Instructions for Form 2441 Internal Revenue Service 2021

What is form 2441?

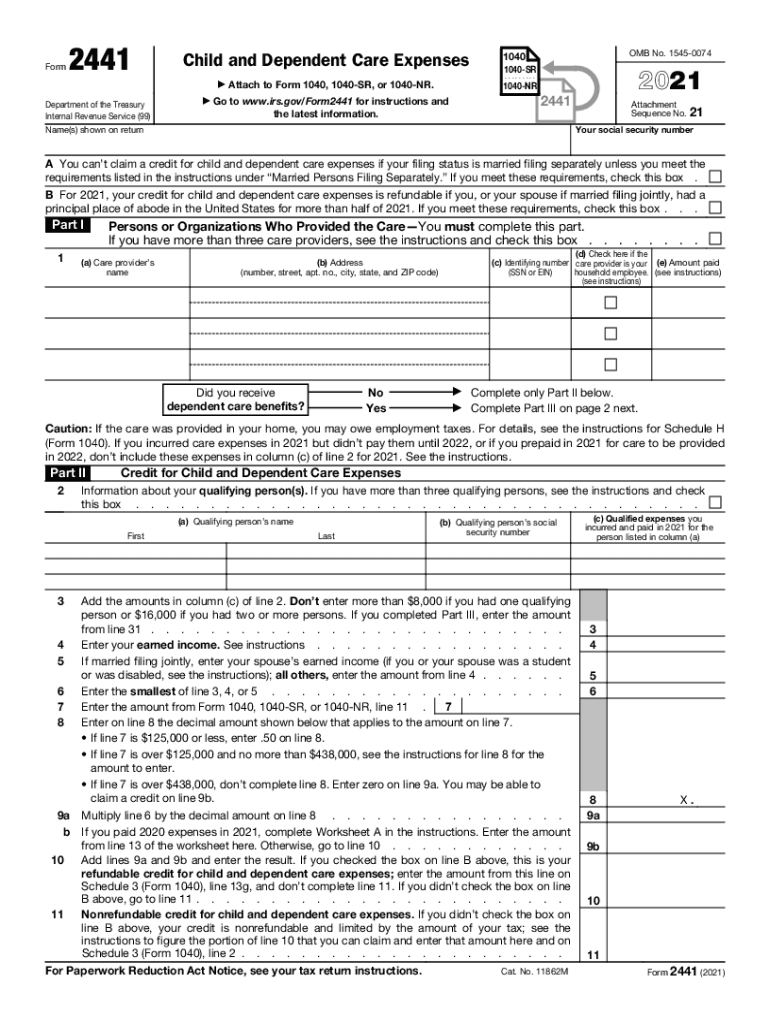

The IRS Form 2441, also known as the Child and Dependent Care Expenses form, is used by taxpayers to claim a credit for child and dependent care expenses incurred while they work or look for work. This form helps individuals and families offset the costs of care for their dependents, which can include children under the age of thirteen or a spouse or dependent who is physically or mentally incapable of self-care. Understanding this form is essential for eligible taxpayers to ensure they receive the appropriate credits on their tax returns.

Key elements of form 2441

When completing the IRS Form 2441, several key elements must be considered:

- Qualified Expenses: These are the costs incurred for care services, which may include daycare, after-school programs, or care provided by a babysitter.

- Eligibility Criteria: To qualify for the credit, the taxpayer must meet specific income thresholds and have incurred expenses while working or actively seeking employment.

- Dependent Information: Accurate details about the dependents receiving care are required, including their names, Social Security numbers, and ages.

- Care Provider Information: Taxpayers must provide details about the care provider, including their name, address, and taxpayer identification number.

Steps to complete form 2441

Completing the IRS Form 2441 involves several steps:

- Gather necessary documentation, including receipts for care expenses and information about the care provider.

- Fill out the personal information section, including your name, Social Security number, and filing status.

- Detail your qualified expenses, ensuring that they align with eligibility requirements.

- Provide information about your dependents and the care providers.

- Calculate the credit based on the provided expenses and follow the instructions for submission.

Filing deadlines for form 2441

The IRS Form 2441 must be filed with your annual tax return, which is typically due on April fifteenth of each year. If you need additional time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is crucial to keep track of these dates to ensure timely filing and avoid any issues with your tax return.

Form submission methods

Taxpayers can submit the IRS Form 2441 in several ways:

- Online: Many tax preparation software programs allow for electronic filing of Form 2441 along with your federal tax return.

- Mail: You can print the completed form and mail it to the appropriate IRS address based on your state of residence.

- In-Person: Some taxpayers may choose to file their forms in person at designated IRS offices, although this is less common.

Penalties for non-compliance

Failing to accurately complete and submit the IRS Form 2441 can result in penalties. If the IRS determines that you have claimed expenses improperly or failed to file the form when required, you may face fines or additional taxes owed. It is essential to ensure that all information is correct and that you meet the eligibility requirements to avoid these potential penalties.

Quick guide on how to complete 2019 instructions for form 2441 internal revenue service

Complete Instructions For Form 2441 Internal Revenue Service effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Instructions For Form 2441 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Instructions For Form 2441 Internal Revenue Service without any hassle

- Find Instructions For Form 2441 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Choose your delivery method for the form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Instructions For Form 2441 Internal Revenue Service to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 instructions for form 2441 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 2441 internal revenue service

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is form 2441 and how can airSlate SignNow help?

Form 2441 is used for claiming the child and dependent care expenses credit. With airSlate SignNow, you can easily fill, sign, and send this form electronically, making the process smooth and efficient.

-

How do I fill out form 2441 using airSlate SignNow?

To fill out form 2441 with airSlate SignNow, simply upload the form to our platform, use our intuitive editing tools to enter your information, and then save your changes. The user-friendly interface ensures that you can complete the form quickly and accurately.

-

Is there a cost associated with using airSlate SignNow to manage form 2441?

airSlate SignNow offers a variety of pricing plans, making it a cost-effective solution for managing form 2441. Depending on your needs, you can choose from several tiers that provide access to essential features at affordable rates.

-

What features does airSlate SignNow provide for form 2441?

airSlate SignNow provides features like document templates, eSigning, and cloud storage for managing form 2441. These features make it easy to streamline your workflow and ensure your documents are always accessible.

-

Can I track the status of my form 2441 submission with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 2441 submission in real-time. You will receive notifications when your form is opened, signed, or completed, providing you peace of mind.

-

Does airSlate SignNow integrate with other applications for handling form 2441?

Absolutely! airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and other cloud services, allowing you to seamlessly manage form 2441 alongside your other business documents.

-

What security measures does airSlate SignNow implement for form 2441?

airSlate SignNow takes security seriously with robust measures in place to protect your form 2441 and other data. Our platform uses end-to-end encryption and complies with regulations to ensure your information remains secure and confidential.

Get more for Instructions For Form 2441 Internal Revenue Service

- Inventory form court

- Physicians affidavit guardianship delaware form

- Proof of compliance delaware form

- Subpoena delaware form

- Waiver notice consent form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy delaware form

- Warranty deed for parents to child with reservation of life estate delaware form

- Warranty deed for separate or joint property to joint tenancy delaware form

Find out other Instructions For Form 2441 Internal Revenue Service

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement