Irs 990 Form 2014

What is the Irs 990 Form

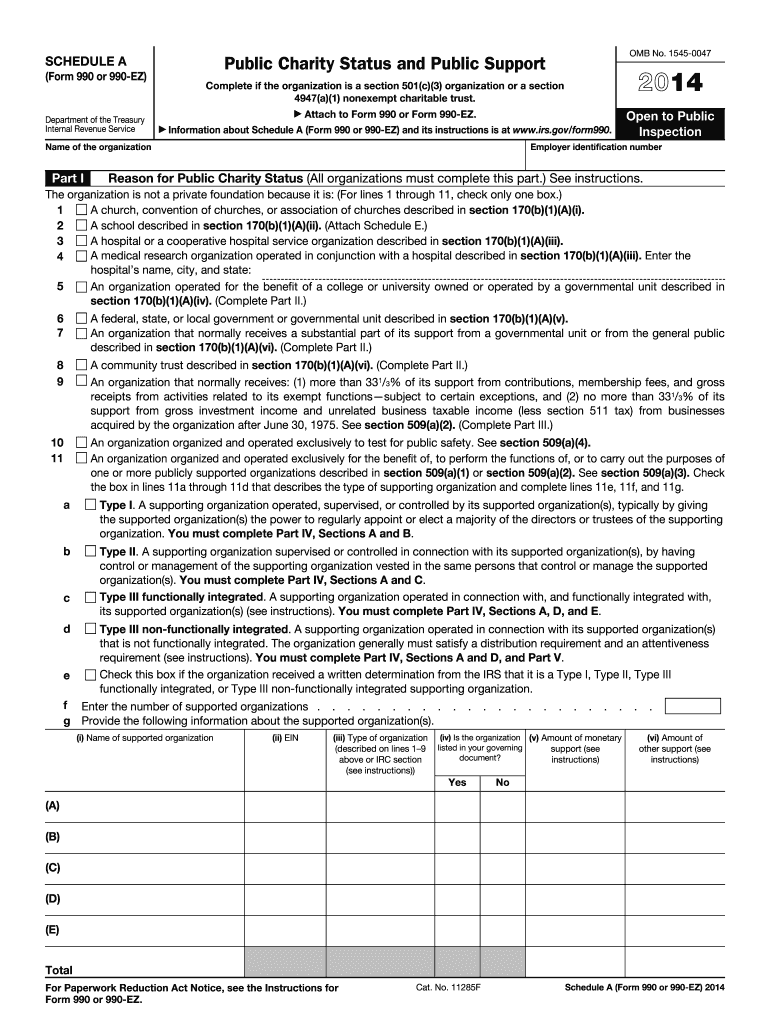

The Irs 990 Form is a crucial document that tax-exempt organizations in the United States must file annually with the Internal Revenue Service (IRS). It provides detailed information about the organization's financial activities, governance, and compliance with federal tax regulations. This form is essential for maintaining tax-exempt status and ensuring transparency in operations. Organizations that typically file this form include charities, foundations, and other non-profit entities.

How to use the Irs 990 Form

Using the Irs 990 Form involves several steps to ensure accurate and compliant reporting. Organizations must gather financial data, including revenue, expenses, and assets, as well as information about governance and programs. The form is divided into various sections, each requiring specific details. It is important to follow the instructions carefully to avoid errors that could lead to penalties or loss of tax-exempt status. Utilizing digital tools can streamline the process, making it easier to fill out and submit the form electronically.

Steps to complete the Irs 990 Form

Completing the Irs 990 Form involves a systematic approach:

- Gather Financial Records: Collect all necessary financial statements, including income statements and balance sheets.

- Review Governance Information: Ensure that details about the board of directors and key personnel are current and accurate.

- Fill Out the Form: Carefully enter the required information into the form, following the specific guidelines provided by the IRS.

- Review and Revise: Double-check all entries for accuracy and completeness before finalizing the document.

- Submit the Form: Choose the appropriate submission method, whether online or by mail, and ensure it is sent by the deadline.

Legal use of the Irs 990 Form

The Irs 990 Form serves as a legal document that demonstrates compliance with federal tax laws. Filing this form is not only a requirement for tax-exempt organizations but also a means of maintaining transparency with the public and the IRS. Failure to file or inaccuracies in the form can result in penalties, including fines or revocation of tax-exempt status. Therefore, it is essential to understand the legal implications of the information reported on the form.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Irs 990 Form to avoid penalties. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, the form is due by May 15 of the following year. Organizations can apply for an extension, but it is crucial to file the extension request before the original deadline to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

The Irs 990 Form can be submitted through various methods, offering flexibility for organizations. The most efficient way is to file electronically using the IRS e-File system, which allows for quicker processing and confirmation of receipt. Alternatively, organizations can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submissions are generally not accepted for this form, making electronic and postal options the primary methods of submission.

Quick guide on how to complete 2014 irs 990 form

Complete Irs 990 Form effortlessly on any device

Digital document management has gained increased traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely preserve it online. airSlate SignNow supplies all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Irs 990 Form on any system with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to alter and eSign Irs 990 Form with ease

- Locate Irs 990 Form and then click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that reason.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you want to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Alter and eSign Irs 990 Form and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs 990 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs 990 form

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the IRS 990 Form and why is it important for nonprofits?

The IRS 990 Form is a crucial document that nonprofits must file annually to provide transparency about their finances. This form helps the IRS and the public understand how nonprofits operate and manage their funds. Filing the IRS 990 Form correctly is essential for maintaining tax-exempt status and ensuring compliance with federal regulations.

-

How can airSlate SignNow assist with filing the IRS 990 Form?

airSlate SignNow simplifies the process of preparing and filing the IRS 990 Form by allowing users to eSign documents quickly and securely. With our platform, you can easily gather signatures from your board members and ensure all required documentation is submitted on time. Streamlining this process helps you avoid late fees and penalties associated with filing errors.

-

Is airSlate SignNow cost-effective for nonprofits needing to file the IRS 990 Form?

Yes, airSlate SignNow offers a cost-effective solution for nonprofits looking to file the IRS 990 Form. Our pricing plans are designed to fit the budget of organizations of all sizes, ensuring that you can access essential eSigning features without breaking the bank. This affordability helps nonprofits focus their funds on their mission rather than administrative costs.

-

What features does airSlate SignNow provide for managing the IRS 990 Form?

airSlate SignNow provides a variety of features tailored for managing the IRS 990 Form, including customizable templates, automatic reminders, and secure cloud storage. These features allow you to prepare the form efficiently while ensuring that all necessary signatures are collected promptly. Additionally, our platform's user-friendly interface makes it easy to navigate the entire process.

-

Can I integrate airSlate SignNow with other software for IRS 990 Form management?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and financial software, enhancing your ability to manage the IRS 990 Form. By connecting with tools like QuickBooks or Xero, you can easily import financial data and ensure accuracy in your filings. This integration streamlines your workflow and reduces the risk of errors.

-

How does airSlate SignNow ensure the security of documents related to the IRS 990 Form?

At airSlate SignNow, we prioritize the security of your documents, including those related to the IRS 990 Form. Our platform uses advanced encryption protocols to protect your data during transmission and storage. This commitment to security ensures that sensitive financial information remains confidential and secure throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for the IRS 990 Form compared to traditional methods?

Using airSlate SignNow for the IRS 990 Form offers numerous benefits over traditional paper methods. Our platform enables faster processing times, reduces paper waste, and minimizes the risk of errors associated with manual entry. Additionally, the convenience of eSigning allows for quicker approvals, helping you meet filing deadlines more efficiently.

Get more for Irs 990 Form

Find out other Irs 990 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors