Form 2441 2023

What is the Form 2441

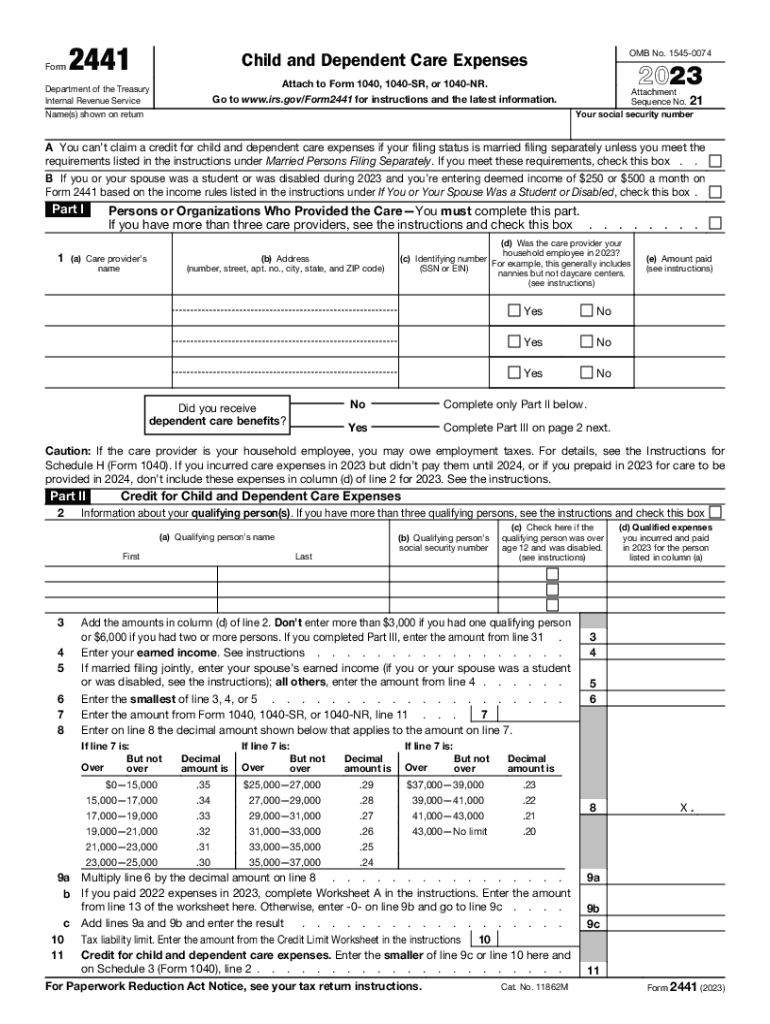

The Form 2441, officially known as the Child and Dependent Care Expenses form, is utilized by taxpayers in the United States to claim the Child and Dependent Care Credit. This credit is designed to assist families with the costs associated with caring for children under the age of thirteen or for dependents who are physically or mentally incapable of self-care. The form allows taxpayers to report the amount of care expenses incurred, which can significantly reduce their overall tax liability.

How to use the Form 2441

To effectively use the Form 2441, taxpayers must first determine their eligibility for the Child and Dependent Care Credit. This involves identifying qualifying care expenses and ensuring that the care provider meets IRS requirements. Once eligibility is confirmed, individuals can fill out the form by entering relevant information, including the care provider's details and the total amount spent on care. The completed form is then submitted with the taxpayer's annual tax return to claim the credit.

Steps to complete the Form 2441

Completing the Form 2441 involves several key steps:

- Gather necessary information about your dependents and care providers.

- Determine the total amount spent on qualifying care expenses.

- Complete the form by filling in the required fields, including your personal information and details about the care provided.

- Calculate the credit amount based on your income and the expenses reported.

- Attach the completed form to your tax return before submission.

Eligibility Criteria

To qualify for the Child and Dependent Care Credit using Form 2441, taxpayers must meet specific eligibility criteria. The primary requirements include:

- The taxpayer must have incurred expenses for the care of a qualifying child under the age of thirteen or a qualifying dependent.

- Both parents must be working or attending school full-time if married and filing jointly.

- The care provider must not be a relative of the taxpayer, unless they are over the age of nineteen.

Required Documents

When filling out the Form 2441, taxpayers should have several documents on hand to support their claims. These documents include:

- Receipts or invoices for child and dependent care expenses.

- The care provider's name, address, and taxpayer identification number (TIN).

- Proof of employment or school attendance for both parents, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 2441, including instructions on how to fill it out and what expenses qualify. Taxpayers should refer to the latest IRS publications and instructions to ensure compliance with current tax laws. It is essential to stay updated on any changes to the form or eligibility requirements to maximize the benefits of the Child and Dependent Care Credit.

Quick guide on how to complete form 2441

Effortlessly prepare Form 2441 on any device

Digital document management has become increasingly favored among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 2441 on any platform using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The simplest way to modify and electronically sign Form 2441 with ease

- Locate Form 2441 and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 2441 to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2441

Create this form in 5 minutes!

How to create an eSignature for the form 2441

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2441 and how can airSlate SignNow help with it?

Form 2441 is used to report the child and dependent care expenses that qualify for the Child and Dependent Care Tax Credit. airSlate SignNow simplifies the process of filling out Form 2441 by allowing users to easily eSign and share the document, ensuring it is completed accurately and submitted on time.

-

Is airSlate SignNow a cost-effective solution for managing Form 2441?

Yes, airSlate SignNow offers a cost-effective solution tailored for businesses needing to manage Form 2441 and other essential documents. Our competitive pricing plans provide features that streamline document management, including eSigning and secure storage options.

-

What features does airSlate SignNow provide for Form 2441 handling?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time collaboration, making it easy to manage Form 2441 efficiently. Users can also track the document’s status and get notifications when actions are taken, enhancing the overall workflow.

-

How does airSlate SignNow ensure the security of my Form 2441 documents?

The security of your Form 2441 documents is a top priority at airSlate SignNow. We implement advanced encryption, secure cloud storage, and compliance with industry standards to protect sensitive information and ensure that your documents are safe from unauthorized access.

-

Can I integrate airSlate SignNow with other software for Form 2441 processing?

Absolutely! airSlate SignNow offers integrations with various platforms, including Google Workspace, Salesforce, and more, to streamline your Form 2441 processing. These integrations help enhance productivity and ensure a seamless workflow across your tools.

-

What are the benefits of using airSlate SignNow for Form 2441?

Using airSlate SignNow for Form 2441 offers several benefits, including faster document turnaround times, reduced paper usage, and improved accuracy in filling out forms. The platform also allows you to manage all your documents in one place, enhancing your organizational efficiency.

-

Is there a trial period available for using airSlate SignNow with Form 2441?

Yes, airSlate SignNow provides a free trial period that allows you to explore its features for managing Form 2441 without any commitment. This trial enables you to evaluate how well the solution meets your needs before making a financial investment.

Get more for Form 2441

Find out other Form 2441

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT