W9 Forms Printable Gov 2018

What is the W-9 Form?

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a document used in the United States for tax purposes. It is primarily utilized by businesses to collect information from independent contractors, freelancers, and vendors. The form requires individuals to provide their name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

How to Obtain the W-9 Form

To obtain the W-9 form, individuals can visit the official IRS website, where the form is available for download in a printable format. It is important to ensure that you are using the most current version of the form to comply with IRS requirements. The form can be easily printed and filled out by hand or completed digitally if using a compatible software solution.

Steps to Complete the W-9 Form

Completing the W-9 form involves several straightforward steps:

- Provide your name as it appears on your tax return.

- If applicable, enter your business name.

- Fill in your address, ensuring it matches your tax records.

- Indicate the appropriate taxpayer identification number (SSN or EIN).

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the W-9 Form

The W-9 form is legally binding and must be filled out accurately to avoid penalties. It is used by businesses to report payments made to contractors and freelancers to the IRS. The information provided on the W-9 is crucial for the issuance of 1099 forms at year-end, which report income to the IRS. Misrepresentation or failure to provide accurate information may result in fines or penalties from the IRS.

Filing Deadlines / Important Dates

While the W-9 form itself does not have a submission deadline, it is important for individuals to provide it to the requesting party in a timely manner. Businesses typically require the W-9 before making payments to ensure compliance with IRS reporting requirements. For tax reporting purposes, 1099 forms must be filed by January thirty-first of the following year, making it essential to submit the W-9 promptly to avoid delays.

Form Submission Methods

The W-9 form can be submitted in several ways, depending on the preferences of the requesting party:

- Electronically via email, if the recipient accepts digital submissions.

- Printed and mailed to the requesting business.

- Hand-delivered in person, if applicable.

Examples of Using the W-9 Form

The W-9 form is commonly used in various scenarios, including:

- Freelancers providing services to a business that requires tax reporting.

- Independent contractors working on projects for multiple clients.

- Vendors supplying goods or services to a company.

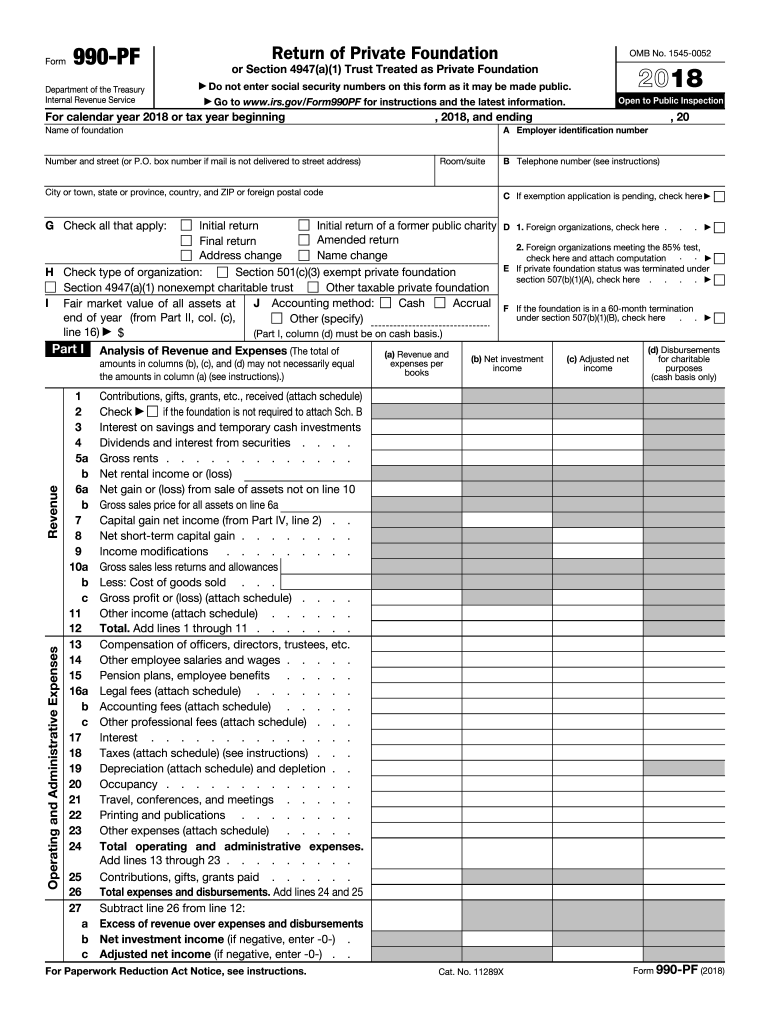

Quick guide on how to complete 990 pf 2018 form

Discover the easiest method to complete and sign your W9 Forms Printable Gov

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and sign your W9 Forms Printable Gov and associated forms for public services. Our intelligent electronic signature solution equips you with everything necessary to manage documents swiftly and comply with official standards - comprehensive PDF editing, organizing, securing, signing, and sharing features are all accessible within a user-friendly interface.

You only need to follow a few steps to finish filling out and signing your W9 Forms Printable Gov:

- Upload the editable template to the editor using the Get Form button.

- Verify the information required in your W9 Forms Printable Gov.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Redact sections that are no longer relevant.

- Press Sign to create a legally binding electronic signature using whichever method you prefer.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed W9 Forms Printable Gov in the Documents folder of your profile, download it, or export it to your preferred cloud service. Our solution also allows for flexible file sharing. There’s no need to print your templates when you can submit them to the relevant public office - use email, fax, or request USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct 990 pf 2018 form

FAQs

-

How can I fill out my PF form when I am currently working abroad?

Try to withdraw onlineMore info comment or check contacts info

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

Can I fill out the PF form online?

Yes you can go to EPFO members home click claim form 10c and 19 c

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

To withdraw PF, how to fill form 15G? Specifically the field numbered "23"

Greeting …I will explain PART 1 of form 15G point wise.Name : write name as per pan card.PAN : write your PAN number.Assessment year: For current year , it is assessment year 2016-17. Don’t make mistake in writing it. It is next to the current financial year. ( No matter about your year of PF withdrawal, assessment year is 2016-17 because you are submitting form for current year ( 2015-16’s estimated income)Flat/ Door/ Block no. : Current Address details .Name of premises: Current Address details.Status : Individual/ HUF/ AOP as applicability to you.Assessed in which ward circle : Details about your income tax ward you were assessed last time. You can know your income tax ward and circle from this link- know your juridictional AO. Just enter your PAN no. and you can find the details.Road : current address details.Area : current address details.AO code : write as per link provided in point 7.Town : current address.State : Current state.PIN : pin code number.Last assessed year in which assessed : Last year generally if you were assessed in last year. 2015-16EmailTelephone NO.Present ward circle : Same if no change after issue of pan card. ( as per point 7)Residential status: Resident.Name of business/ occupation : Your business or job details.Present AO code : as per point 7 if no change in ward/ circle of income tax.Juridictional chief commissioner of income tax ( if not assessed of income tax earlier) : leave it blank.Estimated total income: You are required to enter estimated total income of current year. Do sum of the total income from all sources and tick the relevant boxes.The amount should be from following sources: Interest on securities , Interest on sum other than securities ( interest on FD etc.), Interest on mutual fund units., withdrawals of NSC.Dividend on shares,Estimated total income of the current year should be entered. The income mentioned in column 22 should be included in it .PF income ( if taxable) and other income (business, salary etc.). The amount is taxable income means total income less deductions available.In this column, you are required to give details of investment you have made. For different form of investment different schedules are given.Be Peaceful !!!

Create this form in 5 minutes!

How to create an eSignature for the 990 pf 2018 form

How to create an electronic signature for your 990 Pf 2018 Form online

How to generate an electronic signature for the 990 Pf 2018 Form in Google Chrome

How to create an electronic signature for putting it on the 990 Pf 2018 Form in Gmail

How to create an eSignature for the 990 Pf 2018 Form right from your mobile device

How to generate an eSignature for the 990 Pf 2018 Form on iOS devices

How to create an eSignature for the 990 Pf 2018 Form on Android devices

People also ask

-

What are W9 Forms Printable Gov used for?

W9 Forms Printable Gov are used by individuals and businesses to provide their taxpayer identification number (TIN) to the entity requesting the form. This form is essential for tax purposes, allowing payers to report income to the IRS accurately. By using W9 Forms Printable Gov, you ensure compliance with tax regulations and simplify your reporting process.

-

How do I fill out W9 Forms Printable Gov?

Filling out W9 Forms Printable Gov is straightforward. You need to provide your name, business name (if applicable), address, and TIN, which can be your Social Security Number or Employer Identification Number. Once completed, you can print and send the form to the requester or use an electronic signature solution like airSlate SignNow for convenience.

-

Are W9 Forms Printable Gov available for free?

Yes, W9 Forms Printable Gov can be downloaded for free from various government websites. However, if you want to streamline the signing and submission process, consider using airSlate SignNow, which offers cost-effective solutions for managing your documents electronically and securely.

-

Can I eSign W9 Forms Printable Gov with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to eSign W9 Forms Printable Gov quickly and securely. This electronic signature solution not only saves time but also ensures that your form is submitted promptly, enhancing efficiency in your business operations.

-

What features does airSlate SignNow offer for handling W9 Forms Printable Gov?

AirSlate SignNow offers various features for handling W9 Forms Printable Gov, including electronic signatures, document templates, and secure cloud storage. Additionally, you can track the status of your forms and send reminders to signers, ensuring a seamless document workflow.

-

Is airSlate SignNow compliant with legal requirements for W9 Forms Printable Gov?

Yes, airSlate SignNow is fully compliant with legal requirements for electronic signatures on W9 Forms Printable Gov. The platform adheres to the ESIGN and UETA acts, ensuring that all electronically signed documents hold the same legal weight as traditional paper forms.

-

How does airSlate SignNow integrate with other applications for W9 Forms Printable Gov?

AirSlate SignNow offers integration with various applications, allowing you to streamline your workflow when handling W9 Forms Printable Gov. You can connect it with tools like Google Drive, Dropbox, and CRM systems, making it easier to manage your documents and share them with stakeholders.

Get more for W9 Forms Printable Gov

- Dd 2642 form 2007 2018

- Ngr 614 1 form

- Hartford ocean cargo application form

- Arizona state university employment verification form

- Dpsmv1801 auto hulk affidavit form

- Form int 2 bank franchise tax return 794877509

- Form 2823 credit institution tax return 794877510

- State of missouri employer039s tax guide form

Find out other W9 Forms Printable Gov

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast