Form 2441 Child and Dependent Care Expenses 2024-2026

What is the Form 2441 Child And Dependent Care Expenses

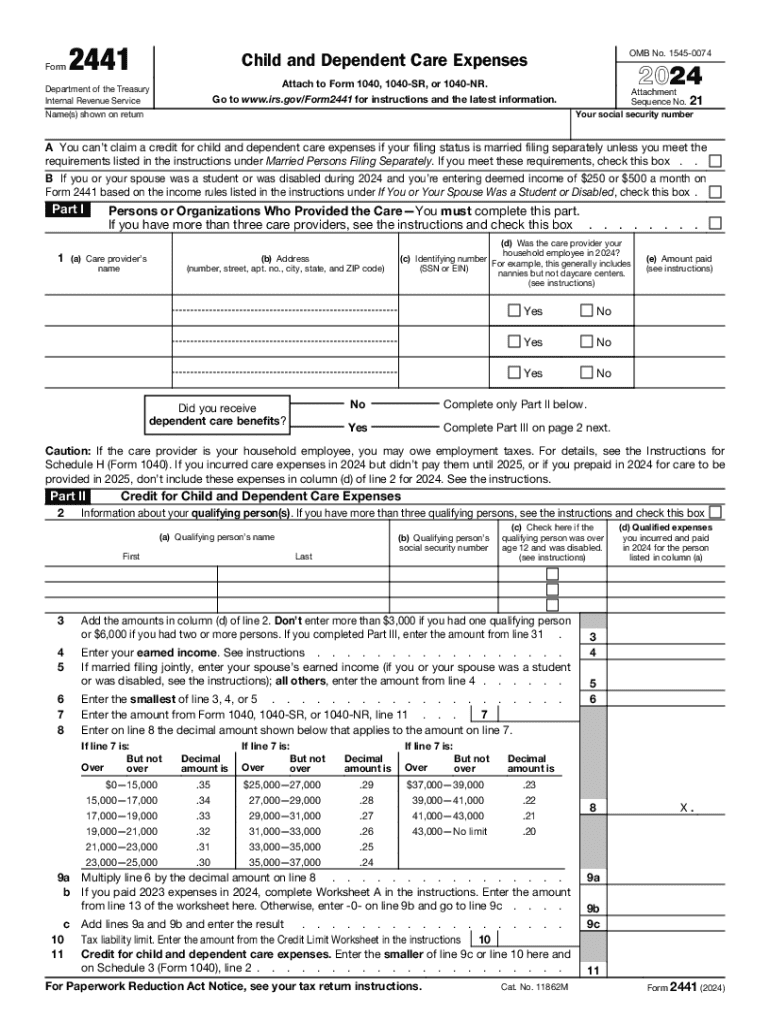

The Form 2441 is a tax document used by U.S. taxpayers to claim child and dependent care expenses. This form allows individuals to report expenses incurred for the care of qualifying children under the age of thirteen or dependents who are physically or mentally incapable of self-care. By completing this form, taxpayers can potentially reduce their tax liability through a credit based on the amount spent on care services. Understanding the purpose and requirements of Form 2441 is essential for maximizing available tax benefits.

How to use the Form 2441 Child And Dependent Care Expenses

Using Form 2441 involves several steps to ensure accurate reporting of child and dependent care expenses. First, gather all relevant information, including the names and Social Security numbers of the qualifying individuals, as well as the details of the care providers. Next, complete the form by entering the total amount spent on care services in the appropriate sections. Ensure that you follow the instructions provided by the IRS to avoid errors. Once completed, attach the form to your tax return and submit it to the IRS.

Steps to complete the Form 2441 Child And Dependent Care Expenses

Completing Form 2441 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including receipts from care providers and Social Security numbers of dependents.

- Fill out Part I of the form, which includes information about the care providers and the total expenses incurred.

- Complete Part II, where you calculate the credit based on your adjusted gross income and the amount spent on care.

- Review the form for accuracy, ensuring all information is correctly entered.

- Attach the completed Form 2441 to your tax return before submission.

Eligibility Criteria

To qualify for the child and dependent care expenses credit, certain eligibility criteria must be met. The care must be provided for a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care. Additionally, the care must enable the taxpayer to work or look for work. The taxpayer must also have earned income, and the care expenses must be incurred for services provided to the qualifying individual. Understanding these criteria is crucial for determining eligibility for the credit.

Filing Deadlines / Important Dates

Filing deadlines for Form 2441 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as natural disasters or government directives. Keeping track of these dates ensures timely submission and avoids penalties for late filing.

Required Documents

When completing Form 2441, several documents are necessary to support the reported expenses. These may include:

- Receipts or invoices from care providers detailing the services rendered.

- Social Security numbers of the qualifying children or dependents.

- Documentation proving the taxpayer's earned income, such as W-2 forms or pay stubs.

Having these documents ready helps streamline the process of filling out the form and ensures compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 2441. Taxpayers should refer to the IRS instructions for detailed information on eligibility, allowable expenses, and how to calculate the credit. It is important to stay updated on any changes to the guidelines each tax year, as these can affect the filing process and the potential credit amount. Adhering to IRS guidelines helps ensure a smooth filing experience and maximizes potential tax benefits.

Create this form in 5 minutes or less

Find and fill out the correct form 2441 child and dependent care expenses

Create this form in 5 minutes!

How to create an eSignature for the form 2441 child and dependent care expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it show care for its users?

airSlate SignNow is a powerful eSignature solution designed to simplify document management. It shows care for its users by providing an intuitive interface that makes sending and signing documents easy and efficient. With a focus on user experience, airSlate SignNow ensures that businesses can manage their documents without unnecessary complications.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority for airSlate SignNow, demonstrating care for your sensitive information. The platform employs advanced encryption protocols and complies with industry standards to protect your documents. This commitment to security gives users peace of mind when managing important documents.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers flexible pricing plans to cater to different business needs, showing care for organizations of all sizes. Whether you are a small business or a large enterprise, you can find a plan that fits your budget. Each plan includes essential features to help streamline your document workflows.

-

What features does airSlate SignNow provide to enhance document management?

airSlate SignNow includes a variety of features designed to enhance document management, reflecting its care for user efficiency. Key features include customizable templates, automated workflows, and real-time tracking of document status. These tools help businesses save time and reduce errors in their document processes.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow offers seamless integrations with popular software applications, demonstrating care for your existing workflows. This allows users to connect their favorite tools, such as CRM systems and cloud storage services, for a more streamlined experience. Integrations help businesses maximize their productivity.

-

How does airSlate SignNow improve collaboration among team members?

airSlate SignNow enhances collaboration by allowing multiple users to work on documents simultaneously, showing care for teamwork. Features like shared templates and comment sections enable team members to communicate effectively during the signing process. This collaborative approach helps ensure that everyone is on the same page.

-

What benefits can businesses expect from using airSlate SignNow?

Businesses can expect numerous benefits from using airSlate SignNow, including increased efficiency and reduced turnaround times, which reflect the platform's care for productivity. By digitizing the signing process, companies can eliminate delays associated with traditional methods. This leads to faster decision-making and improved customer satisfaction.

Get more for Form 2441 Child And Dependent Care Expenses

Find out other Form 2441 Child And Dependent Care Expenses

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease