About Form 2441, Child and Dependent Care ExpensesAbout Form 2441, Child and Dependent Care Expenses2021 Form 2441 IRS Tax Forms 2022

Understanding Form 2441: Child and Dependent Care Expenses

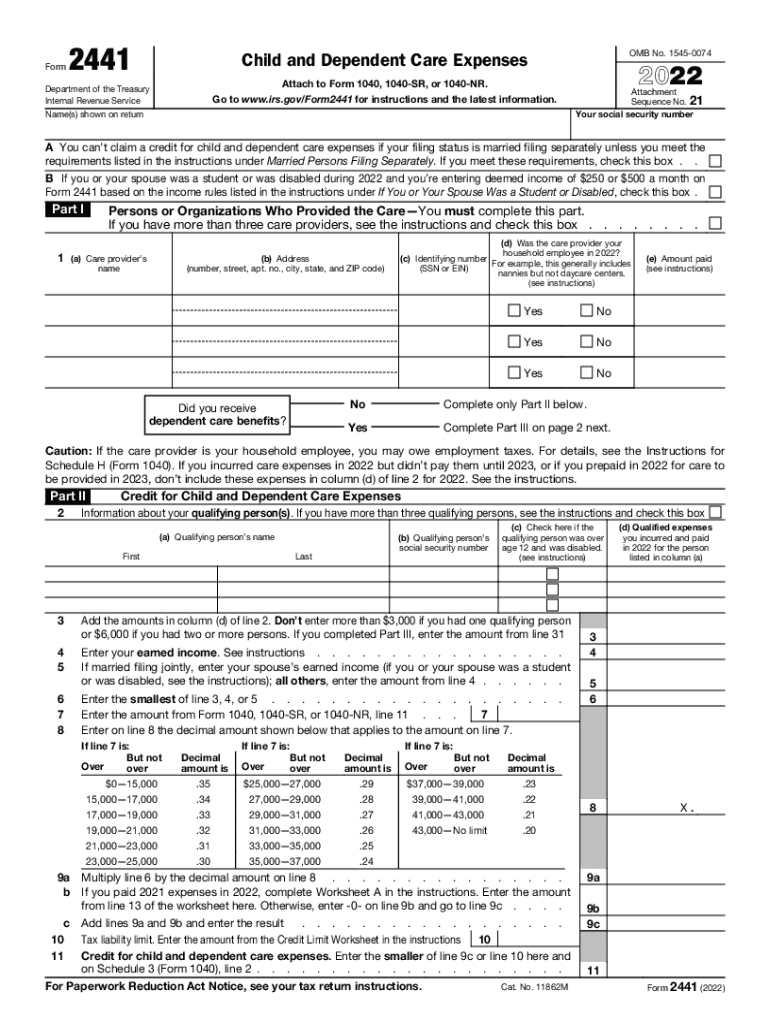

Form 2441 is essential for taxpayers seeking to claim the Child and Dependent Care Credit. This IRS form allows individuals to report expenses incurred for the care of qualifying children or dependents while they work or look for work. The credit can significantly reduce tax liability, making it a valuable resource for families. To qualify, care must be provided for children under the age of thirteen or for dependents who are physically or mentally incapable of self-care.

Steps to Complete Form 2441

Filling out Form 2441 involves several key steps:

- Gather necessary information, including the names, addresses, and taxpayer identification numbers of the care providers.

- Determine the total amount of qualifying expenses incurred for each child or dependent.

- Complete the form by entering the relevant information in the designated fields, ensuring accuracy to avoid delays.

- Calculate the credit based on the total expenses and your adjusted gross income.

- Submit the completed form along with your tax return.

Eligibility Criteria for the Child and Dependent Care Credit

To qualify for the Child and Dependent Care Credit, taxpayers must meet specific eligibility criteria:

- The taxpayer must have earned income from employment or self-employment.

- Care must be provided for a child under the age of thirteen or a dependent who cannot care for themselves.

- The care must be provided so that the taxpayer can work or actively look for work.

- Expenses must be incurred for care provided within the United States.

Required Documents for Filing Form 2441

When preparing to file Form 2441, it is important to have the following documents ready:

- Taxpayer identification numbers for all care providers.

- Receipts or statements showing the total amount paid for care services.

- Documentation proving the relationship of the child or dependent to the taxpayer.

Filing Deadlines for Form 2441

Form 2441 must be filed along with the annual tax return, typically due on April fifteenth. If additional time is needed, taxpayers may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Legal Use of Form 2441

Form 2441 is legally recognized by the IRS as a valid means to claim the Child and Dependent Care Credit. It is essential to ensure that all information provided is accurate and complete to maintain compliance with tax regulations. Failure to correctly complete and submit this form could result in delays in receiving the credit or potential penalties.

Quick guide on how to complete about form 2441 child and dependent care expensesabout form 2441 child and dependent care expenses2021 form 2441 irs tax

Complete About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care Expenses2021 Form 2441 IRS Tax Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care Expenses2021 Form 2441 IRS Tax Forms on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care Expenses2021 Form 2441 IRS Tax Forms without hassle

- Obtain About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care Expenses2021 Form 2441 IRS Tax Forms and click on Get Form to commence.

- Employ the tools we provide to finalize your document.

- Emphasize relevant portions of your documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and electronically sign About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care Expenses2021 Form 2441 IRS Tax Forms and promote exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 2441 child and dependent care expensesabout form 2441 child and dependent care expenses2021 form 2441 irs tax

Create this form in 5 minutes!

People also ask

-

What is the child and dependent care credit 2018?

The child and dependent care credit 2018 is a tax benefit that helps families offset the cost of childcare expenses for qualifying dependents. It allows you to claim a percentage of expenses for children under 13 or other dependents needing care. This credit can signNowly reduce your tax liability and increase your refund.

-

How do I qualify for the child and dependent care credit 2018?

To qualify for the child and dependent care credit 2018, you must pay for childcare services while you work or look for work. Your dependents must be under the age of 13 or unable to care for themselves, and you must meet income requirements. Proper documentation and forms are necessary for claiming the credit.

-

Can I use airSlate SignNow to manage documents related to the child and dependent care credit 2018?

Yes, airSlate SignNow provides an efficient platform to create, send, and eSign documents related to the child and dependent care credit 2018. With our easy-to-use solution, you can securely manage childcare provider agreements and tax documents. This streamlines your record-keeping process, making it hassle-free.

-

What features does airSlate SignNow offer for businesses handling childcare credits?

airSlate SignNow offers features like document templates, eSignature capabilities, and secure storage, which are beneficial for businesses managing the child and dependent care credit 2018. These tools help ensure compliance and easy access to necessary documentation. Our intuitive interface allows for quick document management whenever you need it.

-

Are there any costs associated with using airSlate SignNow for child and dependent care credit documentation?

While airSlate SignNow provides a cost-effective solution for managing documentation, there are subscription plans available that cater to various business needs. Pricing is transparent, and you can choose a plan that suits your volume of documents related to the child and dependent care credit 2018. You can start with a free trial to explore our services without commitment.

-

How can airSlate SignNow help with tax preparation for the child and dependent care credit 2018?

airSlate SignNow simplifies tax preparation for the child and dependent care credit 2018 by allowing you to compile all necessary documents in one place. You can easily send forms to your accountant or tax preparer and securely sign documents online. This reduces the chance of missing documentation and eases your tax filing process.

-

What integrations does airSlate SignNow offer that can help with childcare credits?

airSlate SignNow seamlessly integrates with various accounting and tax software that can be useful when calculating the child and dependent care credit 2018. These integrations facilitate a smoother workflow for document management and tax preparation. This helps businesses maintain better organization when dealing with credits and deductions.

Get more for About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care Expenses2021 Form 2441 IRS Tax Forms

- Notice beneficiaries form 497319746

- Estate planning questionnaire and worksheets new jersey form

- Document locator and personal information package including burial information form new jersey

- Demand to produce copy of will from heir to executor or person in possession of will new jersey form

- Notice of acceptance or rejection of recommended resolution new mexico form

- New mexico compensation form

- Notice of change of health care provider under automatic right of second selection new mexico form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497319753 form

Find out other About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care Expenses2021 Form 2441 IRS Tax Forms

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA