Schedule C Form 2009

What is the Schedule C Form

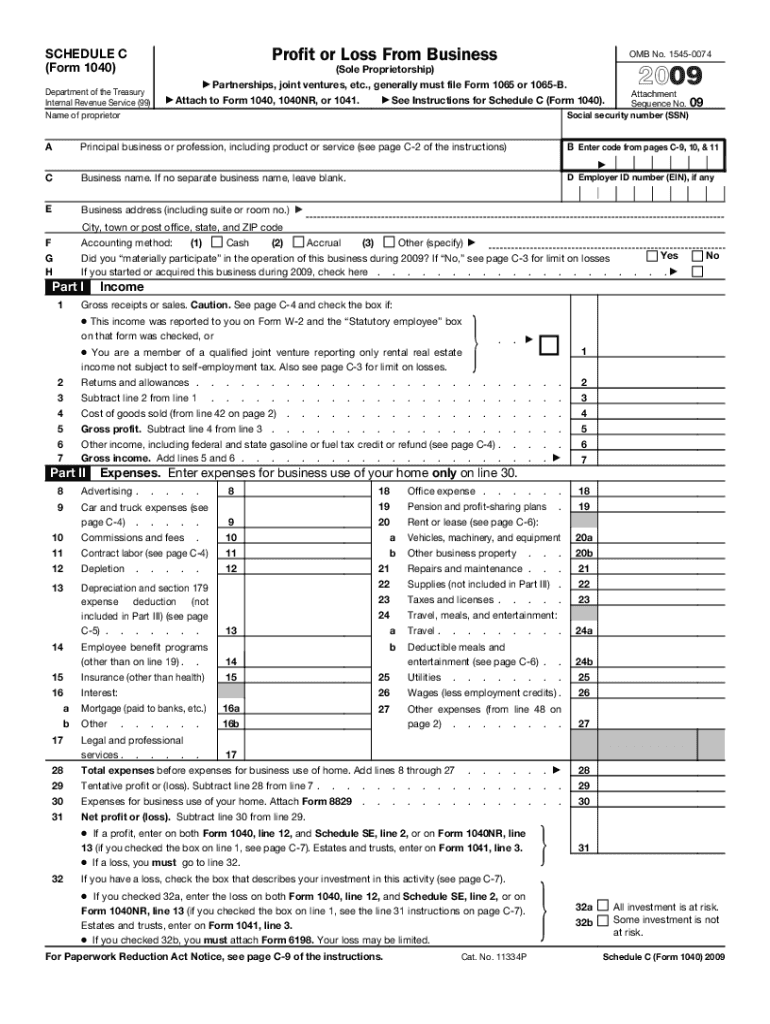

The Schedule C form, officially known as the 2009 Form 1040 Schedule C, is a tax document used by sole proprietors to report income or loss from their business activities. This form is essential for individuals who operate their own businesses and need to detail their earnings and expenses for tax purposes. By completing the Schedule C, taxpayers can calculate their net profit or loss, which is then transferred to their individual income tax return, Form 1040.

How to use the Schedule C Form

Using the Schedule C form involves several steps to accurately report business income and expenses. First, gather all relevant financial records, including sales receipts, invoices, and expense statements. Next, fill out the form by providing details about your business, such as its name, address, and the nature of the business. Report your gross receipts or sales, followed by allowable business expenses, which can include costs like advertising, utilities, and wages. Finally, calculate your net profit or loss, which will impact your overall tax liability.

Steps to complete the Schedule C Form

Completing the Schedule C form requires careful attention to detail. Here are the key steps to follow:

- Step 1: Enter your business name and address at the top of the form.

- Step 2: Indicate your business activity code, which corresponds to the type of business you operate.

- Step 3: Report your gross income from sales or services.

- Step 4: List all business expenses in the appropriate categories, such as cost of goods sold, rent, and utilities.

- Step 5: Calculate your net profit or loss by subtracting total expenses from total income.

- Step 6: Transfer the net profit or loss to your Form 1040.

Key elements of the Schedule C Form

The Schedule C form includes several key elements that are crucial for accurate reporting. These elements consist of:

- Business Information: Name, address, and type of business.

- Income Section: Total gross receipts or sales.

- Expense Categories: Detailed categories for reporting various business expenses.

- Net Profit or Loss Calculation: The final figure that affects your overall tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C form align with the overall tax return deadlines. Typically, the deadline for filing your individual tax return, including the Schedule C, is April 15 of the following year. If you require additional time, you may file for an extension, which generally provides an additional six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Legal use of the Schedule C Form

The Schedule C form is legally binding when completed accurately and submitted to the IRS. It is essential to ensure that all reported income and expenses are truthful and supported by documentation. Misreporting can lead to penalties, audits, or legal issues. Utilizing a reliable eSignature solution can enhance the legal validity of the form when submitting electronically, ensuring compliance with regulations and safeguarding against potential disputes.

Quick guide on how to complete 2009 schedule c form

Prepare Schedule C Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect sustainable alternative to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the instruments required to create, modify, and electronically sign your documents promptly without delays. Handle Schedule C Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to alter and electronically sign Schedule C Form without hassle

- Find Schedule C Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule C Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 schedule c form

Create this form in 5 minutes!

How to create an eSignature for the 2009 schedule c form

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is a Schedule C Form and why do I need it?

The Schedule C Form is a tax document used by sole proprietors to report income and expenses from their business. It's essential for accurately calculating your taxable income and ensuring compliance with IRS regulations. Using airSlate SignNow simplifies the process of completing and eSigning your Schedule C Form, making tax season more manageable.

-

How can airSlate SignNow help me with my Schedule C Form?

airSlate SignNow offers an intuitive platform to create, edit, and securely eSign your Schedule C Form. With its user-friendly interface, you can easily fill out all necessary sections and ensure your document is professionally formatted. This streamlines your tax preparation process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Schedule C Form?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs, including a cost-effective option for individuals and small businesses. These plans include features specifically designed to assist with forms like the Schedule C Form, ensuring you get great value for your investment. You can choose a plan that fits your usage and budget.

-

What features does airSlate SignNow offer for managing the Schedule C Form?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure electronic signatures for your Schedule C Form. These features enable you to customize your forms, track changes, and gather signatures efficiently, saving you time and effort during tax season.

-

Can I integrate airSlate SignNow with other software for my Schedule C Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for managing the Schedule C Form. By connecting your existing tools, you can easily import necessary data and streamline your document management process.

-

How secure is my information when using airSlate SignNow for my Schedule C Form?

Security is a top priority at airSlate SignNow. Your information, including your Schedule C Form, is protected with advanced encryption and secure cloud storage. This ensures that your sensitive data remains confidential and secure from unauthorized access.

-

Can I access my Schedule C Form from any device using airSlate SignNow?

Yes, airSlate SignNow is designed to be accessible from any device, whether it's a computer, tablet, or smartphone. This flexibility allows you to work on your Schedule C Form anytime and anywhere, making it easier to manage your tax documents on the go.

Get more for Schedule C Form

Find out other Schedule C Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors