Form 2441 2017

What is the Form 2441

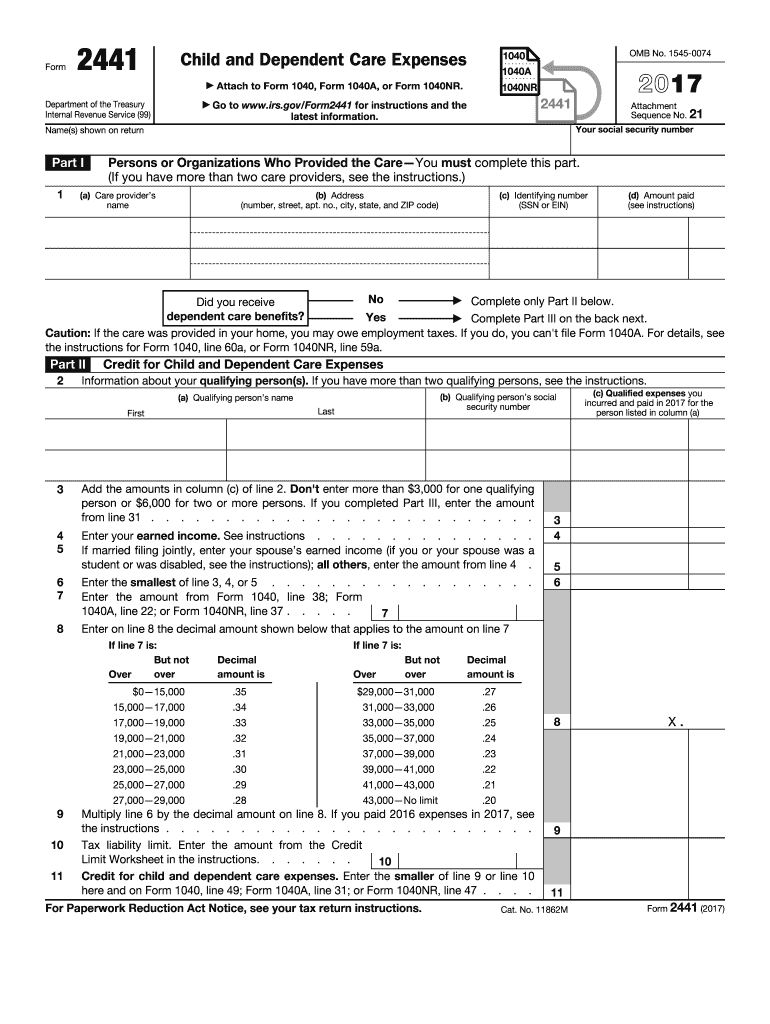

The Form 2441, officially known as the Child and Dependent Care Expenses Credit, is a tax form used by U.S. taxpayers to claim a credit for expenses incurred while caring for qualifying individuals. This form is essential for individuals who pay for child care or care for dependents while they work or look for work. The credit can significantly reduce the amount of tax owed, making it a valuable resource for eligible taxpayers.

How to use the Form 2441

To effectively use the Form 2441, taxpayers must first determine their eligibility based on the care expenses they incurred. The form requires detailed information about the care provider, the amount paid for care, and the qualifying individuals. After gathering the necessary information, taxpayers can complete the form and attach it to their federal tax return. It's important to ensure that all information is accurate to avoid delays in processing or potential audits.

Steps to complete the Form 2441

Completing the Form 2441 involves several key steps:

- Gather necessary information about the care provider and the qualifying individuals.

- Calculate the total amount spent on care during the tax year.

- Fill out the form, ensuring all required fields are completed accurately.

- Attach the form to your federal tax return before submission.

- Keep a copy of the completed form and all supporting documents for your records.

Eligibility Criteria

To qualify for the credit claimed on Form 2441, taxpayers must meet specific eligibility criteria. The care must be for a child under the age of thirteen or for a spouse or dependent who is physically or mentally incapable of self-care. Additionally, the taxpayer must have earned income and the care must be necessary for the taxpayer to work or look for work. It is crucial to review these criteria to ensure compliance and maximize potential credits.

Form Submission Methods

Form 2441 can be submitted in various ways, depending on the taxpayer's preference and the method of filing their tax return. The form can be submitted electronically if filing online through approved tax software or by mail if filing a paper return. When submitting by mail, it is important to send the form to the correct IRS address based on the taxpayer's location and whether a refund is expected.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 2441. Taxpayers should refer to the latest IRS instructions for the form, which detail eligibility requirements, how to calculate the credit, and any necessary documentation that must accompany the form. Adhering to these guidelines is essential for ensuring that the form is processed correctly and efficiently.

Quick guide on how to complete form 2441 2017

Uncover the most efficient method to complete and sign your Form 2441

Are you still spending time preparing your official documents on physical copies instead of online? airSlate SignNow offers a superior way to finalize and authorize your Form 2441 and associated forms for public services. Our innovative electronic signature solution provides you with everything necessary to manage documents swiftly and in accordance with formal standards - comprehensive PDF editing, managing, securing, signing, and sharing tools at your fingertips within a user-friendly interface.

Only a few steps are needed to complete and sign your Form 2441:

- Upload the editable template to the editor by using the Get Form button.

- Review what information you need to include in your Form 2441.

- Move between the fields using the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Redact areas that are no longer necessary.

- Click on Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and finalize your work with the Done button.

Store your finalized Form 2441 in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also provides flexible form sharing. There’s no need to print your templates when you need to deliver them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 2441 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the form 2441 2017

How to make an electronic signature for your Form 2441 2017 online

How to create an electronic signature for the Form 2441 2017 in Chrome

How to generate an eSignature for putting it on the Form 2441 2017 in Gmail

How to create an electronic signature for the Form 2441 2017 right from your mobile device

How to generate an eSignature for the Form 2441 2017 on iOS

How to create an eSignature for the Form 2441 2017 on Android devices

People also ask

-

What is Form 2441 and how is it used?

Form 2441, also known as the Child and Dependent Care Expenses form, is used by taxpayers to claim a credit for expenses incurred for the care of qualifying individuals. With airSlate SignNow, you can easily fill out and eSign Form 2441, streamlining the process of submitting your tax returns. This form is essential for those looking to maximize their tax benefits associated with dependent care.

-

How can airSlate SignNow help with Form 2441?

airSlate SignNow simplifies the process of completing and signing Form 2441 by providing an intuitive interface for filling out tax forms. Our platform ensures that you can easily upload, edit, and eSign the form, making the submission process quicker and more efficient. Plus, you can save your completed forms for future reference.

-

What features does airSlate SignNow offer for managing Form 2441?

With airSlate SignNow, you can take advantage of features like document templates, customizable fields, and team collaboration when working on Form 2441. These tools enhance your productivity and accuracy, ensuring you fill out the form correctly and efficiently. Additionally, electronic signatures are legally binding, making the process hassle-free.

-

Is there a cost associated with using airSlate SignNow for Form 2441?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, including options that are budget-friendly for individual users. While basic features may be available for free, premium plans provide added functionalities for handling forms like Form 2441 more effectively. Check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with my existing software for Form 2441?

Yes, airSlate SignNow easily integrates with a wide range of applications and software, allowing you to manage Form 2441 seamlessly within your current workflow. This means you can connect with tools like Google Drive, Dropbox, and various CRM systems to streamline your document management process. Our integrations help enhance your efficiency.

-

What are the benefits of using airSlate SignNow for tax forms like Form 2441?

Using airSlate SignNow for Form 2441 provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security for your sensitive information. The platform’s user-friendly design makes it accessible for anyone, ensuring you can complete and sign your tax forms with confidence. Plus, it’s a cost-effective solution for businesses and individuals alike.

-

Is airSlate SignNow secure for submitting Form 2441?

Absolutely, airSlate SignNow prioritizes the security of your documents, including Form 2441. We implement advanced encryption and security protocols to protect all data transmitted through our platform. You can trust that your information remains confidential and secure while using our eSigning services.

Get more for Form 2441

Find out other Form 2441

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free