2441 Form 2010

What is the 2441 Form

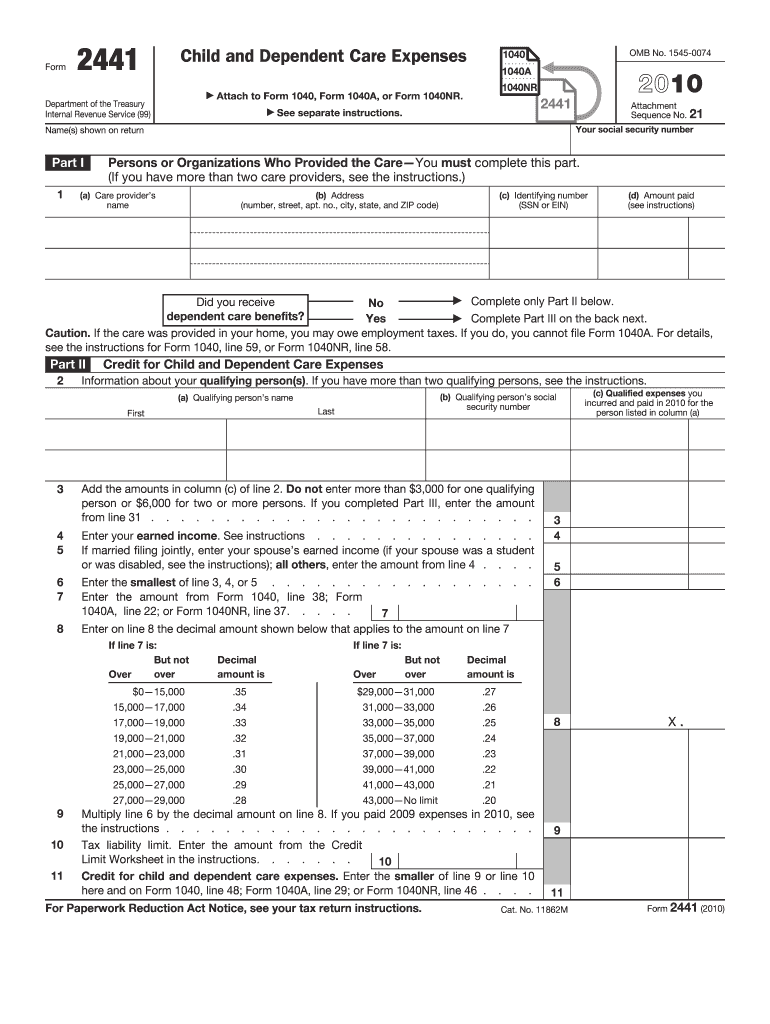

The 2441 Form, officially known as the Child and Dependent Care Expenses form, is utilized by taxpayers in the United States to claim credits for expenses incurred while caring for children or dependents. This form is particularly relevant for families seeking financial assistance for childcare services that enable them to work or look for work. The form allows taxpayers to report eligible expenses and calculate the tax credit they may receive, which can significantly reduce their overall tax liability.

How to use the 2441 Form

To effectively use the 2441 Form, taxpayers must first gather necessary information regarding their dependents and the childcare expenses incurred. This includes the names, addresses, and taxpayer identification numbers of the care providers, as well as the total amount spent on care. After filling out the form, it should be attached to the taxpayer's federal income tax return. Careful attention must be paid to ensure all information is accurate to avoid delays or issues with the IRS.

Steps to complete the 2441 Form

Completing the 2441 Form involves several key steps:

- Gather necessary documentation, including receipts and provider information.

- Fill out personal information, including your name and Social Security number.

- List the dependents for whom care expenses were incurred.

- Provide details about the care providers, including their names and addresses.

- Calculate the total care expenses and enter the amounts in the appropriate sections.

- Review the completed form for accuracy before submission.

Legal use of the 2441 Form

The 2441 Form is legally recognized for claiming tax credits related to childcare expenses. It is essential for taxpayers to ensure that all reported expenses meet IRS guidelines for eligibility. This includes using licensed care providers and maintaining proper documentation of expenses. Failure to comply with these regulations can lead to penalties or disqualification from receiving the tax credit.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the 2441 Form. Typically, the deadline for submitting the form coincides with the federal income tax return deadline, which is usually April 15. However, if taxpayers file for an extension, they may have additional time to submit their forms. It is crucial to stay informed about any changes to deadlines, as they can vary from year to year.

Required Documents

When completing the 2441 Form, certain documents are required to substantiate claims. Taxpayers should have:

- Receipts or invoices from childcare providers.

- Tax identification numbers for all care providers.

- Proof of employment or job search activities, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Quick guide on how to complete 2441 2010 form

Complete 2441 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, adjust, and eSign your documents swiftly without any hold-ups. Manage 2441 Form on any platform via airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign 2441 Form with ease

- Obtain 2441 Form and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using airSlate SignNow's specialized tools designed for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign 2441 Form to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2441 2010 form

Create this form in 5 minutes!

How to create an eSignature for the 2441 2010 form

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the 2441 Form and how is it used?

The 2441 Form is a tax document used to claim the Child and Dependent Care Expenses Credit. This form is essential for parents and caregivers who wish to receive tax benefits for expenses incurred while caring for qualifying dependents. Using airSlate SignNow, you can easily fill, sign, and send your 2441 Form electronically.

-

How can airSlate SignNow help me with the 2441 Form?

airSlate SignNow simplifies the process of completing and submitting the 2441 Form by providing a user-friendly platform for electronic signatures and document management. You can fill out the form, sign it securely, and send it directly to the IRS or your tax professional, streamlining your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the 2441 Form?

While airSlate SignNow offers various pricing plans, using the platform for signing and managing the 2441 Form can be very cost-effective. The platform provides different subscription levels to cater to businesses of all sizes, ensuring you get the features you need without overspending.

-

What features does airSlate SignNow offer for the 2441 Form?

airSlate SignNow includes features such as customizable templates, secure e-signatures, and document sharing capabilities to facilitate your handling of the 2441 Form. These features enhance efficiency and allow for a seamless signing experience, making tax documentation stress-free.

-

Can I integrate airSlate SignNow with other applications for my 2441 Form?

Yes, airSlate SignNow offers integrations with various applications, such as Google Drive, Dropbox, and cloud storage services, which can be incredibly useful for managing your 2441 Form. This connectivity allows you to streamline your workflow and access documents from multiple platforms, enhancing productivity.

-

What benefits can I expect from using airSlate SignNow for the 2441 Form?

By using airSlate SignNow for your 2441 Form, you can expect benefits such as increased efficiency, enhanced security, and a paperless workflow. These advantages help reduce the time spent on paperwork and ensure your forms are submitted accurately and on time.

-

How secure is airSlate SignNow for handling the 2441 Form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and compliance with industry standards to ensure that your 2441 Form and all sensitive information are protected throughout the signing process, giving you peace of mind.

Get more for 2441 Form

- Voluntary disclosure agreement for use tax and form

- Classification and compensation denvergov form

- Commercial water meter sizing form colorado springs

- Volleyball tournament form pdf

- Business questionnaire business questionnaire form

- To denver city council from brandon shaver senior city form

- Certificate of taxes due for business personal property and form

- Hireright criminal history georgia release form

Find out other 2441 Form

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online