1040 SR 2020

What is the 2017 tax form 2441?

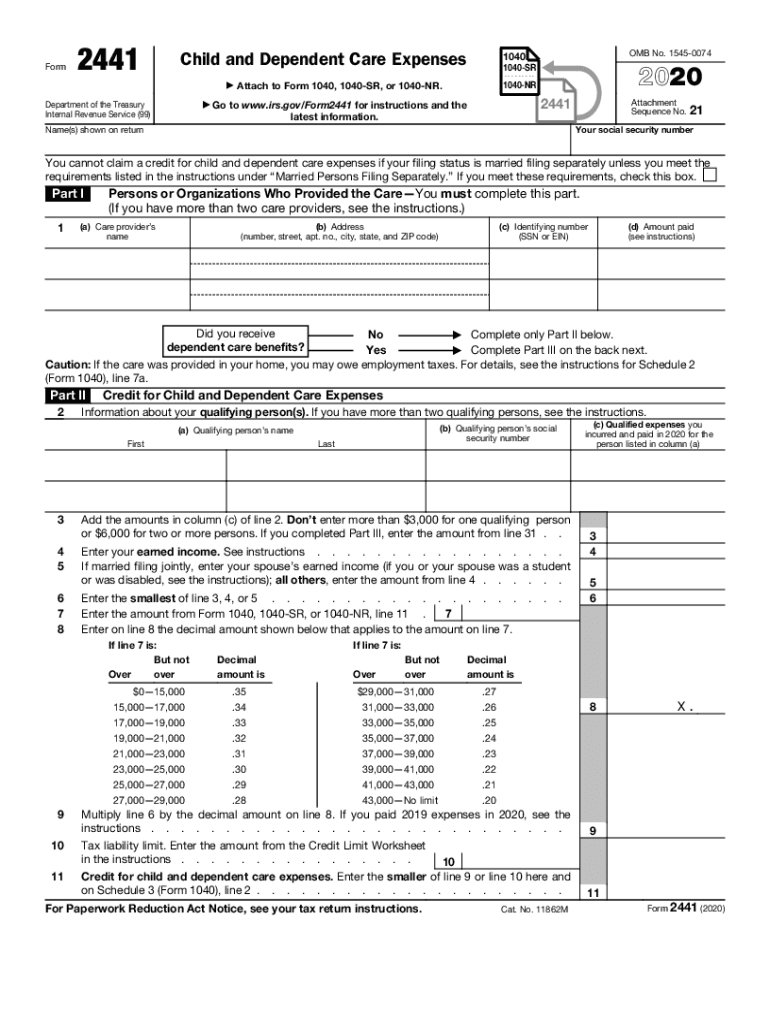

The 2017 tax form 2441 is used by taxpayers in the United States to claim the Child and Dependent Care Expenses Credit. This form allows individuals to report expenses incurred for the care of qualifying individuals, enabling them to work or look for work. The form is essential for those who wish to receive a tax credit for eligible child and dependent care costs, which can significantly reduce their overall tax liability.

Steps to complete the 2017 tax form 2441

Completing the 2017 tax form 2441 involves several key steps:

- Gather necessary documentation, including the names, addresses, and taxpayer identification numbers of the care providers.

- Determine the total amount of qualifying expenses incurred for child or dependent care.

- Fill out the form, providing information about your dependents and the care expenses.

- Calculate the credit based on your income and the total expenses reported.

- Ensure all information is accurate to avoid delays or issues with your tax return.

Eligibility Criteria for the 2017 tax form 2441

To qualify for the Child and Dependent Care Expenses Credit using the 2017 tax form 2441, taxpayers must meet specific eligibility criteria:

- Taxpayers must have earned income from employment or self-employment.

- The care must be for a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care.

- Expenses must be incurred to enable the taxpayer to work or actively look for work.

- Care providers cannot be a relative of the taxpayer unless they are a licensed care provider.

IRS Guidelines for the 2017 tax form 2441

The IRS provides specific guidelines for completing the 2017 tax form 2441. Taxpayers should refer to the official IRS instructions for detailed information on:

- Qualifying expenses that can be claimed.

- Income limits that affect the amount of credit available.

- How to report the information accurately on the form.

- Any changes or updates to the tax code that may impact eligibility.

Form Submission Methods for the 2017 tax form 2441

Taxpayers can submit the 2017 tax form 2441 through various methods:

- Online filing through tax preparation software that supports e-filing.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, though this option may vary by location.

Penalties for Non-Compliance with the 2017 tax form 2441

Failure to comply with the requirements of the 2017 tax form 2441 can result in penalties. Common consequences include:

- Disallowance of the credit, leading to a higher tax liability.

- Potential audits by the IRS if discrepancies are found.

- Fines for incorrect reporting or failure to file the form altogether.

Quick guide on how to complete 1040 sr

Effortlessly Prepare 1040 SR on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents quickly and without delays. Handle 1040 SR on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign 1040 SR with Ease

- Locate 1040 SR and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and electronically sign 1040 SR and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 sr

Create this form in 5 minutes!

How to create an eSignature for the 1040 sr

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2017 tax form 2441 and who needs it?

The 2017 tax form 2441 is used to claim the Child and Dependent Care Expenses Credit. Taxpayers who have incurred expenses for child care or care for disabled dependents while they work should file this form. Understanding how to properly complete the 2017 tax form 2441 can help you maximize your tax benefits.

-

How can airSlate SignNow assist with the 2017 tax form 2441?

airSlate SignNow provides a seamless way to eSign and send the 2017 tax form 2441 electronically, ensuring your documents are securely handled. This simplifies the process by making it easy to gather necessary eSignatures and confirmations efficiently. With airSlate SignNow, managing your tax documentation becomes hassle-free.

-

Is there a cost associated with using airSlate SignNow for the 2017 tax form 2441?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning documents, pricing plans vary based on features and user needs. You can access competitive rates that allow you to utilize the platform efficiently for your 2017 tax form 2441 and other documents. It's advisable to check the pricing page for the latest offers.

-

What features does airSlate SignNow offer for signing the 2017 tax form 2441?

The airSlate SignNow platform offers several features for signing the 2017 tax form 2441, including template creation, automated workflows, and real-time tracking. These features streamline the eSigning process, making it easier for you to manage and complete your tax documentation. User-friendly interface ensures that even those new to eSigning can navigate confidently.

-

Can I integrate airSlate SignNow with other tax software for the 2017 tax form 2441?

Absolutely! airSlate SignNow supports integrations with various tax software solutions, allowing you to easily manage your 2017 tax form 2441 alongside other financial documents. This compatibility ensures that your workflow remains uninterrupted and efficient. Check the integrations page for a full list of compatible software.

-

What are the benefits of using airSlate SignNow for my 2017 tax form 2441?

Using airSlate SignNow for your 2017 tax form 2441 offers numerous benefits, such as improved document security, reduced processing time, and enhanced convenience in obtaining signatures. The platform is designed to make the eSigning process smoother, thus helping you meet deadlines effortlessly. Additionally, it promotes a more professional handling of sensitive tax materials.

-

Is it safe to eSign the 2017 tax form 2441 with airSlate SignNow?

Yes, eSigning the 2017 tax form 2441 with airSlate SignNow is safe. The platform adheres to strict security protocols, ensuring that your documents are protected through encryption and secure cloud storage. With airSlate SignNow, you can confidently manage sensitive tax information knowing that your data privacy is a priority.

Get more for 1040 SR

- Aup bank account form

- Lowes closet organizers do it yourself spray woodstorenet form

- Arkusz spisu z natury wzordoc arkusz spisu z natury form

- Pleading guilty by letter mauritius form

- Tesco application form

- Wwwuniteddogsportsnneorgcoursing entry formofficial united kennel club coursing entry form

- Wwwcheggcomhomework helpquestions andsolved t h e r e a r e m a n y a p p l i c a t i o ncheggcom form

- Ukc nosework official judge apprentice form

Find out other 1040 SR

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple