Form 2441 2009

What is the Form 2441

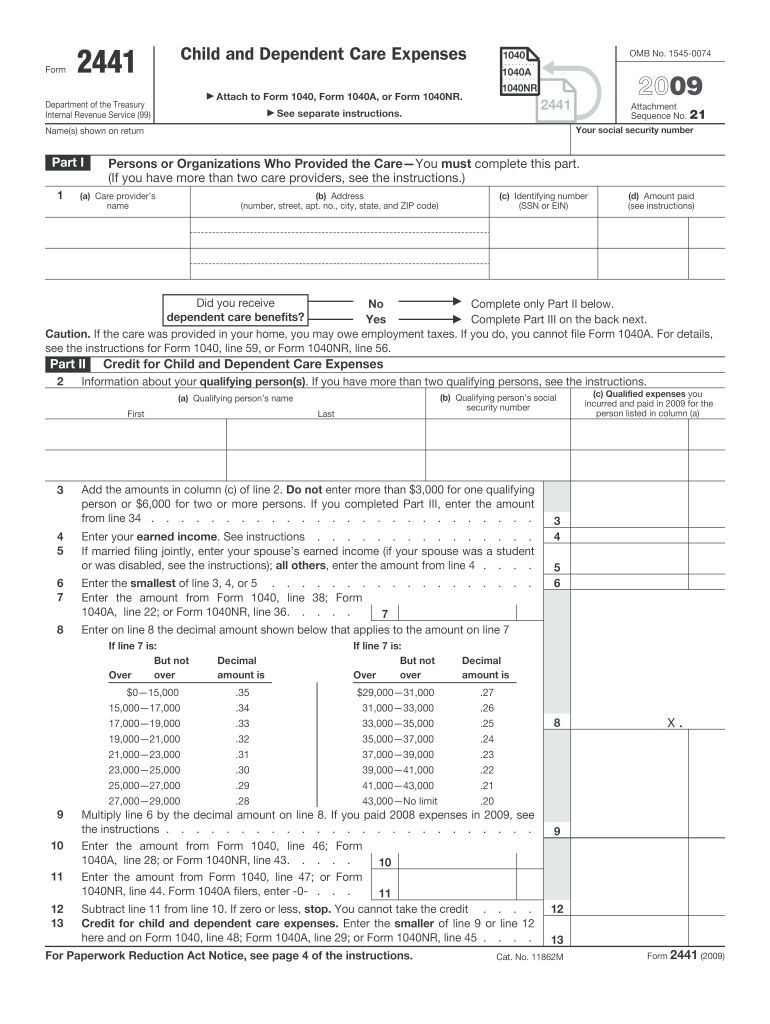

The Form 2441 is a tax form used by U.S. taxpayers to claim the Child and Dependent Care Expenses Credit. This credit helps offset the costs incurred for the care of qualifying individuals, allowing parents or guardians to work or look for work. The form requires detailed information about the care provider, the expenses incurred, and the individuals receiving care, which can include children under the age of thirteen or dependents who cannot care for themselves.

How to use the Form 2441

To effectively use Form 2441, taxpayers must gather necessary information about their dependent care expenses. This includes the names, addresses, and taxpayer identification numbers of care providers, as well as the total amount spent on care. After completing the form, it must be attached to the taxpayer's federal income tax return, typically Form 1040. It is important to ensure that all entries are accurate and that the form is submitted by the tax filing deadline.

Steps to complete the Form 2441

Completing Form 2441 involves several key steps:

- Gather all necessary documentation, including receipts and provider information.

- Fill out the personal information section, including your name and Social Security number.

- Provide details of the care provider, including their name, address, and taxpayer identification number.

- Enter the total amount spent on care for each qualifying individual.

- Calculate the credit based on the expenses and the applicable percentage.

- Review the completed form for accuracy before submission.

Legal use of the Form 2441

The legal use of Form 2441 is governed by IRS regulations. To be eligible for the Child and Dependent Care Expenses Credit, taxpayers must meet specific criteria, including having earned income and incurring qualifying expenses for care. The form must be filled out accurately and submitted with the appropriate tax return to ensure compliance with tax laws. Failure to comply can result in penalties or disqualification from claiming the credit.

Filing Deadlines / Important Dates

Form 2441 must be filed along with your federal income tax return, which is typically due on April fifteenth of each year. If you are unable to meet this deadline, you may request an extension, but any taxes owed must still be paid by the original due date to avoid penalties. It is essential to keep track of these deadlines to ensure timely submission and to maintain eligibility for the credit.

Eligibility Criteria

To qualify for the Child and Dependent Care Expenses Credit using Form 2441, taxpayers must meet several eligibility criteria:

- Taxpayers must have earned income from employment or self-employment.

- The care must be provided for a qualifying individual, such as a child under the age of thirteen or a dependent who cannot care for themselves.

- Expenses must be incurred for care that allows the taxpayer to work or look for work.

- Care must be provided by a qualified provider who meets IRS requirements.

Quick guide on how to complete form 2441 2009

Complete Form 2441 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Form 2441 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Form 2441 with ease

- Obtain Form 2441 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 2441 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2441 2009

Create this form in 5 minutes!

How to create an eSignature for the form 2441 2009

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form 2441 and why is it important for businesses?

Form 2441 is used to claim the Child and Dependent Care Expenses Credit on your tax return. It is essential for businesses and individuals who provide or pay for care related to dependents during the tax year, as it can signNowly reduce tax liabilities.

-

How can airSlate SignNow help with completing Form 2441?

airSlate SignNow simplifies the process of completing Form 2441 by allowing users to fill out, sign, and send documents securely. With our easy-to-use interface, businesses can manage Form 2441 efficiently, ensuring accuracy and compliance.

-

Is there a cost associated with using airSlate SignNow for Form 2441?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that organizations can efficiently manage Form 2441 and other documents without breaking the bank.

-

What features does airSlate SignNow provide that are beneficial for Form 2441?

airSlate SignNow includes features such as document templates, eSignature capabilities, and real-time tracking that can enhance the Form 2441 submission process. These tools streamline workflow and increase efficiency in managing important paperwork.

-

Are there integrations available with airSlate SignNow to enhance Form 2441 processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, improving the overall workflow for managing Form 2441. This allows for easy data transfer and reduces the chances of manual errors.

-

Can I store and manage multiple Form 2441 submissions using airSlate SignNow?

Yes, airSlate SignNow provides secure storage solutions for all your documents, including multiple Form 2441 submissions. This ensures that your records are organized and easily accessible whenever you need to reference or update them.

-

How long does it take to complete and submit Form 2441 with airSlate SignNow?

The time it takes to complete and submit Form 2441 using airSlate SignNow can vary based on the complexity of your situation. However, our user-friendly platform is designed to expedite the process, allowing users to finalize and send their forms within minutes.

Get more for Form 2441

- Wvrhitec participation agreementdoc form

- Self certification liberty form

- Stanford law school transfer application fee waiver form

- Physical therapist assistantcentral piedmont community form

- Nomination to graduate faculty form umd grad school

- Lpn work verification form draftdoc

- Staff classified advertising form staff classified advertising request form

- New mexico highlands university s its nmhu form

Find out other Form 2441

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free