organizations must follow to ensure compliance. These guidelines include instructions on what constitutes qualifying public support, how to calculate the public support percentage, and the types of income that should be reported. Organizations should familiarize themselves with these guidelines to avoid errors that could jeopardize their tax-exempt status. Regular updates from the IRS can also impact how the form should be completed, so staying informed is crucial.

Filing Deadlines / Important Dates

Timely filing of the Schedule A Form 990 is essential to maintain compliance with IRS regulations. The standard deadline for filing is the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this typically means May fifteenth. Extensions may be available, but it is important to file for them in advance. Missing the deadline can result in penalties and jeopardize the organization's tax-exempt status.

Eligibility Criteria

To qualify for public charity status under the Schedule A Form 990, organizations must meet specific eligibility criteria set by the IRS. These criteria include demonstrating a significant level of public support, which can be shown through donations from the general public, government grants, or other qualifying sources. Additionally, organizations must operate primarily for charitable purposes and adhere to the regulations governing tax-exempt entities. Understanding these criteria is essential for organizations seeking to maintain their status.

Penalties for Non-Compliance

Failure to comply with the requirements of the Schedule A Form 990 can lead to significant penalties for organizations. These penalties may include fines for late filing, loss of tax-exempt status, and increased scrutiny from the IRS. Non-compliance can also damage an organization's reputation and hinder its ability to secure funding. Therefore, it is crucial for organizations to understand their obligations and ensure timely and accurate submission of the form.

Quick guide on how to complete 2021 schedule a form 990 public charity status and public support

Effortlessly Prepare Schedule A Form 990 Public Charity Status And Public Support on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily obtain the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Schedule A Form 990 Public Charity Status And Public Support on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

Steps to Modify and Electronically Sign Schedule A Form 990 Public Charity Status And Public Support with Ease

- Find Schedule A Form 990 Public Charity Status And Public Support and click Get Form to begin.

- Utilize the tools available to fill in your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Adjust and electronically sign Schedule A Form 990 Public Charity Status And Public Support and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule a form 990 public charity status and public support

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule a form 990 public charity status and public support

How to make an e-signature for a PDF online

How to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

How to create an e-signature for a PDF document on Android

People also ask

-

What is Form 990 Schedule A and how does airSlate SignNow assist with it?

Form 990 Schedule A is a crucial document for tax-exempt organizations, detailing their public charity status. airSlate SignNow simplifies the eSigning process for Form 990 Schedule A, allowing users to securely send and receive signatures quickly and efficiently, ensuring compliance with IRS filing requirements.

-

How does airSlate SignNow ensure the security of my Form 990 Schedule A?

Security is a top priority for airSlate SignNow. When handling your Form 990 Schedule A, we employ advanced encryption protocols to protect your sensitive data, ensuring that all documents remain confidential and secure throughout the signing process.

-

What features does airSlate SignNow offer for managing Form 990 Schedule A?

airSlate SignNow offers a range of features for managing your Form 990 Schedule A, including customizable templates, automated workflows, and the ability to track document status. These features streamline the process, making it easier to prepare and submit your Schedule A on time.

-

Is airSlate SignNow suitable for non-profits that file Form 990 Schedule A?

Yes, airSlate SignNow is specifically designed for organizations, including non-profits, that need to file Form 990 Schedule A. Our platform provides an intuitive way to manage documents, making it easier for non-profit organizations to stay compliant with IRS regulations.

-

What is the pricing structure for using airSlate SignNow for Form 990 Schedule A?

airSlate SignNow offers flexible pricing options that cater to various budgets, allowing organizations to choose a plan that best fits their needs. Users can start with a free trial to explore how airSlate SignNow can enhance their workflow for Form 990 Schedule A and beyond.

-

Can I integrate airSlate SignNow with other software to manage Form 990 Schedule A?

Absolutely! airSlate SignNow supports integrations with various software solutions, including accounting and CRM systems, to streamline your workflow for Form 990 Schedule A. This allows for seamless data transfer and management, eliminating duplication and errors.

-

How can airSlate SignNow help speed up the filing of Form 990 Schedule A?

With airSlate SignNow, you can eliminate the delays often associated with traditional paperwork. Our platform enables quick eSigning and document sharing, which can signNowly reduce the time it takes to complete and file your Form 990 Schedule A.

Get more for Schedule A Form 990 Public Charity Status And Public Support

- Quitclaim deed from individual to husband and wife mississippi form

- Mississippi warranty deed form

- Quitclaim deed from corporation to husband and wife mississippi form

- Warranty deed from corporation to husband and wife mississippi form

- Order on petition for appointment of co conservator mississippi form

- Order on petition for appointment of successor conservatrix mississippi form

- Letters of conservatorship mississippi form

- Petition of mother and natural guardian of a minor for payment of insurance proceeds mississippi form

Find out other Schedule A Form 990 Public Charity Status And Public Support

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure