Schedule C Form 2016

What is the Schedule C Form

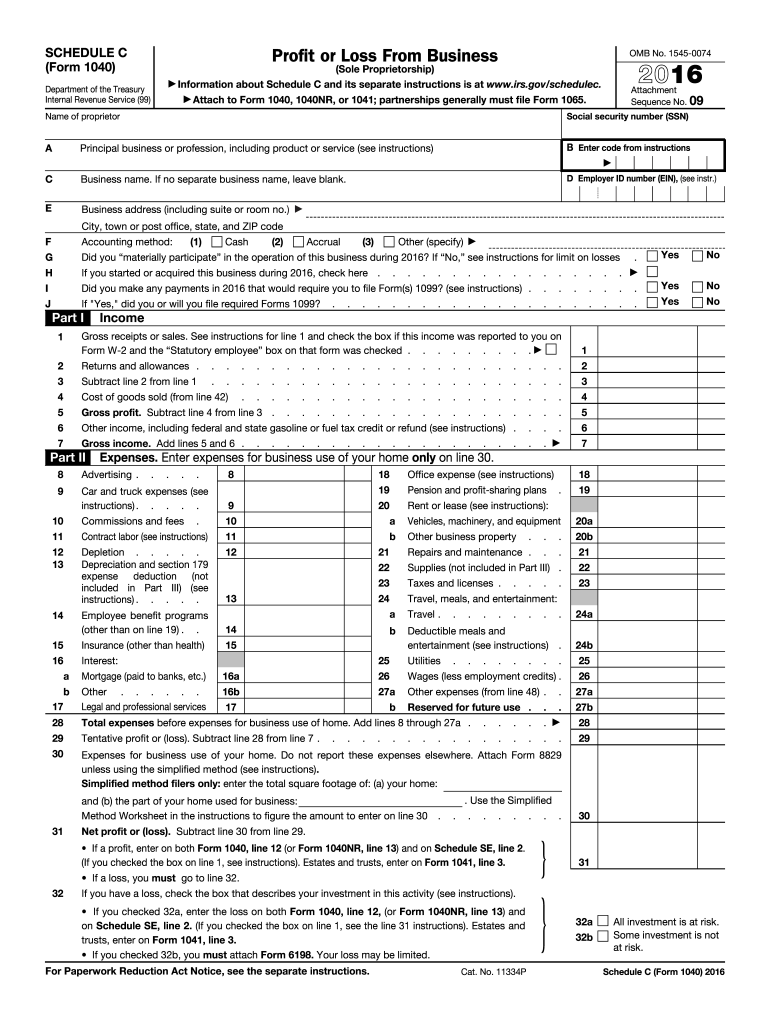

The Schedule C form is a vital document used by self-employed individuals and sole proprietors to report income or loss from their business. Officially known as the "Profit or Loss from Business" form, it is part of the 2016 Form 1040 tax return. This form allows taxpayers to detail their business income, expenses, and deductions, ultimately determining their net profit or loss for the year. Properly filling out the Schedule C is essential for accurate tax reporting and compliance with IRS regulations.

Steps to complete the Schedule C Form

Completing the Schedule C form involves several key steps. First, gather all necessary financial records, including income statements and receipts for business expenses. Next, fill out the top section of the form with your business name, address, and the principal business activity. Then, report your gross receipts or sales in Part I. In Part II, list your business expenses, categorizing them into specific types such as advertising, car and truck expenses, and office supplies. Finally, calculate your net profit or loss by subtracting total expenses from gross income, and transfer this amount to your Form 1040.

Legal use of the Schedule C Form

The Schedule C form is legally binding when completed accurately and submitted to the IRS. It is essential to ensure that all information provided is truthful and reflects actual business activities. Misrepresentation or inaccuracies can lead to penalties, audits, or legal repercussions. Utilizing electronic tools like signNow can enhance the legal standing of your Schedule C by ensuring secure and compliant eSignature processes, which are recognized under U.S. law.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C form, including detailed instructions on allowable deductions and reporting requirements. Taxpayers must adhere to these guidelines to ensure compliance and avoid potential audits. Key points include maintaining accurate records, understanding which expenses are deductible, and being aware of the implications of reporting a loss. The IRS also emphasizes the importance of filing the Schedule C by the tax deadline to avoid penalties.

Filing Deadlines / Important Dates

The filing deadline for the 2016 Schedule C form aligns with the general tax return deadline, which is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to file the Schedule C on time to avoid late fees and interest on any taxes owed. Taxpayers should also be aware of any extensions that may apply, allowing additional time to file without penalties.

Required Documents

To accurately complete the Schedule C form, several documents are required. These include records of all business income, such as invoices and bank statements, as well as receipts for business expenses. Additional documentation may include mileage logs for vehicle use, proof of home office expenses, and any relevant contracts or agreements. Keeping organized records simplifies the completion process and ensures compliance with IRS requirements.

Quick guide on how to complete schedule c form 2016

Complete Schedule C Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Schedule C Form across any platform with the airSlate SignNow Android or iOS applications and simplify your document-centric tasks today.

The easiest way to modify and eSign Schedule C Form without hassle

- Obtain Schedule C Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using airSlate SignNow's dedicated tools.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Schedule C Form to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c form 2016

Create this form in 5 minutes!

How to create an eSignature for the schedule c form 2016

How to generate an electronic signature for your Schedule C Form 2016 in the online mode

How to make an electronic signature for the Schedule C Form 2016 in Chrome

How to generate an electronic signature for signing the Schedule C Form 2016 in Gmail

How to create an eSignature for the Schedule C Form 2016 from your mobile device

How to create an eSignature for the Schedule C Form 2016 on iOS devices

How to generate an eSignature for the Schedule C Form 2016 on Android OS

People also ask

-

What is a Schedule C Form and who needs it?

The Schedule C Form is an essential tax document used by sole proprietors to report income and expenses from their business. If you're self-employed or a single-member LLC, you'll likely need to fill out and file this form with your personal tax return. Understanding the Schedule C Form is crucial for accurate tax reporting and maximizing your deductions.

-

How does airSlate SignNow help with filling out a Schedule C Form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign documents, including the Schedule C Form. With our user-friendly interface, you can complete all required fields quickly and accurately, ensuring you meet all IRS requirements without hassle.

-

Can I use airSlate SignNow for free to complete my Schedule C Form?

While airSlate SignNow offers a range of pricing plans, you can start with a free trial that allows you to explore the features available for completing your Schedule C Form. This trial gives you access to eSigning and document management tools without any upfront costs, making it easy to assess if our solution meets your needs.

-

What features does airSlate SignNow provide for managing my Schedule C Form?

airSlate SignNow offers several features to help you manage your Schedule C Form effectively, including eSigning, document templates, and secure storage. You can easily send your Schedule C Form for signatures, track the signing process, and store completed forms securely, ensuring peace of mind and compliance.

-

Is it easy to integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, making it easy to incorporate your Schedule C Form into your overall tax filing process. This integration ensures that your data is consistent and readily available across platforms, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for my Schedule C Form?

Using airSlate SignNow for your Schedule C Form offers numerous benefits, such as reduced paperwork, faster turnaround times, and enhanced security for your sensitive tax information. Our solution simplifies the eSigning process, allowing you to focus on your business rather than administrative tasks.

-

How can I ensure my Schedule C Form is filled out correctly using airSlate SignNow?

To ensure your Schedule C Form is filled out correctly, airSlate SignNow provides helpful tips and guidelines throughout the document completion process. Additionally, our platform allows you to collaborate with tax professionals who can review your form before submission, increasing accuracy and compliance.

Get more for Schedule C Form

Find out other Schedule C Form

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online