Irs 990 Form 2015

What is the Irs 990 Form

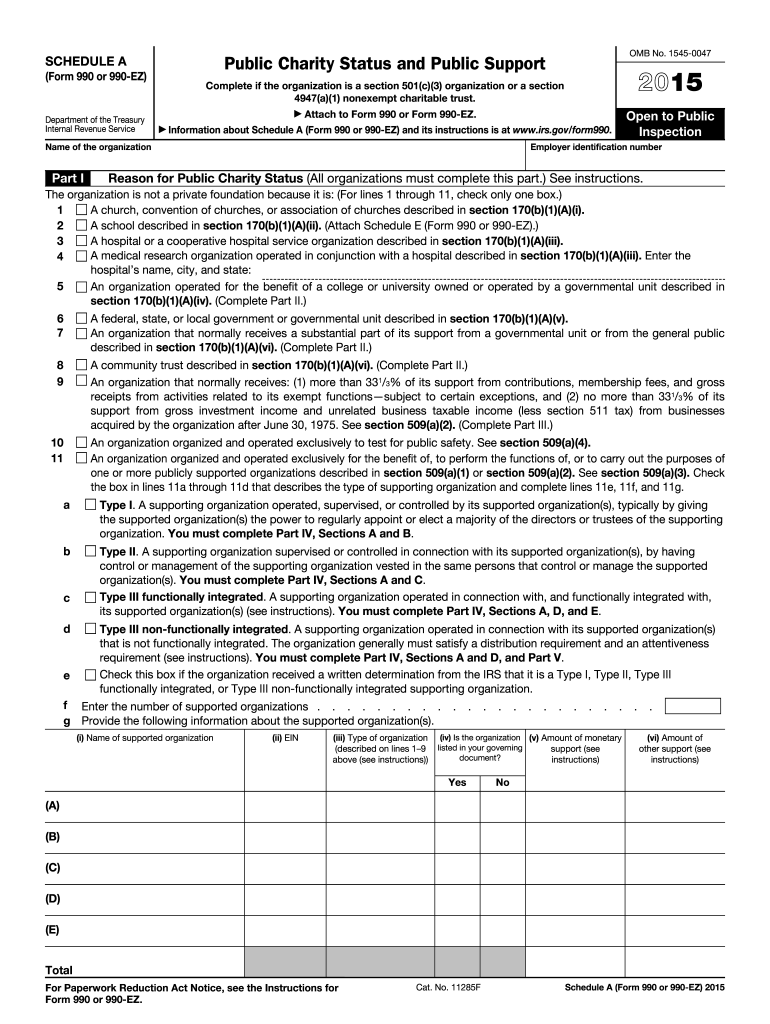

The Irs 990 Form is a crucial document that tax-exempt organizations in the United States must file annually with the Internal Revenue Service (IRS). This form provides detailed information about the organization’s financial activities, governance, and compliance with tax regulations. Nonprofits, charities, and other tax-exempt entities use this form to report their income, expenses, and operational activities, ensuring transparency and accountability to the public and the IRS.

How to use the Irs 990 Form

Using the Irs 990 Form involves several steps to ensure accurate reporting. Organizations must first gather all relevant financial data, including revenue, expenses, and program activities. Next, they should carefully complete each section of the form, which includes information about the organization’s mission, governance structure, and financial statements. After filling out the form, it is essential to review it for accuracy and completeness before submission. Organizations can file the Irs 990 Form electronically or via mail, depending on their preference and IRS guidelines.

Steps to complete the Irs 990 Form

Completing the Irs 990 Form involves a systematic approach to ensure all required information is accurately reported. Here are the key steps:

- Gather Documentation: Collect financial records, including income statements, balance sheets, and details about programs and services.

- Complete the Form: Fill out the form sections, including organizational information, financial data, and governance details.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid potential penalties.

- File the Form: Submit the completed form electronically or by mail, ensuring it is sent before the filing deadline.

Legal use of the Irs 990 Form

The Irs 990 Form serves as a legal document that demonstrates an organization’s compliance with federal tax laws. Filing this form is mandatory for tax-exempt organizations, and failure to do so can result in penalties or loss of tax-exempt status. The information provided in the form is used by the IRS to assess compliance and by the public to evaluate the organization’s financial health and transparency. Therefore, it is essential for organizations to understand the legal implications of the Irs 990 Form and to ensure that it is completed and submitted correctly.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Irs 990 Form to maintain compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December thirty-first, the Irs 990 Form is due by May fifteenth of the following year. It is important for organizations to mark these deadlines on their calendars and plan accordingly to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the Irs 990 Form. The most common method is electronic filing through the IRS e-file system, which allows for quicker processing and confirmation of receipt. Alternatively, organizations can submit the form by mail, ensuring it is sent to the correct IRS address based on their location. While in-person submission is generally not available for the Irs 990 Form, organizations can contact the IRS for assistance if needed. Choosing the appropriate submission method is essential for timely and accurate filing.

Quick guide on how to complete 2015 irs 990 form

Complete Irs 990 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct format and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any holdups. Manage Irs 990 Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

The easiest way to edit and eSign Irs 990 Form without hassle

- Obtain Irs 990 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Irs 990 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs 990 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs 990 form

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the Irs 990 Form and why is it important?

The Irs 990 Form is an annual information return that many tax-exempt organizations must file with the IRS. It provides transparency about the organization's finances, governance, and activities, ensuring compliance with federal regulations. Understanding this form is vital for maintaining tax-exempt status and for public accountability.

-

How can airSlate SignNow help with Irs 990 Form processing?

airSlate SignNow streamlines the process of preparing and signing the Irs 990 Form by offering a user-friendly platform for document management. Our eSigning feature allows organizations to easily gather signatures from stakeholders, ensuring timely submission. This efficient workflow reduces the risk of delays or errors in the filing process.

-

Is airSlate SignNow cost-effective for filing Irs 990 Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing the Irs 990 Form and other business documents. Our competitive pricing plans ensure that organizations of all sizes can access essential features without breaking the bank. By saving time and resources, airSlate SignNow ultimately enhances the efficiency of your filing process.

-

What features does airSlate SignNow provide for Irs 990 Form management?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure document storage, making it ideal for managing the Irs 990 Form. These features simplify document preparation and ensure all necessary information is collected and organized. Additionally, our platform ensures compliance with eSignature laws for valid submissions.

-

Can airSlate SignNow be integrated with other tools for Irs 990 Form preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software tools, enhancing your workflow for preparing the Irs 990 Form. These integrations allow for easy data transfer, ensuring that information is accurate and readily available during the form completion process. Maximizing your tools leads to a more efficient filing experience.

-

What are the benefits of using airSlate SignNow for Irs 990 Form submissions?

Using airSlate SignNow for Irs 990 Form submissions offers numerous benefits, including increased efficiency, time savings, and enhanced security. Our platform ensures that all documentation is securely signed and stored, reducing the risks associated with manual handling. This boosts organizational productivity and helps maintain compliance with regulatory requirements.

-

How does airSlate SignNow ensure the security of the Irs 990 Form?

airSlate SignNow prioritizes security by employing advanced encryption and secure storage protocols for sensitive documents like the Irs 990 Form. We maintain compliance with industry standards to protect your data, ensuring that unauthorized access is prevented. Users can confidently manage their documents, knowing their information is safe and secure.

Get more for Irs 990 Form

- Editable pdf patient intake form

- Accident claim form housatonic valley regional high school

- Dear patient to facilitate your first visit we ask that you kindly form

- Taxonomy crosswalk form

- How can is change the name of my beneficiary in valic form

- Husttp investigation form alabama public health

- Acute stress reaction questionnaire form

- Oneclick instructions for use form

Find out other Irs 990 Form

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online