Sc 1040 Form 2019

What is the Sc 1040 Form

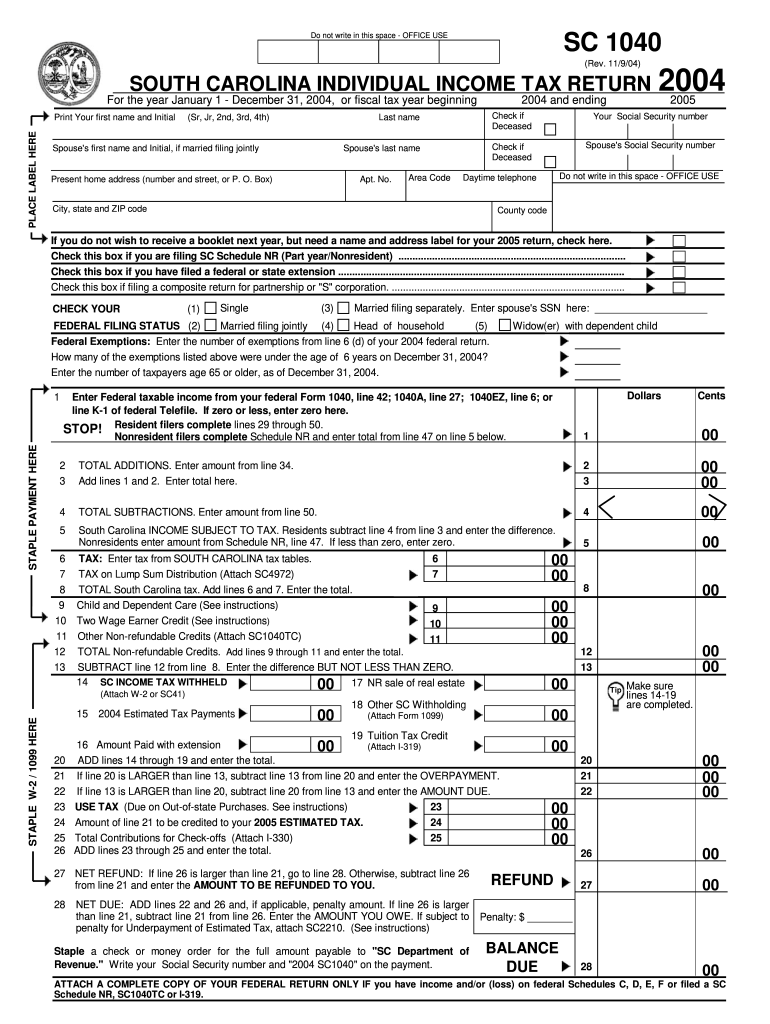

The Sc 1040 Form is a tax document used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form is essential for taxpayers to calculate their tax liability, claim deductions, and report credits. It is specifically designed for residents of South Carolina, allowing them to report state income tax in conjunction with their federal tax obligations. The Sc 1040 Form captures various types of income, including wages, dividends, and interest, ensuring that taxpayers comply with state tax laws.

How to use the Sc 1040 Form

Using the Sc 1040 Form involves several steps to ensure accurate reporting of your financial information. First, gather all necessary documents, such as W-2s, 1099s, and other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your income in the designated sections, and calculate your tax liability based on the provided instructions. Ensure to claim any eligible deductions or credits that apply to your situation. Finally, review the completed form for accuracy before submitting it to the IRS and your state tax authority.

Steps to complete the Sc 1040 Form

Completing the Sc 1040 Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill in your personal information accurately at the top of the form.

- Report your total income, including wages, interest, and dividends.

- Calculate your Adjusted Gross Income (AGI) by applying any adjustments.

- Claim deductions, either standard or itemized, depending on your eligibility.

- Determine your tax liability using the tax tables provided by the IRS.

- Complete the form by signing and dating it, ensuring all information is accurate.

Legal use of the Sc 1040 Form

The Sc 1040 Form is legally binding once it is signed and submitted. To ensure its legal validity, it must be filled out truthfully and accurately. Any discrepancies or false information can result in penalties or legal action by the IRS. Additionally, the form must be filed by the designated deadline to avoid late fees or interest on unpaid taxes. Utilizing digital platforms for completing and submitting the form can enhance security and compliance with eSignature laws, making the process more efficient.

Filing Deadlines / Important Dates

Filing deadlines for the Sc 1040 Form typically align with federal tax deadlines. Generally, taxpayers must submit their forms by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to be aware of any changes in deadlines or extensions that may apply, especially during extraordinary circumstances such as natural disasters or public health emergencies. Filing on time helps avoid penalties and interest on any owed taxes.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Sc 1040 Form through various methods, providing flexibility based on individual preferences. The form can be filed online using approved tax software, which often includes e-filing options for quicker processing. Alternatively, taxpayers may choose to print and mail the completed form to the appropriate IRS address. For those who prefer in-person submission, local IRS offices may accept forms directly, though this option may require an appointment. Each method has its own processing times and considerations, so it is advisable to choose the one that best suits your needs.

Required Documents

To complete the Sc 1040 Form accurately, several documents are necessary. These typically include:

- W-2 forms from employers, detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for any deductions or credits, such as mortgage interest statements or medical expenses.

- Previous year’s tax return for reference.

Having these documents ready will streamline the process and ensure that all income and deductions are reported correctly.

Quick guide on how to complete sc 1040 form 2004

Complete Sc 1040 Form effortlessly on any device

Digital document management has become favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents rapidly without delays. Manage Sc 1040 Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Sc 1040 Form with ease

- Obtain Sc 1040 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, through email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and eSign Sc 1040 Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 1040 form 2004

Create this form in 5 minutes!

How to create an eSignature for the sc 1040 form 2004

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the SC 1040 Form?

The SC 1040 Form is an essential tax document used for filing state income taxes in South Carolina. This form allows residents to report their income and calculate their tax liability. Completing the SC 1040 Form accurately ensures compliance and helps avoid potential penalties.

-

How can airSlate SignNow help with the SC 1040 Form?

airSlate SignNow simplifies the process of signing and sending the SC 1040 Form electronically. With our easy-to-use platform, you can securely eSign and share your tax documents, ensuring a smooth filing process. Our service is designed to reduce the hassle of paperwork, saving you time and effort.

-

What features does airSlate SignNow offer for the SC 1040 Form?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure document storage for the SC 1040 Form. These features help streamline the signing process and ensure that all documents are organized and easily accessible. You can also collaborate with multiple parties seamlessly.

-

Is airSlate SignNow cost-effective for handling the SC 1040 Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the SC 1040 Form and other documents. With affordable pricing plans, you can maximize your savings while ensuring efficient document handling. Our transparent pricing enables you to choose a plan that fits your budget and needs.

-

Can I integrate airSlate SignNow with other applications for the SC 1040 Form?

Absolutely! airSlate SignNow integrates with popular applications like Google Drive, Dropbox, and more, facilitating seamless access to your SC 1040 Form. This integration allows you to streamline your workflow by pulling in documents from various locations and sharing them effortlessly.

-

What security measures are in place for the SC 1040 Form in airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the SC 1040 Form. We implement robust encryption protocols and secure access controls to protect your information. You can trust us to keep your personal and financial details confidential.

-

How can I track the status of my SC 1040 Form with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your SC 1040 Form in real-time. Our platform provides detailed updates on document engagement, so you know when your form is viewed, signed, or completed. This feature enhances accountability and helps you manage deadlines effectively.

Get more for Sc 1040 Form

Find out other Sc 1040 Form

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy