Get and Sign Schedule C Form 1040 2021

Understanding the Schedule C Form 1040

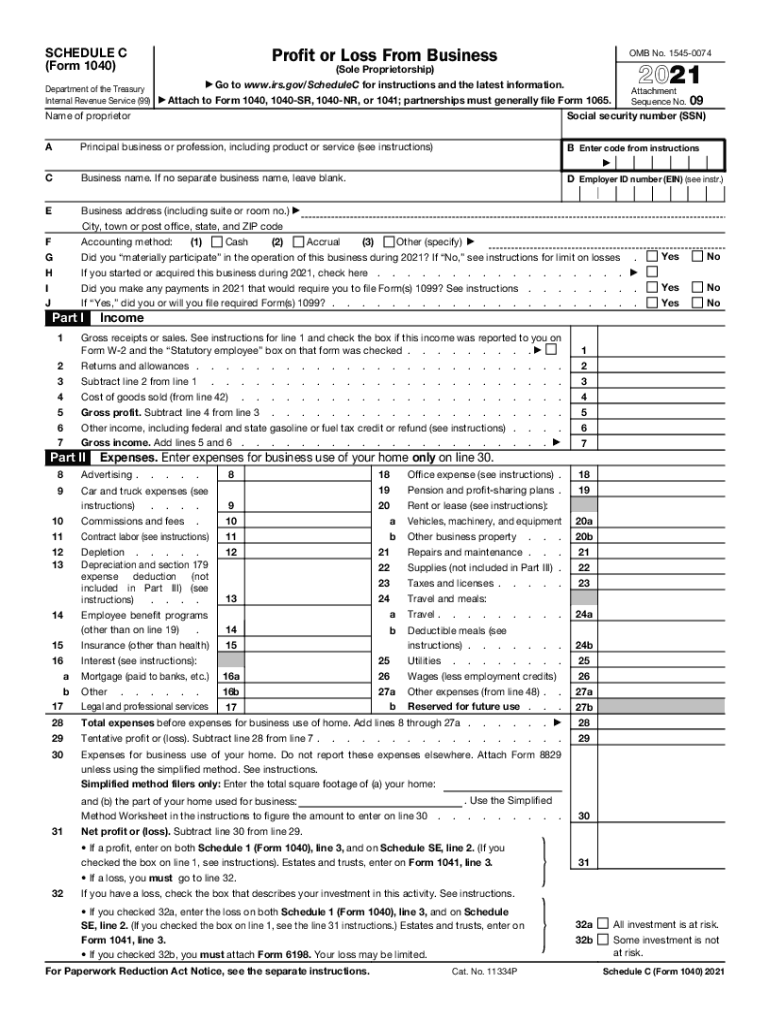

The Schedule C form 1040, officially known as the Profit or Loss From Business, is a crucial document for self-employed individuals and sole proprietors in the United States. It allows taxpayers to report income and expenses from their business activities, ultimately determining their net profit or loss for the tax year. This form is essential for calculating the self-employment tax and is typically filed alongside the IRS Form 1040.

When filling out the Schedule C 2021, it is important to accurately report all income received from business activities, as well as any allowable deductions. Common deductions include operating expenses, vehicle expenses, and home office deductions. The IRS provides detailed instructions for completing this form, ensuring that taxpayers can navigate the complexities of reporting their business income effectively.

Steps to Complete the Schedule C Form 1040

Completing the Schedule C form 1040 requires careful attention to detail. Here are the key steps to follow:

- Gather Required Information: Collect all relevant financial records, including income statements, receipts for expenses, and any other documentation related to your business activities.

- Fill Out Basic Information: Enter your name, Social Security number, and business name at the top of the form.

- Report Income: Document all income earned from your business, including sales, services, and other revenue sources.

- List Expenses: Itemize all business expenses, ensuring to categorize them correctly. Common categories include advertising, utilities, and supplies.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss.

- Review and Sign: Double-check all entries for accuracy before signing and dating the form.

Legal Use of the Schedule C Form 1040

The Schedule C form 1040 serves a significant legal purpose in the context of U.S. tax law. It is legally binding when properly completed and submitted to the IRS. The information provided on this form can be used by the IRS to verify income and expenses, ensuring compliance with tax regulations. Failing to accurately report income or expenses may result in penalties or audits.

Additionally, the Schedule C form can be utilized in various legal contexts, such as applying for loans or grants, where proof of income from self-employment is required. It is advisable to maintain copies of submitted forms and supporting documents for future reference.

IRS Guidelines for Schedule C Form 1040

The IRS provides comprehensive guidelines for completing the Schedule C form 1040. These guidelines cover eligibility criteria, filing requirements, and specific instructions for various business types. Taxpayers should familiarize themselves with the IRS publications related to the Schedule C, as these resources offer valuable insights into allowable deductions, record-keeping requirements, and common pitfalls to avoid.

Moreover, staying updated with any changes in tax laws or IRS regulations is crucial for accurate reporting. The IRS website regularly posts updates that may impact how self-employed individuals complete their tax forms.

Examples of Using the Schedule C Form 1040

Understanding the practical application of the Schedule C form 1040 can help taxpayers navigate their filing process more effectively. Here are a few scenarios:

- Freelancers: A graphic designer providing services to various clients would report all income received and deduct expenses related to software, equipment, and office supplies.

- Small Business Owners: A sole proprietor running a retail shop would list sales revenue and deduct costs associated with inventory, rent, and utilities.

- Consultants: A business consultant would report income from consulting fees and deduct travel expenses, office supplies, and professional development costs.

Filing Deadlines for Schedule C Form 1040

Timely filing of the Schedule C form 1040 is essential to avoid penalties. The deadline for submitting the form typically aligns with the due date for Form 1040, which is usually April 15 of the following tax year. However, if that date falls on a weekend or holiday, the deadline may be extended to the next business day.

Taxpayers who require additional time to prepare their returns can file for an extension, allowing them until October 15 to submit their forms. It is important to note that an extension to file does not extend the deadline to pay any taxes owed.

Quick guide on how to complete schedule c form 1040free fillable form ampamp pdf sample about schedule c form 1040 profit or loss from business 2020

Effortlessly Prepare Get and Sign Schedule C Form 1040 on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal ecologically friendly option to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without any delays. Handle Get and Sign Schedule C Form 1040 on any platform with airSlate SignNow apps for Android or iOS and enhance any document-centered workflow today.

How to Edit and Electronically Sign Get and Sign Schedule C Form 1040 with Ease

- Locate Get and Sign Schedule C Form 1040 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or shared link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Get and Sign Schedule C Form 1040 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c form 1040free fillable form ampamp pdf sample about schedule c form 1040 profit or loss from business 2020

Create this form in 5 minutes!

How to create an eSignature for the schedule c form 1040free fillable form ampamp pdf sample about schedule c form 1040 profit or loss from business 2020

The way to create an e-signature for your PDF online

The way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the Schedule C 1040 2021 form for self-employed individuals?

The Schedule C 1040 2021 form is crucial for self-employed individuals as it allows them to report income and expenses related to their business. Accurately filling out this form helps in calculating taxes owed and maximizing deductions. Understanding its components is essential for effective tax filing and ensuring compliance.

-

How can airSlate SignNow help in completing the Schedule C 1040 2021?

airSlate SignNow simplifies the process of completing the Schedule C 1040 2021 by providing easy-to-use document templates. Users can electronically sign and send documents, streamlining workflows to ensure that all necessary paperwork is completed accurately and timely. This efficiency can save time and reduce errors during tax season.

-

What features does airSlate SignNow offer that are beneficial for tax professionals handling Schedule C 1040 2021 forms?

AirSlate SignNow offers features like document templates, in-document comments, and secure eSigning, making it an excellent choice for tax professionals. These tools help ensure that all Schedule C 1040 2021 forms are filled out correctly and reviewed promptly. Additionally, document tracking keeps both clients and professionals informed throughout the process.

-

Is airSlate SignNow cost-effective for small businesses dealing with Schedule C 1040 2021 forms?

Yes, airSlate SignNow provides a cost-effective solution for small businesses required to manage Schedule C 1040 2021 forms. The pricing plans are affordable and tailored to various business needs. This economical approach helps entrepreneurs focus more on their business operations rather than paperwork.

-

What integrations does airSlate SignNow offer to assist with tax preparation for Schedule C 1040 2021?

AirSlate SignNow seamlessly integrates with popular accounting software and applications, enhancing the management of Schedule C 1040 2021 forms. These integrations streamline data transfer and eliminate duplication of effort, making tax preparation more efficient. Utilizing these integrations can signNowly improve workflow and accuracy.

-

Can airSlate SignNow help track the status of my Schedule C 1040 2021 documents?

Absolutely! AirSlate SignNow comes with an integrated tracking feature that allows users to monitor the status of their Schedule C 1040 2021 documents in real-time. This transparency ensures that you are always updated on which documents have been signed or are pending. Such capabilities enhance overall communication and efficiency.

-

What are the benefits of using airSlate SignNow for electronic signatures on Schedule C 1040 2021 forms?

Using airSlate SignNow for electronic signatures on Schedule C 1040 2021 forms ensures compliance with legal electronic signature standards. This method is not only faster but also more secure than traditional paper signing. It simplifies the signing process, allowing for immediate and reliable contract management.

Get more for Get and Sign Schedule C Form 1040

- Inventory and condition of leased premises for pre lease and post lease idaho form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out idaho form

- Property manager agreement idaho form

- Agreement for delayed or partial rent payments idaho form

- Tenants maintenance repair request form idaho

- Guaranty attachment to lease for guarantor or cosigner idaho form

- Amendment to lease or rental agreement idaho form

- Warning notice due to complaint from neighbors idaho form

Find out other Get and Sign Schedule C Form 1040

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe