Schedule a Form 2011

What is the Schedule A Form

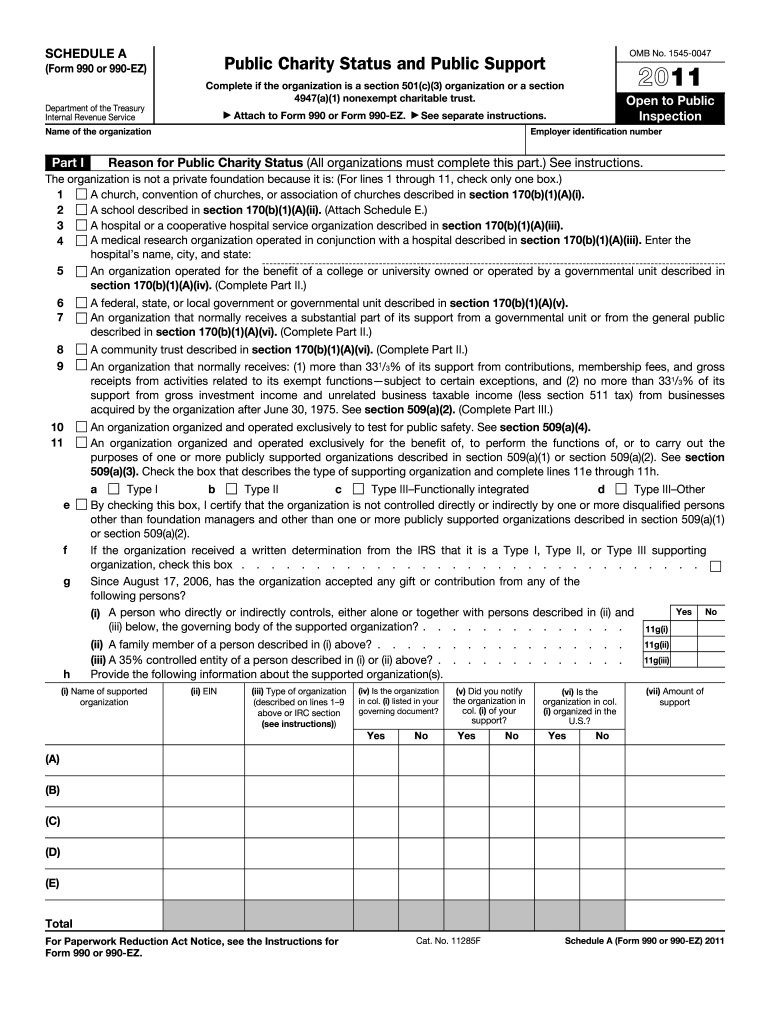

The Schedule A Form is an essential tax document used by individual taxpayers in the United States to report itemized deductions. This form allows taxpayers to detail various deductible expenses, which can reduce their taxable income and potentially lower their overall tax liability. Common deductions reported on Schedule A include medical expenses, mortgage interest, charitable contributions, and certain taxes paid. By itemizing deductions on this form, taxpayers may benefit from a higher deduction amount compared to the standard deduction, depending on their individual financial situations.

How to use the Schedule A Form

Using the Schedule A Form involves several steps to ensure accurate reporting of deductions. Taxpayers begin by gathering necessary documentation, such as receipts and statements for deductible expenses. Next, they will fill out the form by entering relevant information in the designated fields, including the total amounts for each category of deduction. It is important to follow IRS guidelines closely to ensure compliance and maximize potential deductions. After completing the form, it should be attached to the taxpayer's Form 1040 when filing their annual tax return.

Steps to complete the Schedule A Form

Completing the Schedule A Form requires careful attention to detail. Here are the key steps:

- Gather Documentation: Collect all receipts, invoices, and statements related to deductible expenses.

- Fill Out Personal Information: Enter your name, Social Security number, and other personal details at the top of the form.

- Report Deductions: Complete the sections for each type of deduction, ensuring that all amounts are accurately calculated and entered.

- Review for Accuracy: Double-check all entries for correctness and completeness to avoid potential issues.

- Attach to Form 1040: Once completed, attach Schedule A to your Form 1040 and submit your tax return by the deadline.

Legal use of the Schedule A Form

The Schedule A Form is legally recognized by the IRS as a valid means for taxpayers to claim itemized deductions. To ensure legal compliance, it is crucial that all information reported on the form is accurate and supported by appropriate documentation. Misreporting or fraudulent claims can result in penalties, including fines and interest on unpaid taxes. Taxpayers should also be aware of the specific IRS guidelines regarding eligible deductions to avoid any legal issues.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Schedule A Form is vital for compliance. Typically, individual tax returns, including those that utilize Schedule A, are due on April 15 of each year. If April 15 falls on a weekend or holiday, the due date may be extended to the next business day. Taxpayers can also request an extension, which allows them to file their return by October 15, but any taxes owed must still be paid by the original due date to avoid penalties.

Examples of using the Schedule A Form

There are various scenarios in which taxpayers might utilize the Schedule A Form. For instance, a homeowner who pays mortgage interest and property taxes may find that itemizing these deductions on Schedule A results in a greater tax benefit than taking the standard deduction. Similarly, individuals who incur significant medical expenses that exceed a certain percentage of their adjusted gross income may also benefit from itemizing those costs. Each taxpayer's situation is unique, and evaluating the benefits of itemizing versus taking the standard deduction is essential.

Quick guide on how to complete 2011 schedule a form

Effortlessly prepare Schedule A Form on any device

Digital document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule A Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Schedule A Form with ease

- Locate Schedule A Form and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to store your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule A Form to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 schedule a form

Create this form in 5 minutes!

How to create an eSignature for the 2011 schedule a form

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the process to Schedule A Form using airSlate SignNow?

To Schedule A Form with airSlate SignNow, simply log into your account and select the document you wish to send. Use the scheduling feature to choose a date and time for signing. This ensures that recipients are notified and can eSign the document conveniently.

-

How much does it cost to Schedule A Form with airSlate SignNow?

Pricing for airSlate SignNow varies based on the plan you choose, but it generally offers cost-effective solutions for businesses. Each plan includes features that allow you to Schedule A Form and manage your documents efficiently. Consider starting with a free trial to explore the platform's capabilities.

-

Can I integrate airSlate SignNow with other tools when I Schedule A Form?

Yes, airSlate SignNow provides various integrations with popular tools like Google Drive, Salesforce, and more. This allows you to seamlessly Schedule A Form directly from your preferred software, enhancing your workflow and document management.

-

What are the benefits of using airSlate SignNow to Schedule A Form?

Using airSlate SignNow to Schedule A Form streamlines your document signing process, saving you time and reducing errors. The platform is user-friendly, enabling you to send documents for eSigning with just a few clicks. Additionally, it enhances collaboration and keeps your documents secure.

-

Is it secure to Schedule A Form with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption and compliance with regulations like GDPR and eIDAS. When you Schedule A Form on our platform, you can trust that your documents and data are protected throughout the signing process.

-

Can I customize the reminders when I Schedule A Form?

Yes, airSlate SignNow allows you to customize reminder settings when you Schedule A Form. You can choose how often and when reminders are sent to recipients, ensuring they receive timely notifications and reducing the chances of delays in document signing.

-

What types of documents can I eSign when I Schedule A Form?

You can eSign a wide variety of documents when you Schedule A Form with airSlate SignNow, including contracts, agreements, and forms. The platform supports various file formats, making it versatile for different business needs.

Get more for Schedule A Form

- Personal history statement instructions city of denton form

- Agricultural pesticide use record keeping form for texas private

- Tdlr form cos001 2020

- Fire exit drills fire prevention form

- Time clock correction form

- Employee benefits third party administrator tpa appointment form

- Any false inaccurate incomplete or misleading information provided

- South texas cardiovascular consultants patient financial agreement form

Find out other Schedule A Form

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple