Schedule C Form 2011

What is the Schedule C Form

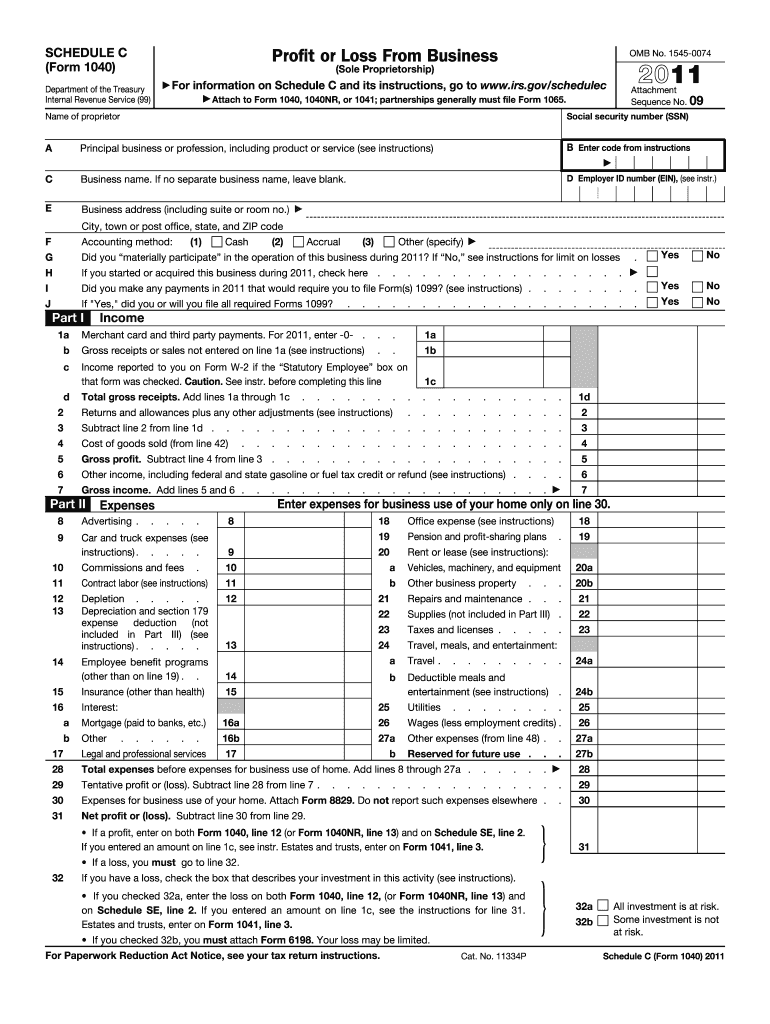

The Schedule C form, officially known as the 2011 IRS Schedule C, is used by self-employed individuals to report income and expenses related to their business activities. This form is part of the individual income tax return, Form 1040, and is essential for those operating as sole proprietors or single-member LLCs. It allows taxpayers to detail their business earnings, costs, and ultimately calculate their net profit or loss.

How to use the Schedule C Form

To effectively use the Schedule C form, taxpayers must first gather all relevant financial information, including income statements and expense receipts. The form is divided into sections where users report gross receipts, cost of goods sold, and various business expenses such as advertising, utilities, and depreciation. It is crucial to accurately categorize each expense to ensure compliance with IRS guidelines and maximize potential deductions.

Steps to complete the Schedule C Form

Completing the Schedule C form involves several steps:

- Gather Documentation: Collect all income and expense records for the tax year.

- Fill in Business Information: Enter your business name, address, and type of business.

- Report Income: List all gross receipts and any other income sources.

- Calculate Expenses: Itemize expenses in the appropriate categories provided on the form.

- Determine Net Profit or Loss: Subtract total expenses from total income to find your net profit or loss.

- Review and Submit: Double-check all entries for accuracy before submitting with your Form 1040.

Legal use of the Schedule C Form

The Schedule C form must be filled out accurately to comply with IRS regulations. It is legally binding and can be subject to audit. Taxpayers should ensure that all reported income and expenses are legitimate and well-documented. Misreporting can lead to penalties or additional taxes owed. Utilizing electronic filing solutions can streamline this process and enhance the security of submitted information.

Filing Deadlines / Important Dates

For the 2011 tax year, the deadline for filing the Schedule C form is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes in deadlines or additional extensions that may apply to their specific situation. Staying informed about these dates is essential to avoid late fees or penalties.

Required Documents

When preparing the Schedule C form, certain documents are necessary to ensure accurate reporting:

- Income statements, including 1099 forms and sales receipts.

- Expense receipts and invoices for all business-related costs.

- Bank statements that reflect business transactions.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The Schedule C form can be submitted in several ways. Taxpayers may choose to file electronically using tax software, which often simplifies the process and reduces errors. Alternatively, the form can be mailed to the IRS along with the Form 1040. In-person submissions are generally not available, but taxpayers can seek assistance from tax professionals or certified public accountants for guidance.

Quick guide on how to complete 2011 schedule c form

Effortlessly Prepare Schedule C Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without interruptions. Manage Schedule C Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The Easiest Way to Edit and eSign Schedule C Form with Ease

- Locate Schedule C Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically available through airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Revise and eSign Schedule C Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 schedule c form

Create this form in 5 minutes!

How to create an eSignature for the 2011 schedule c form

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the Schedule C Form and who needs it?

The Schedule C Form is a tax document used by sole proprietors to report income or loss from their business. If you operate as a sole proprietor and earn income from self-employment, you will need to complete the Schedule C Form as part of your annual tax return.

-

How can airSlate SignNow help with the Schedule C Form process?

airSlate SignNow streamlines the process of filling out and signing the Schedule C Form. With our easy-to-use platform, you can quickly create, edit, and eSign your Schedule C Form, making tax season less stressful and more efficient.

-

Is there a cost associated with using airSlate SignNow for the Schedule C Form?

Yes, airSlate SignNow offers various pricing plans to suit your needs, starting with a free trial. Depending on your requirements for features and document volume, you can choose a plan that allows you to manage your Schedule C Form efficiently and cost-effectively.

-

Can I integrate airSlate SignNow with other software to manage my Schedule C Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, allowing you to manage your Schedule C Form alongside your other financial documents. This integration helps streamline your workflow and ensures all necessary data is readily available.

-

What features does airSlate SignNow offer for completing a Schedule C Form?

With airSlate SignNow, you can utilize features like customizable templates, real-time collaboration, and secure electronic signatures to complete your Schedule C Form. These features enhance productivity and ensure that your documents are handled efficiently and securely.

-

How secure is my information when using airSlate SignNow for the Schedule C Form?

Security is a top priority at airSlate SignNow. When filling out and sending your Schedule C Form, your data is protected with industry-standard encryption and secure storage, ensuring that your sensitive financial information remains confidential.

-

Can I access my completed Schedule C Form from anywhere?

Yes, airSlate SignNow is cloud-based, which means you can access your completed Schedule C Form from any device with internet access. This flexibility allows you to manage your documents on the go, making it easier to stay organized during tax season.

Get more for Schedule C Form

- Australian disability parking permit mobility impairment form

- The vehicle must be further than 200 miles away from the nearest dmv inspection lane to qualify form

- Icao flight plan equipment codes for aircraft with ifr gps form

- Certified public accountant form 4b verification of experience by supervisor

- New zealand superannuation applicationm12 use this application to apply for new zealand superannuation nz super if youre not form

- Solved irs letter from estonia intuit accountants community form

- Pdf notice cp2566 internal revenue service form

- Inbjudan fr besk lngre tid n 90 dagarfylls i av personer i form

Find out other Schedule C Form

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure