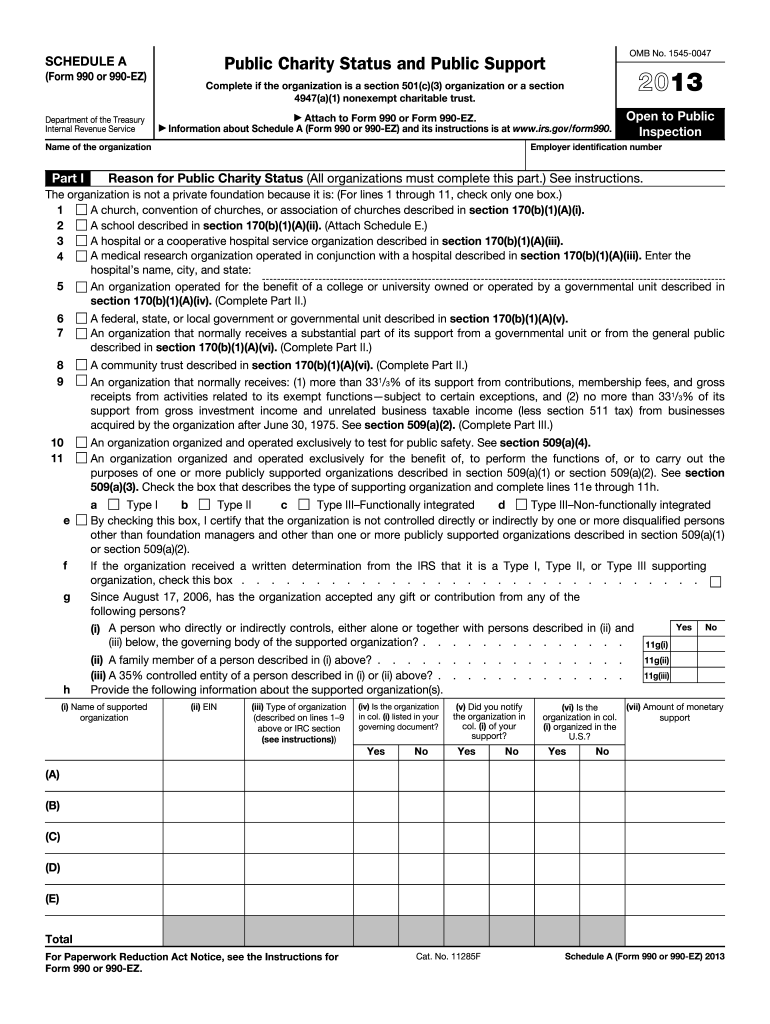

990 Ez Form 2013

What is the 990 Ez Form

The 990 Ez Form is a simplified version of the IRS Form 990, designed for smaller tax-exempt organizations, including charities and non-profits. This form allows these organizations to report their financial information, activities, and governance practices to the IRS. The 990 Ez Form is specifically tailored for organizations with gross receipts of less than two hundred fifty thousand dollars and total assets under five hundred thousand dollars, making it easier for them to comply with federal tax regulations.

How to use the 990 Ez Form

Using the 990 Ez Form involves several key steps. First, organizations must gather their financial records, including income statements, balance sheets, and details of their programs. Next, they should complete the form accurately, ensuring that all required sections are filled out, such as revenue, expenses, and net assets. Once completed, the form must be signed by an authorized individual, typically an officer or director of the organization. Finally, the form should be submitted to the IRS by the appropriate deadline, typically the fifteenth day of the fifth month after the end of the organization’s fiscal year.

Steps to complete the 990 Ez Form

Completing the 990 Ez Form involves a series of organized steps:

- Gather financial records, including income and expense statements.

- Fill out the form, starting with basic organizational information.

- Report revenue and expenses accurately in the designated sections.

- Provide information about the organization’s programs and activities.

- Ensure all required signatures are obtained.

- Review the form for accuracy before submission.

Legal use of the 990 Ez Form

The 990 Ez Form is legally binding when completed and submitted according to IRS guidelines. Organizations must ensure that the information provided is truthful and accurate, as any discrepancies can result in penalties or loss of tax-exempt status. Compliance with federal regulations is crucial, and organizations should keep detailed records to support the information reported on the form. Additionally, understanding the legal implications of the data submitted can help organizations maintain their standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Ez Form are critical for maintaining compliance. Generally, the form must be filed by the fifteenth day of the fifth month following the end of the organization’s fiscal year. For organizations with a fiscal year ending December 31, the deadline is May 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can request an extension, but this must be done before the original deadline.

Required Documents

To complete the 990 Ez Form, organizations need to prepare several key documents:

- Financial statements, including income and balance sheets.

- Records of contributions and grants received.

- Details of program services and activities.

- Information about board members and key staff.

- Any additional documentation that supports the financial data reported.

Examples of using the 990 Ez Form

Organizations use the 990 Ez Form in various scenarios, such as:

- Small charities reporting their annual financial activities to maintain tax-exempt status.

- Non-profits applying for grants that require proof of financial accountability.

- Foundations needing to disclose their financial operations to stakeholders.

Quick guide on how to complete 2013 990 ez form

Complete 990 Ez Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Manage 990 Ez Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign 990 Ez Form with ease

- Locate 990 Ez Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight essential sections of your documents or obscure sensitive data using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to apply your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign 990 Ez Form to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 990 ez form

Create this form in 5 minutes!

How to create an eSignature for the 2013 990 ez form

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the 990 Ez Form and how does it work?

The 990 Ez Form is a simplified version of the IRS Form 990, designed for small tax-exempt organizations to report their financial information. By using airSlate SignNow, you can easily prepare, sign, and submit your 990 Ez Form online, ensuring compliance with IRS requirements while saving time and effort.

-

How can I eSign my 990 Ez Form using airSlate SignNow?

With airSlate SignNow, eSigning your 990 Ez Form is straightforward. After preparing your form, simply upload it to our platform, add the required signatures, and send it for electronic signing. This process not only streamlines your workflow but also enhances security and convenience.

-

Is there a cost associated with using airSlate SignNow for the 990 Ez Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. You can choose a plan that fits your budget and access features that simplify the process of completing your 990 Ez Form, making it a cost-effective solution for organizations of all sizes.

-

What features does airSlate SignNow offer for managing the 990 Ez Form?

airSlate SignNow provides a range of features to help you manage your 990 Ez Form efficiently. These include template creation, automated workflows, secure storage, and real-time tracking of document status, all designed to enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for my 990 Ez Form?

Absolutely! airSlate SignNow offers integrations with popular software applications, enabling you to streamline your workflow when preparing your 990 Ez Form. Whether you use accounting software or CRM systems, our integrations help you manage documents seamlessly.

-

What are the benefits of using airSlate SignNow for the 990 Ez Form?

Using airSlate SignNow for your 990 Ez Form provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, ensuring that your forms are completed accurately and submitted on time.

-

Is airSlate SignNow compliant with legal requirements for the 990 Ez Form?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures and document management. When you use our platform for your 990 Ez Form, you can be confident that your submissions meet IRS regulations and are legally binding.

Get more for 990 Ez Form

Find out other 990 Ez Form

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship