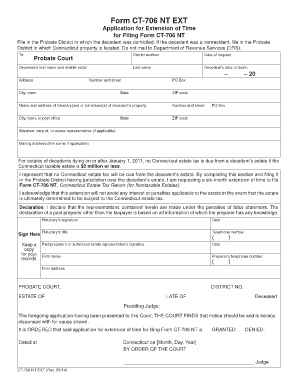

CT 706 709 EXT, Application for Estate and Gift Tax Return CT Gov 2020

What is the CT 706 709 EXT, Application For Estate And Gift Tax Return

The CT 706 709 EXT is a specific application form used for filing estate and gift tax returns in the state of Connecticut. This form allows individuals to request an extension of time to file their estate tax return or gift tax return. It is essential for taxpayers who need additional time beyond the standard filing deadline to prepare their documents accurately. Understanding this form is crucial for ensuring compliance with state tax regulations and avoiding potential penalties.

Steps to complete the CT 706 709 EXT, Application For Estate And Gift Tax Return

Completing the CT 706 709 EXT involves several important steps to ensure accuracy and compliance. First, gather all necessary information regarding the estate or gift, including asset valuations and any relevant documentation. Next, accurately fill out the form, ensuring all sections are completed. It is important to double-check for any errors or omissions. Once the form is completed, sign and date it. Finally, submit the form by the specified deadline to avoid any late penalties.

Required Documents for the CT 706 709 EXT, Application For Estate And Gift Tax Return

When filling out the CT 706 709 EXT, certain documents are required to support your application. These may include:

- Valuation documents for the estate or gift

- Previous tax returns related to the estate or gift

- Any relevant legal documents, such as wills or trust agreements

- Proof of payment for any taxes owed

Having these documents ready will facilitate a smoother application process and help ensure compliance with state requirements.

Filing Deadlines / Important Dates for the CT 706 709 EXT, Application For Estate And Gift Tax Return

It is crucial to be aware of the filing deadlines associated with the CT 706 709 EXT. Typically, the application must be submitted by the original due date of the estate or gift tax return. Extensions may be granted, but they must be requested before the deadline. Missing these deadlines can result in penalties and interest on any unpaid taxes. Always check the latest state regulations for any updates regarding due dates.

Legal use of the CT 706 709 EXT, Application For Estate And Gift Tax Return

The legal use of the CT 706 709 EXT is governed by Connecticut state tax laws. This form must be completed accurately and submitted in accordance with state regulations to be considered valid. The extension granted by this form allows taxpayers additional time to gather necessary information and prepare their returns without incurring penalties for late filing. It is essential to adhere to the legal requirements to ensure the extension is recognized by the state.

Digital vs. Paper Version of the CT 706 709 EXT, Application For Estate And Gift Tax Return

Taxpayers have the option to complete the CT 706 709 EXT in either digital or paper format. The digital version allows for easier completion and submission, often with built-in checks for errors. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that the form is filled out completely and accurately to avoid any issues with the filing process.

Quick guide on how to complete ct 706 709 ext application for estate and gift tax return ctgov

Complete CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov effortlessly across any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the essential tools needed to create, modify, and electronically sign your documents quickly without delays. Handle CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov on any platform using airSlate SignNow’s Android or iOS applications and enhance your document-centric processes today.

How to alter and eSign CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov with ease

- Locate CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant parts of your documents or obscure private information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Adjust and eSign CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov and guarantee seamless communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 706 709 ext application for estate and gift tax return ctgov

Create this form in 5 minutes!

How to create an eSignature for the ct 706 709 ext application for estate and gift tax return ctgov

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov?

The CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov, is a form used to report and pay estate and gift taxes in Connecticut. It allows individuals and businesses to comply with state laws regarding tax obligations related to estates and gifts. This form helps ensure accurate reporting and timely payment to avoid penalties.

-

How can airSlate SignNow help with the CT 706 709 EXT application process?

airSlate SignNow streamlines the CT 706 709 EXT application process by enabling users to fill out, sign, and send the document electronically. This simplifies the submission process, reduces paper usage, and ensures that forms are submitted accurately and on time. With our intuitive platform, you can manage all paperwork related to estate and gift tax efficiently.

-

What are the pricing options for using airSlate SignNow to handle CT 706 709 EXT forms?

airSlate SignNow offers various pricing plans tailored to different business needs, ensuring cost-effective solutions for the CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov. You can choose from monthly or annual subscriptions, with options that provide additional features and flexibility. Each plan is designed to deliver value while helping you manage and eSign your important documents.

-

Are there any specific features that support the CT 706 709 EXT application on airSlate SignNow?

Yes, airSlate SignNow offers features specifically tailored to support the CT 706 709 EXT application, including customizable templates, secure eSignature options, and advanced tracking for document status. These features ensure that your applications are accurate, compliant, and easily accessible. Additionally, you can invite team members to collaborate on the document with real-time updates.

-

What benefits does airSlate SignNow provide for submitting the CT 706 709 EXT application?

Using airSlate SignNow for the CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov, provides numerous benefits including enhanced efficiency, reduced turnaround time, and improved security. You can sign documents anytime and from anywhere, streamlining the submission process. This leads to greater compliance with tax regulations and peace of mind for your estate planning.

-

How does airSlate SignNow ensure the security of my CT 706 709 EXT documents?

AirSlate SignNow prioritizes document security by implementing advanced encryption standards and secure data storage for all files, including the CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov. Each transaction is protected with top-level encryption, ensuring that your sensitive tax information remains confidential and secure. Additionally, you can set access permissions to control who can view and edit your documents.

-

Can I integrate airSlate SignNow with other applications to manage the CT 706 709 EXT process?

Yes, airSlate SignNow seamlessly integrates with numerous applications such as CRM systems, cloud storage solutions, and productivity tools to manage the CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov. This integration capability enables a more efficient workflow by allowing you to access, manage, and send documents within the applications you already use. This ensures a smooth transition and helps streamline your operations.

Get more for CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov

- Kanban from the inside pdf form

- Stevenson protractor pdf form

- Proforma application for mutation

- Continuing education form template

- Api 1104 welder qualification form

- Apsr ffy south carolina department of social services form

- Dss form 1620 oct 16 dss form 1620 mar 11 qxd dss sc

- Dss form 2454 nov 09 qxd

Find out other CT 706 709 EXT, Application For Estate And Gift Tax Return CT gov

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online