Form K 1 2019

What is the Form K-1

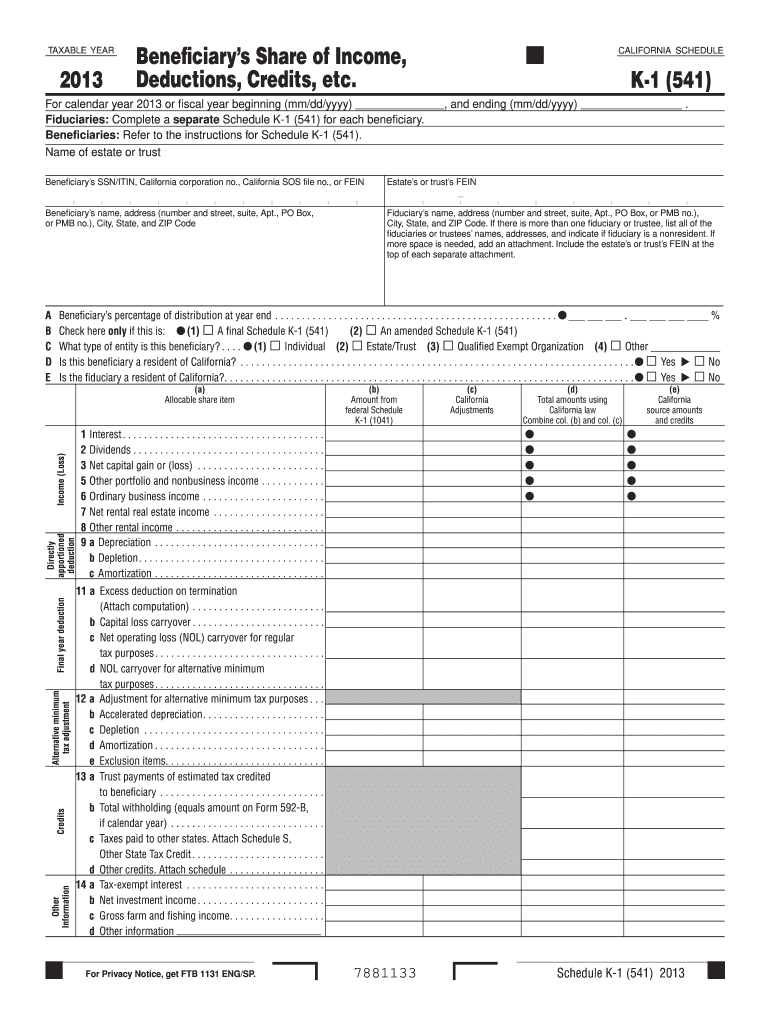

The Form K-1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. Each partner or shareholder receives a K-1, which details their share of the entity's income, losses, and other tax-related items. This form is essential for individuals to accurately report their income on their personal tax returns. The information provided on the K-1 is critical for ensuring compliance with IRS regulations and for determining the correct tax liability for each recipient.

How to use the Form K-1

To use the Form K-1, recipients must first review the information provided, which includes their share of income, deductions, and credits. This information should be transferred to the appropriate sections of the individual tax return, typically on Form 1040. It's important to ensure that the amounts reported on the K-1 match the recipient's records to avoid discrepancies. If there are any errors or questions regarding the information, the recipient should contact the issuer of the K-1 for clarification before filing their tax return.

Steps to complete the Form K-1

Completing the Form K-1 involves several key steps:

- Gather necessary information, including the partnership or corporation's details and the recipient's tax identification number.

- Fill out the entity's information at the top of the form, including the name, address, and tax identification number.

- Report the income, deductions, and credits allocated to each partner or shareholder in the designated sections of the form.

- Ensure all calculations are accurate and that the form is signed by an authorized representative of the entity.

- Distribute copies of the completed K-1 to each partner or shareholder by the deadline set by the IRS.

Legal use of the Form K-1

The legal use of the Form K-1 is governed by IRS regulations. It must be accurately completed and filed to ensure compliance with tax laws. Failure to provide correct information can lead to penalties for both the entity and the individual recipients. The K-1 serves as an official document that substantiates the income and deductions reported on individual tax returns, making it crucial for tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form K-1 vary depending on the type of entity. Generally, partnerships must provide K-1s to partners by March 15, while S corporations have the same deadline. It is essential for recipients to receive their K-1s in time to incorporate the information into their personal tax returns, which are typically due by April 15. Extensions may be available, but the K-1 must still be provided to partners and shareholders by the original deadline.

Examples of using the Form K-1

Examples of using the Form K-1 include reporting income from a partnership where an individual is a partner, receiving distributions from an S corporation, or reporting income from an estate or trust. For instance, if an individual is a partner in a business that earned $100,000 in profits, their K-1 would reflect their share of that profit, which they would then report on their tax return. Similarly, beneficiaries of a trust may receive a K-1 detailing the income distributed to them, which must be reported as taxable income.

Quick guide on how to complete 2013 form k 1

Complete Form K 1 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without interruptions. Manage Form K 1 on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

Efficiently edit and eSign Form K 1 with ease

- Locate Form K 1 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form K 1 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form k 1

Create this form in 5 minutes!

How to create an eSignature for the 2013 form k 1

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Form K 1, and how does it work with airSlate SignNow?

The Form K 1 is a tax document that reports income, deductions, and credits for partners and shareholders. With airSlate SignNow, you can easily send, receive, and eSign Form K 1, streamlining the process and ensuring compliance with tax regulations.

-

How can airSlate SignNow help in managing Form K 1 documentation?

airSlate SignNow offers a user-friendly platform for creating, sending, and tracking Form K 1 documents. This eliminates confusion and ensures that all necessary parties can provide signatures and reviews without delay.

-

What are the pricing options for using airSlate SignNow for Form K 1?

airSlate SignNow provides flexible pricing plans that cater to different business needs. Whether you're a small business or a large enterprise, you'll find a plan that allows you to eSign Form K 1 documents at an affordable cost, often with various user levels and features included.

-

What key features of airSlate SignNow make it suitable for Form K 1?

Key features of airSlate SignNow include easy eSignature capabilities, document tracking, and secure storage. These features help ensure that your Form K 1 documents are handled efficiently and securely, providing peace of mind during tax season.

-

Can I integrate airSlate SignNow with other software for managing Form K 1?

Yes, airSlate SignNow offers seamless integrations with various software solutions commonly used in accounting and tax preparation. This enables you to enhance your workflow when managing Form K 1, making it easier to gather information and share documents across platforms.

-

Is it secure to eSign Form K 1 with airSlate SignNow?

Absolutely! airSlate SignNow ensures the highest levels of security for eSigning Form K 1. With features like advanced encryption and compliance with industry standards, your sensitive tax documents are protected throughout the entire signing process.

-

What are the benefits of using airSlate SignNow for eSigning Form K 1?

Using airSlate SignNow for eSigning Form K 1 offers numerous benefits, including time savings, reduced paperwork, and increased efficiency. By electronically signing documents, you can expedite tax processes while maintaining compliance and accuracy.

Get more for Form K 1

Find out other Form K 1

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast