Wv State Tax Department Fiduciary Estate Tax Return Forms 2019

What is the Wv State Tax Department Fiduciary Estate Tax Return Forms

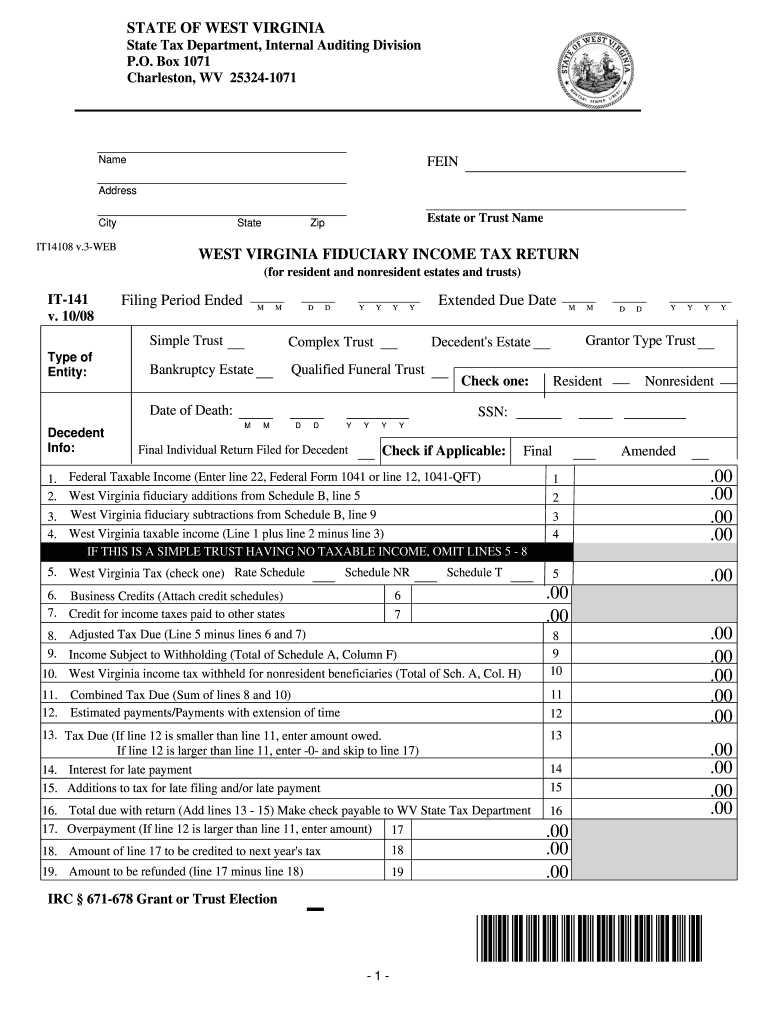

The Wv State Tax Department Fiduciary Estate Tax Return Forms are essential documents used for reporting the income, deductions, and credits of estates and trusts in West Virginia. These forms are required to ensure compliance with state tax laws and to facilitate the proper assessment of estate tax obligations. The fiduciary responsible for managing the estate must accurately complete these forms to reflect the financial activities of the estate during the tax year.

How to use the Wv State Tax Department Fiduciary Estate Tax Return Forms

Using the Wv State Tax Department Fiduciary Estate Tax Return Forms involves several steps. First, the fiduciary must gather all necessary financial information related to the estate, including income statements, deductions, and any applicable credits. Next, the forms should be filled out with accurate data, ensuring that all required fields are completed. Once the forms are filled, they must be reviewed for accuracy before submission to the appropriate tax authority.

Steps to complete the Wv State Tax Department Fiduciary Estate Tax Return Forms

Completing the Wv State Tax Department Fiduciary Estate Tax Return Forms involves the following steps:

- Collect all relevant financial documents, including income and expense records.

- Obtain the correct version of the fiduciary estate tax return forms from the West Virginia State Tax Department.

- Fill out the forms carefully, ensuring that all information is accurate and complete.

- Review the completed forms for any errors or omissions.

- Submit the forms by the designated deadline, either electronically or by mail.

Legal use of the Wv State Tax Department Fiduciary Estate Tax Return Forms

The legal use of the Wv State Tax Department Fiduciary Estate Tax Return Forms is crucial for ensuring compliance with state tax regulations. These forms must be completed accurately to avoid potential penalties or legal issues. When properly filled out and submitted, they serve as a formal declaration of the estate's financial activities and tax obligations, which can be critical in legal proceedings or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Wv State Tax Department Fiduciary Estate Tax Return Forms are typically set by the state tax authority. It is important for fiduciaries to be aware of these dates to ensure timely submission. Missing the deadline may result in penalties or interest charges on unpaid taxes. Generally, the forms are due within a specified period following the end of the tax year for the estate.

Required Documents

To complete the Wv State Tax Department Fiduciary Estate Tax Return Forms, several documents are required. These may include:

- Financial statements detailing income and expenses of the estate.

- Records of any deductions or credits applicable to the estate.

- Previous tax returns, if applicable, to provide context for the current filing.

- Any legal documents related to the estate, such as wills or trust agreements.

Form Submission Methods (Online / Mail / In-Person)

The Wv State Tax Department Fiduciary Estate Tax Return Forms can typically be submitted through various methods. Fiduciaries may choose to file the forms online through the West Virginia State Tax Department's website, which often provides a streamlined process. Alternatively, the forms can be mailed to the appropriate tax office or submitted in person, depending on the preferences and capabilities of the fiduciary. Each method has its own requirements and processing times, so it is advisable to choose the one that best suits the situation.

Quick guide on how to complete wv state tax department fiduciary estate tax return forms 2008

Complete Wv State Tax Department Fiduciary Estate Tax Return Forms easily on any device

Digital document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the suitable form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Wv State Tax Department Fiduciary Estate Tax Return Forms on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Steps to edit and eSign Wv State Tax Department Fiduciary Estate Tax Return Forms effortlessly

- Locate Wv State Tax Department Fiduciary Estate Tax Return Forms and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize key sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Wv State Tax Department Fiduciary Estate Tax Return Forms and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wv state tax department fiduciary estate tax return forms 2008

Create this form in 5 minutes!

How to create an eSignature for the wv state tax department fiduciary estate tax return forms 2008

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What are Wv State Tax Department Fiduciary Estate Tax Return Forms?

Wv State Tax Department Fiduciary Estate Tax Return Forms are necessary documents for reporting and managing estate taxes in West Virginia. These forms ensure that fiduciaries accurately report the income and assets of the decedent's estate, complying with state tax regulations. Understanding these forms is crucial for effective estate management.

-

How can airSlate SignNow help with Wv State Tax Department Fiduciary Estate Tax Return Forms?

airSlate SignNow streamlines the process of completing and eSigning Wv State Tax Department Fiduciary Estate Tax Return Forms. Our user-friendly platform allows for easy document sharing and collaboration, ensuring all relevant parties can review and sign documents effortlessly. This saves time and ensures compliance with state tax requirements.

-

Is there a cost associated with using airSlate SignNow for estate tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Whether you are a small firm or a large enterprise, you can choose a plan that suits your budget and frequency of use for Wv State Tax Department Fiduciary Estate Tax Return Forms. We also offer a free trial, allowing you to test our features before committing.

-

What features does airSlate SignNow offer for managing estate tax forms?

airSlate SignNow provides robust features for managing Wv State Tax Department Fiduciary Estate Tax Return Forms, including eSigning, document templates, and automatic reminders. These features ensure that documents are completed accurately and on time, reducing the chances of errors and penalties associated with delayed filings.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various tax management software and tools. This integration ensures that you can easily import and export Wv State Tax Department Fiduciary Estate Tax Return Forms, streamlining the workflow and making document management easier and more efficient.

-

What are the benefits of using airSlate SignNow for fiduciary estate tax filings?

Using airSlate SignNow for fiduciary estate tax filings provides numerous benefits, including enhanced efficiency, reduced paperwork, and quicker turnaround times for Wv State Tax Department Fiduciary Estate Tax Return Forms. Our platform helps minimize errors and ensures a smoother filing process, giving you peace of mind during tax season.

-

Are there any customer support options available for users of airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with any queries regarding Wv State Tax Department Fiduciary Estate Tax Return Forms. Our support team is available through various channels, including chat, email, and phone, ensuring you receive the help you need whenever you require assistance.

Get more for Wv State Tax Department Fiduciary Estate Tax Return Forms

- Cui when filled in form

- Inspector general action request da form 1559 apr

- Fin 357 request to close provincial sales tax account form

- Declaration of eligibility for a registration conc form

- Corporate request form for certificates of good standing and

- Task analysissafe work method statement form

- Dmv dc gov form

- License plates militarydepartment of revenue motor vehicle form

Find out other Wv State Tax Department Fiduciary Estate Tax Return Forms

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure