Expenses for Business Use of Your Home RegInfo Gov 2020

What is the Expenses For Business Use Of Your Home RegInfo gov

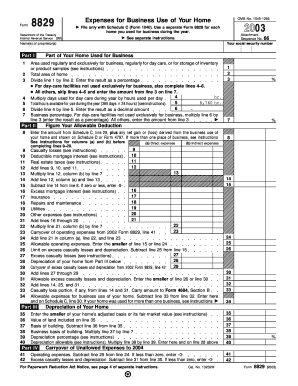

The Expenses For Business Use Of Your Home RegInfo gov form is a document that allows individuals who operate a business from their residence to claim certain expenses related to their home. This form is essential for self-employed individuals, freelancers, or anyone who conducts business activities from their home office. It enables taxpayers to deduct a portion of their home expenses, such as mortgage interest, utilities, and repairs, proportional to the space used for business purposes.

How to use the Expenses For Business Use Of Your Home RegInfo gov

To effectively use the Expenses For Business Use Of Your Home RegInfo gov form, individuals should first determine the percentage of their home that is used for business. This involves measuring the area of the home office and comparing it to the total area of the home. Once the percentage is established, taxpayers can calculate the allowable deductions based on this figure. It is important to maintain accurate records of all related expenses, as these will be necessary for completing the form and for potential audits.

Steps to complete the Expenses For Business Use Of Your Home RegInfo gov

Completing the Expenses For Business Use Of Your Home RegInfo gov form involves several key steps:

- Determine the square footage of your home office.

- Calculate the total square footage of your home.

- Establish the percentage of your home used for business.

- Gather documentation for all relevant expenses, including utilities, mortgage interest, and repairs.

- Fill out the form accurately, reflecting the calculated percentages and expenses.

- Review the completed form for accuracy before submission.

Legal use of the Expenses For Business Use Of Your Home RegInfo gov

The legal use of the Expenses For Business Use Of Your Home RegInfo gov form is governed by IRS regulations. To ensure compliance, taxpayers must meet specific criteria, such as using a designated area of their home exclusively for business activities. It is crucial to adhere to these legal requirements to avoid penalties or disallowed deductions. Additionally, maintaining thorough documentation of all expenses and the business use of the home is essential for substantiating claims made on the form.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Expenses For Business Use Of Your Home RegInfo gov form. Taxpayers should familiarize themselves with IRS Publication 587, which outlines the eligibility criteria, allowable expenses, and methods for calculating deductions. Understanding these guidelines helps ensure that individuals accurately report their expenses and maximize their potential deductions while remaining compliant with tax laws.

Eligibility Criteria

To qualify for deductions using the Expenses For Business Use Of Your Home RegInfo gov form, taxpayers must meet certain eligibility criteria. These include:

- Using a portion of the home exclusively for business purposes.

- Regularly using the home office for business activities.

- Meeting the IRS requirements for the home office deduction.

Understanding these criteria is vital for individuals aiming to utilize this form effectively and legally.

Quick guide on how to complete expenses for business use of your home reginfogov

Effortlessly Prepare Expenses For Business Use Of Your Home RegInfo gov on Any Device

Digital document handling has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without any hold-ups. Manage Expenses For Business Use Of Your Home RegInfo gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Edit and eSign Expenses For Business Use Of Your Home RegInfo gov with Ease

- Find Expenses For Business Use Of Your Home RegInfo gov and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Expenses For Business Use Of Your Home RegInfo gov and ensure effective communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct expenses for business use of your home reginfogov

Create this form in 5 minutes!

How to create an eSignature for the expenses for business use of your home reginfogov

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What are the key benefits of using airSlate SignNow for managing Expenses For Business Use Of Your Home RegInfo gov?

Using airSlate SignNow allows businesses to efficiently handle documentation related to Expenses For Business Use Of Your Home RegInfo gov. The platform streamlines the eSigning process, reducing paperwork and time spent on manually signing documents. Additionally, it is cost-effective and user-friendly, making it accessible for businesses of all sizes.

-

How does airSlate SignNow ensure compliance with Expenses For Business Use Of Your Home RegInfo gov regulations?

airSlate SignNow complies with industry standards and regulations, including those related to Expenses For Business Use Of Your Home RegInfo gov. Our platform provides templates and tools that help users maintain compliance while handling their documentation. This ensures that your business operations meet legal requirements and best practices.

-

What are the pricing options available for airSlate SignNow, particularly for managing Expenses For Business Use Of Your Home RegInfo gov?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those related to Expenses For Business Use Of Your Home RegInfo gov. Users can choose from various subscription models, ensuring they only pay for the features they need. All plans come with a free trial to explore the platform's capabilities at no initial cost.

-

Can I integrate airSlate SignNow with other tools to manage Expenses For Business Use Of Your Home RegInfo gov documentation?

Yes, airSlate SignNow seamlessly integrates with various popular tools and applications, enhancing your ability to manage Expenses For Business Use Of Your Home RegInfo gov documentation. This includes integrations with platforms for accounting, project management, and file storage. Streamlining your workflow is easy with our adaptable integration options.

-

Is airSlate SignNow user-friendly for individuals handling Expenses For Business Use Of Your Home RegInfo gov?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible even for those new to digital document management. Its intuitive interface helps users quickly navigate through the eSigning process related to Expenses For Business Use Of Your Home RegInfo gov, ensuring a smooth experience without a steep learning curve.

-

What features does airSlate SignNow offer for efficiently managing Expenses For Business Use Of Your Home RegInfo gov?

airSlate SignNow provides comprehensive features tailored for managing Expenses For Business Use Of Your Home RegInfo gov documentation. Key features include customizable templates, automated workflows, and secure eSigning capabilities. These tools enhance productivity and ensure that all your documentation is completed accurately and efficiently.

-

How does airSlate SignNow help in tracking Expenses For Business Use Of Your Home RegInfo gov?

With airSlate SignNow, you can easily track and manage Expenses For Business Use Of Your Home RegInfo gov through detailed audit trails. The platform records all actions taken on your documents, providing transparency and accountability. This helps businesses maintain accurate records for tax purposes and compliance.

Get more for Expenses For Business Use Of Your Home RegInfo gov

- Wv dmv irp form

- Cit 0407 october 272017 form

- Kelly j bryant memorial scholarship application university of extension arizona form

- Application access form

- The harm hamilton anatomy of risk management tool form

- Transmittal of tax returns reported on magnetic media ok form

- Lease input form

- University of south carolina mph admissions details 2014 2015 management ind form

Find out other Expenses For Business Use Of Your Home RegInfo gov

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later