Schedule C Tax Form 2007

What is the Schedule C Tax Form

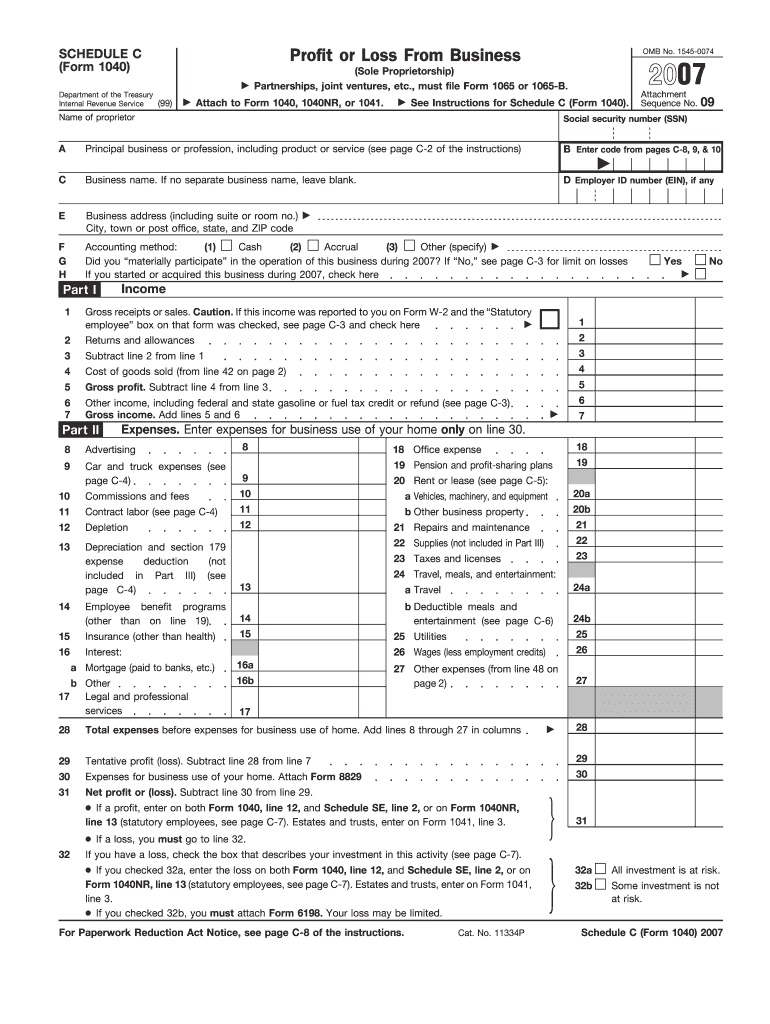

The Schedule C tax form, officially known as the 2007 Schedule C (Form 1040), is used by self-employed individuals to report income and expenses related to their business. This form is essential for sole proprietors and single-member LLCs, as it allows them to calculate their net profit or loss from their business activities. The information reported on Schedule C is then transferred to the individual’s Form 1040, which is the standard tax return form for individuals in the United States.

Steps to Complete the Schedule C Tax Form

Completing the 2007 Schedule C form involves several key steps:

- Gather necessary documents: Collect all relevant financial records, including income statements, expense receipts, and any other documentation that supports your business activities.

- Fill in business information: Provide your business name, address, and the type of business you operate. This section also requires you to indicate your accounting method, whether cash or accrual.

- Report income: Enter your total business income or gross receipts. This includes all money received from sales or services.

- Deduct expenses: List all business-related expenses in the appropriate categories, such as advertising, car and truck expenses, and supplies. Ensure you have documentation for each expense.

- Calculate net profit or loss: Subtract total expenses from total income to determine your net profit or loss. This figure will be crucial for your overall tax calculation.

Legal Use of the Schedule C Tax Form

The 2007 Schedule C form is legally binding when completed accurately and submitted to the IRS. It must reflect true and correct information about your business income and expenses. Misrepresentation or inaccuracies can lead to penalties, including fines or audits. To ensure compliance, it is advisable to keep detailed records and consult with a tax professional if needed.

Filing Deadlines / Important Dates

For the 2007 tax year, the deadline to file your Schedule C, along with your Form 1040, is typically April 15 of the following year. If you require additional time, you may file for an extension, which generally provides an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The 2007 Schedule C form can be submitted in several ways:

- Online: Many taxpayers choose to file their taxes electronically using tax preparation software, which often includes the Schedule C form as part of the filing process.

- Mail: You can print the completed Schedule C form and mail it to the appropriate IRS address based on your state of residence.

- In-Person: While less common, some taxpayers may choose to file their taxes in person at designated IRS offices or through a tax professional.

Eligibility Criteria

To use the 2007 Schedule C form, you must be a sole proprietor or single-member LLC. This means that you operate your business independently and are not incorporated. Additionally, you should have income generated from self-employment activities, which may include freelance work, consulting, or any other business ventures where you are the primary owner.

Quick guide on how to complete 2007 schedule c tax form

Handle Schedule C Tax Form effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Schedule C Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign Schedule C Tax Form with ease

- Locate Schedule C Tax Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, frustrating form searching, or errors that require printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Schedule C Tax Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2007 schedule c tax form

Create this form in 5 minutes!

How to create an eSignature for the 2007 schedule c tax form

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2007 schedule eic form?

The 2007 schedule eic form is used to determine eligibility for the Earned Income Credit (EIC) when filing your taxes. This form helps taxpayers maximize their credits and refunds and is essential for those who qualify. Utilizing this form can lead to increased tax savings and improved financial awareness.

-

How can airSlate SignNow assist with submitting the 2007 schedule eic form?

airSlate SignNow simplifies the process of sending and eSigning documents, allowing for easy submission of the 2007 schedule eic form. With our user-friendly platform, you can electronically sign your form and ensure it is submitted securely and timely. This feature saves you time and reduces paperwork hassles.

-

Is there a cost associated with using airSlate SignNow for the 2007 schedule eic form?

airSlate SignNow offers a cost-effective solution for businesses looking to manage documents like the 2007 schedule eic form. Our pricing plans are designed to accommodate various needs and budgets, ensuring you only pay for what you use. Explore our flexible pricing options to find the best fit for your requirements.

-

What features does airSlate SignNow offer for managing the 2007 schedule eic form?

airSlate SignNow provides several features designed to enhance the management of documents such as the 2007 schedule eic form. Key features include customizable templates, secure eSigning, and real-time tracking of document status. These tools streamline the process, making it easier and faster to handle your tax forms.

-

Can I store my submitted 2007 schedule eic form with airSlate SignNow?

Yes, airSlate SignNow allows you to securely store your submitted 2007 schedule eic form along with other critical documents. Our cloud storage solution keeps your files organized and accessible whenever you need them. This ensures peace of mind knowing your important documents are safe and easy to retrieve.

-

How does airSlate SignNow ensure the security of the 2007 schedule eic form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the 2007 schedule eic form. We implement robust encryption protocols and comply with industry standards to protect your information. You can trust that your data is safe while using our platform for eSigning.

-

Are there integrations with other software for managing the 2007 schedule eic form?

Absolutely, airSlate SignNow offers seamless integrations with various software solutions that can help manage the 2007 schedule eic form. These integrations streamline workflows and enhance your productivity by connecting directly to other applications you may already be using. Check our integrations page to see the full list of compatible tools.

Get more for Schedule C Tax Form

- Presentation peer feedback form pdf

- Individual membership application american welding society form

- Join or renew form

- Fillable online request for inhaler to be kept on person heritage form

- Email website if applicable form

- Epcot international festival of the holidays walt disney form

- Quadrilateral proofs form

- Signed and stamped as an agreement on legal stamp form

Find out other Schedule C Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors