Irs Form Schedule C 2010

What is the IRS Form Schedule C

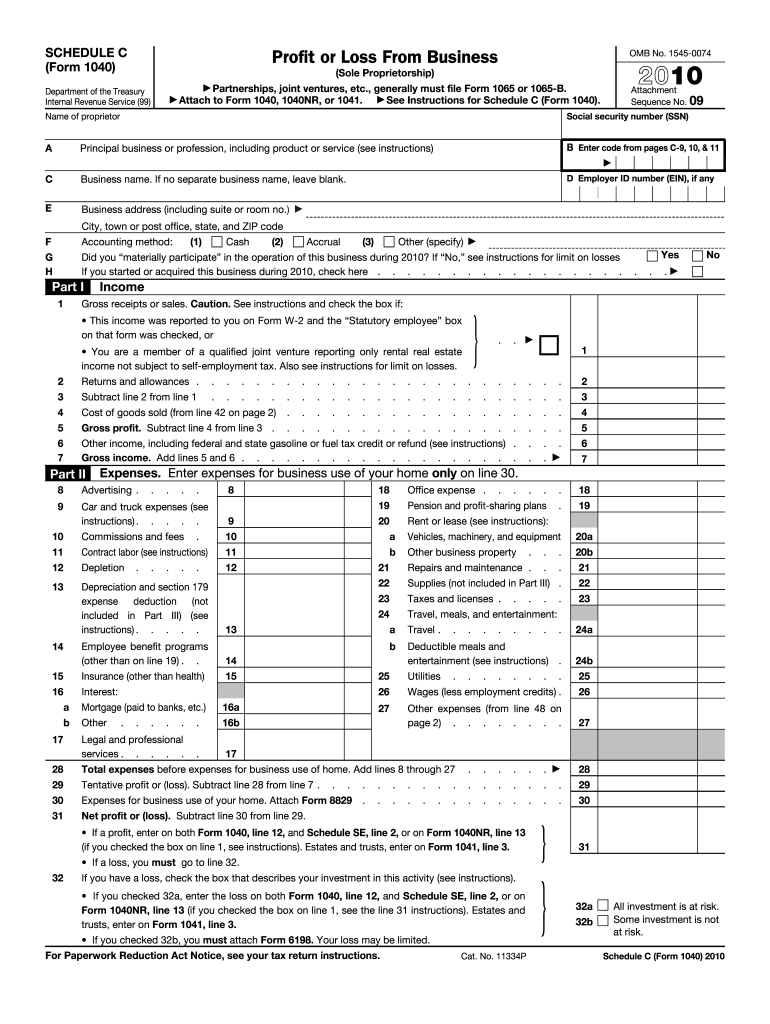

The IRS Form Schedule C is a tax form used by sole proprietors to report income or loss from their business. This form is essential for individuals who are self-employed or operate a single-member LLC. It helps in calculating the net profit or loss from the business, which is then reported on the individual’s Form 1040. The Schedule C captures various income sources, expenses, and deductions related to the business, making it a crucial document for accurate tax reporting.

How to use the IRS Form Schedule C

Using the IRS Form Schedule C involves several steps to ensure accurate reporting of business income and expenses. First, gather all relevant financial documents, including income statements and receipts for business expenses. Next, fill out the form by providing details such as the business name, address, and type of business activity. Report gross receipts and any other income, followed by listing allowable expenses, which can include costs for supplies, utilities, and other operational expenses. Finally, calculate the net profit or loss, which will be transferred to the Form 1040.

Steps to complete the IRS Form Schedule C

Completing the IRS Form Schedule C requires careful attention to detail. Start by entering your business information at the top of the form. Then, report your gross receipts in Part I. In Part II, list your business expenses, categorizing them appropriately. Common categories include advertising, car and truck expenses, and depreciation. After entering all relevant figures, calculate your net profit or loss in Part III. Ensure that all calculations are accurate to avoid issues with the IRS.

Key elements of the IRS Form Schedule C

Several key elements make up the IRS Form Schedule C. These include:

- Business Information: This section requires the business name, address, and type of business.

- Gross Receipts: Total income generated from business activities.

- Expenses: Detailed listing of all business-related expenses, categorized for clarity.

- Net Profit or Loss: The final calculation that determines the income to be reported on the Form 1040.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form Schedule C align with the individual tax return deadlines. Typically, the due date for filing the Form 1040, along with the Schedule C, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates to avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form Schedule C can be submitted in several ways. Taxpayers can file it electronically using tax preparation software, which often simplifies the process and reduces errors. Alternatively, the form can be printed and mailed to the IRS along with the Form 1040. In-person filing is generally not an option, as the IRS does not accept walk-in submissions for individual tax returns. Ensure that all forms are sent to the correct address based on your location and filing method.

Quick guide on how to complete irs form schedule c 2010

Complete Irs Form Schedule C smoothly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form Schedule C on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Irs Form Schedule C effortlessly

- Locate Irs Form Schedule C and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irs Form Schedule C and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form schedule c 2010

Create this form in 5 minutes!

How to create an eSignature for the irs form schedule c 2010

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is IRS Form Schedule C and why do I need it?

IRS Form Schedule C is used by sole proprietors to report income or loss from their business. By accurately completing IRS Form Schedule C, you can deduct business expenses and determine the net profit or loss, which is crucial for your overall tax obligations. Using airSlate SignNow can help streamline the process of signing and submitting this important document.

-

How can airSlate SignNow assist with IRS Form Schedule C?

airSlate SignNow allows you to easily prepare, sign, and send IRS Form Schedule C digitally. With its user-friendly interface, you can ensure that all necessary fields are filled out correctly, minimizing errors and expediting tax filing. Plus, the ability to eSign documents saves you time and enhances your workflow.

-

Is airSlate SignNow cost-effective for small businesses needing IRS Form Schedule C?

Yes, airSlate SignNow offers a cost-effective solution for small businesses that need to manage IRS Form Schedule C. With flexible pricing plans, you can choose a package that fits your budget while still accessing all the features necessary for efficient document management and eSigning.

-

What features does airSlate SignNow provide for handling IRS Form Schedule C?

airSlate SignNow provides a range of features including customizable templates for IRS Form Schedule C, secure eSigning, and document tracking. These features simplify the process of preparing your form and ensure that you can monitor its status at every step. This enhances your efficiency and helps you stay organized.

-

Can I integrate airSlate SignNow with accounting software for IRS Form Schedule C?

Absolutely! airSlate SignNow can be integrated with various accounting software platforms to streamline your preparation of IRS Form Schedule C. This integration allows for seamless data transfer, ensuring that all financial information is accurate and up-to-date, which is critical for tax reporting.

-

How secure is my information when using airSlate SignNow for IRS Form Schedule C?

Your information is highly secure when using airSlate SignNow for IRS Form Schedule C. The platform utilizes advanced encryption and security protocols to protect your documents and personal data. You can trust that your sensitive tax information remains confidential and safe.

-

Can I access IRS Form Schedule C on my mobile device using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access IRS Form Schedule C from your smartphone or tablet. This flexibility means you can prepare and eSign your tax documents on the go, making it easier to manage your business and meet deadlines.

Get more for Irs Form Schedule C

- 2019 2019 enrollment revision form

- 2019 2020 student enrollment verification form sevf

- Summer housing residential life boston college form

- Active afterschool at the ymca albany area ymca form

- Student information all fields required

- Satisfactory academic progress sap and loss of bogfw form

- Official transcript request form utah state university usu

- Clarion university handbook for facultystaff conducting form

Find out other Irs Form Schedule C

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF