Schedule C Form 2013

What is the Schedule C Form

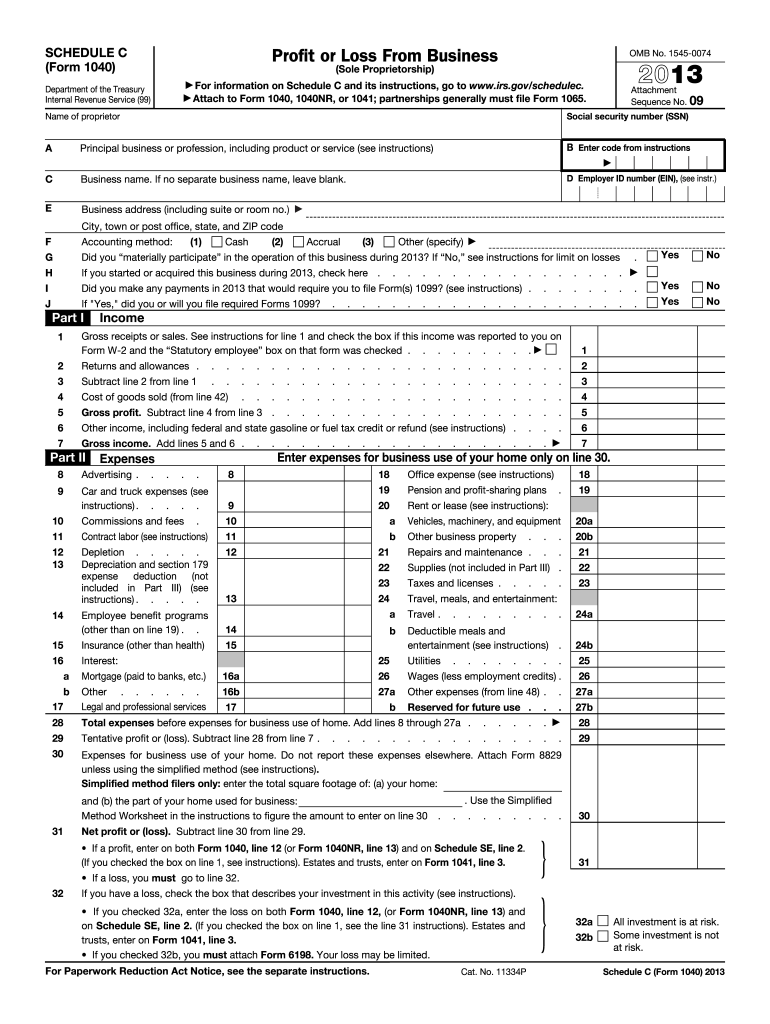

The Schedule C form, officially known as IRS Form 1040 Schedule C, is used by sole proprietors to report income and expenses related to their business. This form is essential for individuals who operate a business as a single entity and need to report their profits or losses to the IRS. It allows taxpayers to detail their business income, costs, and deductions, ultimately determining their net profit or loss for the tax year.

How to use the Schedule C Form

Using the Schedule C form involves several steps. First, gather all necessary financial documents, including income records and receipts for business expenses. Next, fill out the form by providing information about your business, such as its name, address, and type of business. Report your gross receipts, followed by various expenses like advertising, car and truck expenses, and other costs necessary for running your business. Finally, calculate your net profit or loss, which will be transferred to your Form 1040 when filing your taxes.

Steps to complete the Schedule C Form

Completing the Schedule C form requires careful attention to detail. Start by entering your business name and address at the top of the form. Then, in Part I, report your gross receipts or sales. In Part II, list your business expenses, categorizing them appropriately. Common expense categories include salaries and wages, rent, utilities, and supplies. After calculating your total expenses, subtract them from your gross receipts to determine your net profit or loss in Part III. Ensure all calculations are accurate, as this figure directly affects your overall tax liability.

Legal use of the Schedule C Form

The Schedule C form is legally binding, meaning the information provided must be accurate and truthful. Misreporting income or expenses can lead to penalties or audits by the IRS. It is crucial to maintain thorough records of all business transactions and retain supporting documents for at least three years after filing. Compliance with IRS guidelines ensures that your use of the Schedule C form is legitimate and protects you from potential legal issues.

Filing Deadlines / Important Dates

For most taxpayers, the deadline to file the Schedule C form coincides with the annual tax filing deadline, typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to tax laws or filing dates, as these can impact your submission timeline. Filing on time helps avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Schedule C form accurately, certain documents are necessary. These include records of all income earned from your business, receipts for expenses, bank statements, and any other relevant financial documents. Keeping organized records throughout the year simplifies the process of filling out the form and ensures that you have all the necessary information at hand when tax season arrives.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C form, which can be found in the instructions accompanying the form. These guidelines outline how to report income, what constitutes deductible expenses, and how to handle various business situations. Familiarizing yourself with these instructions is crucial for accurate reporting and compliance with tax laws.

Quick guide on how to complete schedule c 2013 form

Easily Prepare Schedule C Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the required template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Handle Schedule C Form on any device with airSlate SignNow mobile applications for Android or iOS and streamline any document-related process today.

Steps to Modify and eSign Schedule C Form Effortlessly

- Obtain Schedule C Form and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Select relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule C Form to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c 2013 form

Create this form in 5 minutes!

How to create an eSignature for the schedule c 2013 form

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is a Schedule C Form and why is it important?

The Schedule C Form is a crucial tax document used by sole proprietors to report income and expenses from their business. Filing this form accurately is essential for determining your taxable income and ensuring compliance with tax laws. By using airSlate SignNow, you can easily prepare and sign your Schedule C Form digitally, streamlining your tax filing process.

-

How can airSlate SignNow help me with my Schedule C Form?

airSlate SignNow simplifies the process of filling out your Schedule C Form by allowing you to eSign and send documents securely. Our platform supports the easy integration of tax documents, enabling you to manage and store your Schedule C Form efficiently. This means you can focus more on your business while staying organized with your tax filings.

-

Is airSlate SignNow affordable for small business owners needing to file a Schedule C Form?

Yes, airSlate SignNow offers a cost-effective solution for small business owners looking to file their Schedule C Form. With flexible pricing plans, you can choose the option that best fits your needs without breaking the bank. This affordability makes it easier for you to manage your business paperwork without added financial stress.

-

Can I integrate airSlate SignNow with other accounting software for my Schedule C Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easy to import and export your Schedule C Form data. This integration helps you maintain accurate financial records and facilitates a smooth transition between systems, enhancing your overall productivity.

-

What features does airSlate SignNow offer for managing my Schedule C Form?

airSlate SignNow provides a range of features designed to assist you with your Schedule C Form. You can create templates, set up automated workflows, and track document status, all of which simplify the signing and submission process. These features ensure that your tax documents are handled efficiently and securely.

-

Is it safe to use airSlate SignNow for my Schedule C Form?

Yes, airSlate SignNow prioritizes the security of your documents, including your Schedule C Form. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can confidently eSign and manage your tax documents knowing that they are secure.

-

What types of documents can I manage alongside my Schedule C Form on airSlate SignNow?

In addition to your Schedule C Form, airSlate SignNow allows you to manage a variety of documents such as contracts, agreements, and other tax-related forms. This versatility makes it a comprehensive solution for all your document needs, helping you stay organized and efficient year-round.

Get more for Schedule C Form

- How obtain duplicate copy of degree from grambling university form

- The family and medical leave act fmla siue form

- High school graduation self certification liberty university liberty form

- How do i apply for veterans benefits at university of umuc form

- Procurement operations business card order form csusm

- Fitchburg state university transcript request fitchburgstate form

- Notice of violation of the policy on equal opportunity harassment and form

- Threshold program parent questionaire2015doc form

Find out other Schedule C Form

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word