Form Schedule C 2008

What is the Form Schedule C

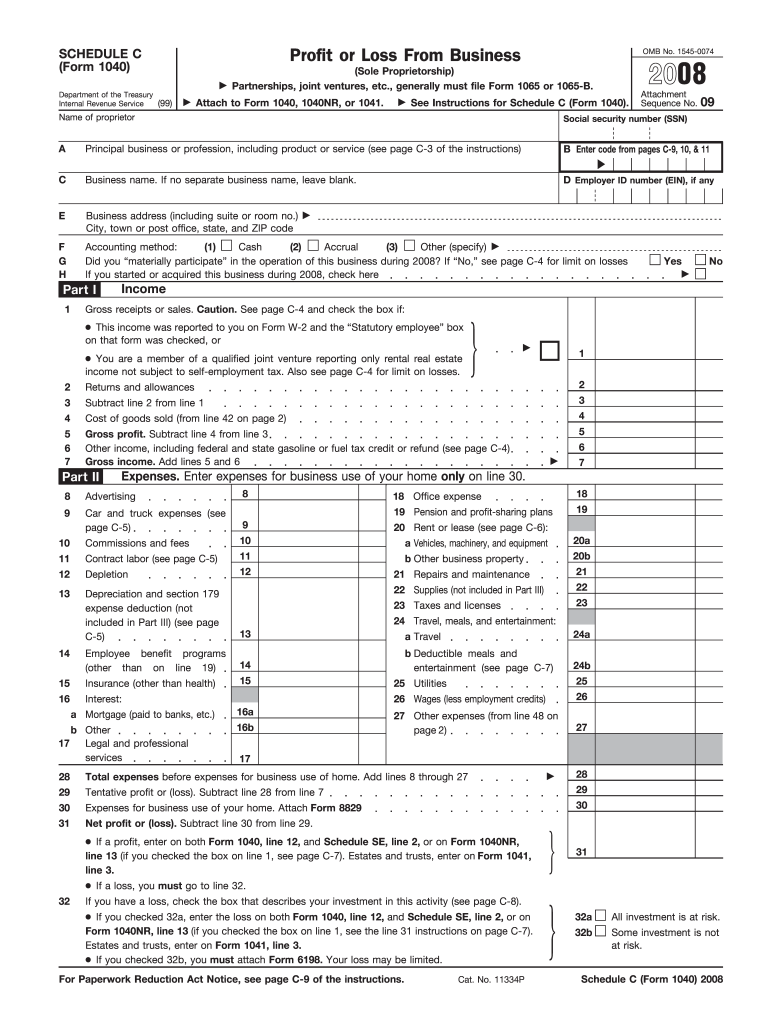

The Form Schedule C is a tax form used by self-employed individuals to report income and expenses from their business. It is filed alongside the Form 1040, which is the standard individual income tax return in the United States. This form allows taxpayers to detail their business activities, including gross receipts, cost of goods sold, and various deductions related to business expenses. Understanding the Schedule C is essential for accurately reporting income and minimizing tax liability.

How to use the Form Schedule C

To effectively use the Form Schedule C, taxpayers must gather all relevant financial information pertaining to their business. This includes records of income, expenses, and any supporting documentation. The form is divided into sections that require detailed entries, such as business name, address, and type of business. Each section must be completed accurately to ensure compliance with IRS regulations. After filling out the form, it should be attached to the Form 1040 when submitting taxes.

Steps to complete the Form Schedule C

Completing the Form Schedule C involves several key steps:

- Gather all financial records related to your business.

- Fill in your business information, including name and address.

- Report your gross receipts or sales.

- Calculate the cost of goods sold if applicable.

- Detail your business expenses in the appropriate categories.

- Calculate your net profit or loss.

- Transfer the net profit or loss to your Form 1040.

Legal use of the Form Schedule C

The Form Schedule C must be used in accordance with IRS guidelines to ensure it is legally valid. This includes accurately reporting all income and expenses, maintaining proper documentation, and filing by the designated deadline. Failure to comply with these regulations may result in penalties or audits. It is crucial for taxpayers to understand the legal implications of the information reported on this form.

Filing Deadlines / Important Dates

The filing deadline for the Form Schedule C coincides with the due date for the Form 1040, typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines and plan accordingly to avoid late fees. Additionally, if an extension is needed, Form 4868 can be filed to request additional time.

Examples of using the Form Schedule C

Examples of using the Form Schedule C include various self-employed individuals, such as freelancers, consultants, and small business owners. For instance, a freelance graphic designer would report income from clients and deduct expenses for software, equipment, and home office costs. Similarly, a small business owner would report sales revenue and deduct costs related to inventory, rent, and utilities. These examples illustrate the versatility of the Schedule C for different business types.

Quick guide on how to complete 2008 form schedule c

Prepare Form Schedule C effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute to traditionally printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Form Schedule C on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Form Schedule C with ease

- Locate Form Schedule C and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form Schedule C and secure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 form schedule c

Create this form in 5 minutes!

How to create an eSignature for the 2008 form schedule c

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the form 2008 1040, and who needs to file it?

The form 2008 1040 is the U.S. Individual Income Tax Return used for reporting income and calculating taxes owed for the 2008 tax year. Individuals who had income during this period, including wages, self-employment income, and investment earnings, need to file this form to fulfill their tax obligations.

-

How can airSlate SignNow help with filing the form 2008 1040?

airSlate SignNow simplifies the process of gathering and signing documents necessary for completing the form 2008 1040. With our easy-to-use platform, users can easily collect signatures and organize essential information, ensuring a smooth and efficient filing experience.

-

Are there any costs associated with using airSlate SignNow for the form 2008 1040?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions provide access to features that streamline the document signing process for the form 2008 1040, ensuring great value for users.

-

What features does airSlate SignNow offer to enhance my experience with the form 2008 1040?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These tools are designed to enhance your workflow while dealing with the form 2008 1040, making the signing and filing process more efficient.

-

Can I integrate airSlate SignNow with my existing tax software for the form 2008 1040?

Absolutely! airSlate SignNow offers integrations with various tax software solutions, allowing you to seamlessly manage your documents related to the form 2008 1040. This ensures that you can efficiently handle your tax filing needs without disrupting your workflow.

-

What benefits does airSlate SignNow provide for businesses managing form 2008 1040?

By using airSlate SignNow, businesses can enhance collaboration, reduce paperwork, and accelerate the signing process related to the form 2008 1040. Our platform not only saves time but also helps ensure compliance with legal requirements for document handling.

-

Is it safe to use airSlate SignNow for signing my form 2008 1040?

Yes, airSlate SignNow prioritizes the security of your documents. Our platform employs advanced encryption protocols and complies with industry standards to ensure that your form 2008 1040 and all sensitive information remain protected throughout the signing process.

Get more for Form Schedule C

Find out other Form Schedule C

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney